The crisis in Ukraine has sparked calls for the U.S. to step up its natural gas exports. The hope is that increased supplies will weaken the hand of Russia, Iran or other nations in future confrontations.

Russia is Europe's biggest supplier of energy and pipes much of its natural gas through Ukraine. Energy prices rose earlier this week on concerns that an escalation of the conflict could choke that supply.

There may be good reasons to up U.S. gas, or oil, exports, but it's far from clear that politics is the main one.

A bigger role for the U.S. in world energy markets would diversify global energy supply, potentially reducing the influence of countries such as Russia or Iran.

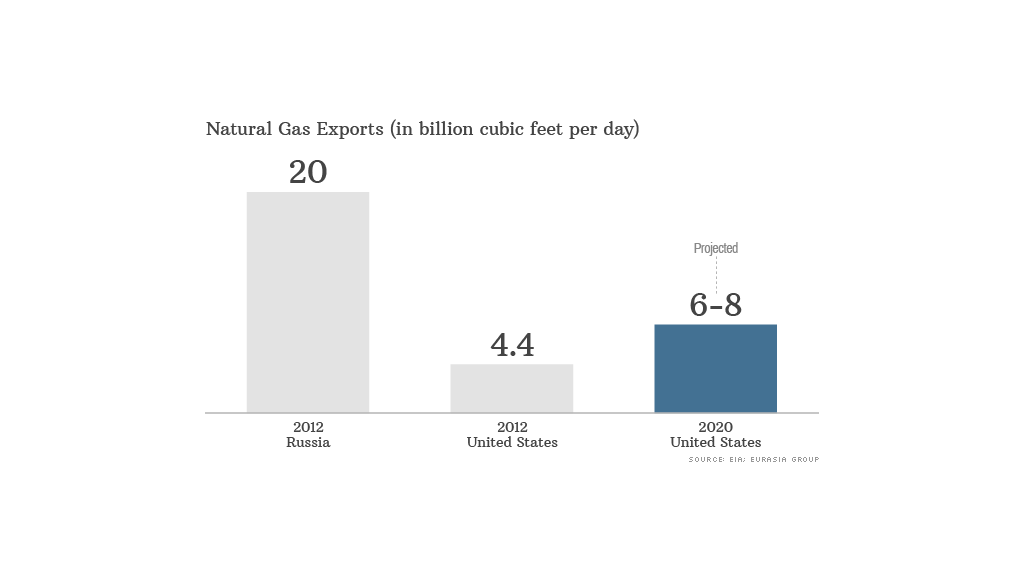

But ultimately the volume of gas the U.S. could export is relatively small, and is unlikely to alter the current energy markets over which Russia holds so much sway.

"This isn't a gamechanger," said Ian Bremmer, head of the political risk consultancy Eurasia Group.

Related: Russian energy should keep flowing

A more solid reason to support more U.S. energy exports is money, and it's no surprise that the loudest calls are coming from energy producing states.

"Selling our natural gas would benefit the United States economy, help our allies in Europe, eliminate Russia's energy monopoly and lessen their influence," Republican Representative Ted Poe of Texas said after introducing a bill this week calling for the government to speed up export licenses to Ukraine and other former Soviet states.

The Department of Energy must approve most proposals to export gas.

Exporting more oil and gas would certainly benefit the industry. With less energy available in the U.S., prices would likely rise, meaning bigger profits for companies and their shareholders.

It could also benefit the millions of workers employed directly or indirectly by the industry, and could give a boost to the U.S. energy boom, which is showing some signs of slowing as prices stay low. It would help the U.S. trade balance and generate revenue for the government.

The broader economic impact is less clear, however. U.S. manufacturers, which use natural gas as both an energy source and raw material for chemicals and fertilizers, are wary. They fear higher prices would put a damper on the revival of manufacturing.

Environmentalists hate the idea of more exports, saying they would lead to more fracking and associated problems including water and air pollution.

For these reasons, the Energy Department is taking a cautions approach. It has approved just six export applications since 2011 -- the most recent one last month for a project in Louisiana. There are 22 projects still pending.

No one thinks all 22 will be approved. That has little to do with politics and more to do with price -- at some point, U.S. natural gas becomes too expensive and no one wants it.

Price is the main reason why some say plans to use U.S. gas as a geopolitical weapon will have a limited effect.

"There is not going to be a deluge of U.S. exports," said Sam Ori, executive vice president at Securing America's Energy Future, a group that works to lessen U.S. dependence on foreign energy. "The pricing will just not be that competitive."

Despite the political pressure to speed up exports, the time and money needed to build the multi-billion dollar facilities means construction will proceed at a measured, market-driven pace, even if the approval process is stream lined, analysts say.

And nothing the U.S. can do is going to help in the current crisis -- the first new gas exports won't happen until the end of 2015.

Still, more U.S. exports won't be entirely devoid of diplomatic value.

In time, U.S. natural gas could become the global reserve in times of crisis, said Leslie Palti-Guzman, Eurasia Group's senior analyst for energy and natural resources.

And the mere possibility of U.S. gas "is increasing the negotiating leverage of both European and Asian consumers of Russian gas and diminishing Russian leverage," said Trevor Houser, an analyst at the Rhodium Group, a consultancy.