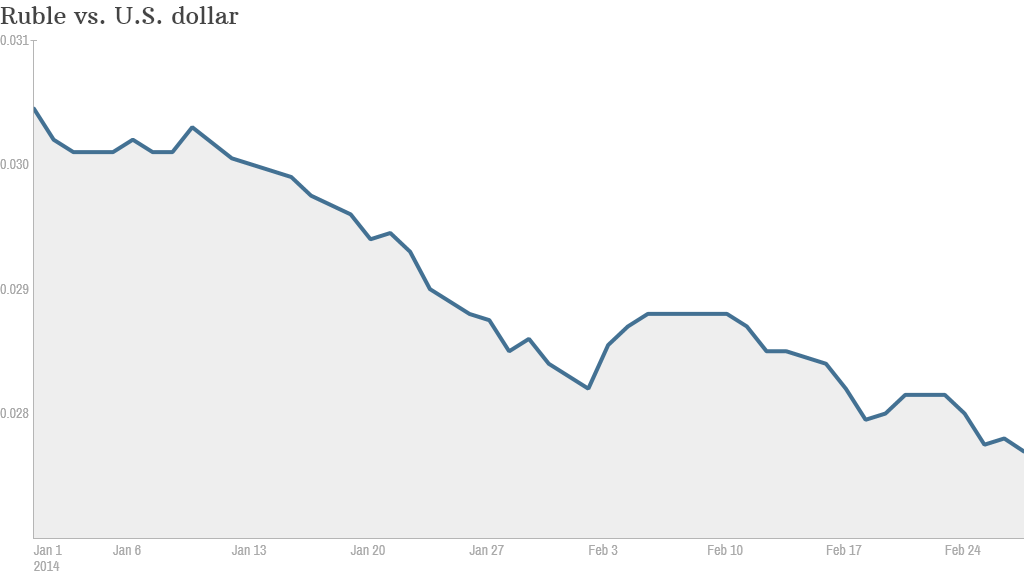

The ruble has taken a big hit as political tensions escalate over the fate of Ukraine and the Russian economy falters.

The currency has fallen by 1.4% versus the U.S. dollar over the past week, bringing its decline for the year to 10%. The dollar now buys 36.10 rubles, a level not seen since 2009.

Foreign exchange traders have reacted, in part, to rising regional tension since Ukrainian protestors forced pro-Moscow President Viktor Yanukovych from office.

"Any political volatility or military stand off in the region will send negative signals to [people] who have investments in those countries," said Lilit Gevorgyan, a senior economist at IHS Global Insight.

"If Russia ventures into military action in Ukraine, this will have a serious impact on the performance of the Russian currency," she said.

Russia has strategic interests in its neighbor Ukraine, a country that is divided between pro-European regions in the west and a more Russia-oriented east.

Ukraine is a key route for Russian gas exports to Europe and has a large Russian-speaking population. It's also home to a Russian naval fleet, based in the city of Sevastopol in the Crimean region.

Related: Ukraine crisis spills onto world markets

Russian banks have about $30 billion in Ukrainian loans on their books and they face big losses as the Ukrainian currency -- the hryvnia -- continues its free fall.

Ratings agency Fitch estimates that about 60% of the loans were made in foreign currency.

But the steep decline in the ruble can't be blamed solely on the situation in Ukraine, which only accounts for about 5% of Russia's total exports.

A significant slowdown in the Russian economy last year is also to blame.

According to the International Monetary Fund, Russian gross domestic product grew by just 1.5% last year compared to more than 4% in 2010 and 2011, and 3.4% in 2012.

The IMF expects a slight improvement this year, but growth will still lag its historical trend.

"This is one of the sharpest deteriorations in GDP trends compared to other emerging markets," said Alfa Bank analyst Dmitry Dolgin in Moscow.

"When expectations of economic activity are low, companies and the population as a whole prefer to use their resources to accumulate foreign exchange savings," he said.

Russia's current account surplus has also fallen to its lowest level in years, reflecting a weaker export performance.

"The foreign exchange market is adjusting their expectations to this new reality," said Dolgin.

The ruble has taken one of the biggest hits among emerging market currencies this year as investors have moved their money out of riskier assets.

The South African rand has fallen 1.6% since the start of the year. The Thai baht is flat and the Turkish lira is down by about 3% over the same period.