Taxpayers are making millions of dollars in interest payments on U.S. Treasuries to an unlikely source -- tech giants Apple, Microsoft, Google and Cisco.

Those tech companies have more than $100 billion in U.S. bonds, according to a report released Thursday by The Bureau of Investigative Journalism, a not-for-profit, privately funded reporting outfit in London. Due to U.S. tax laws, much of that cash is held in overseas subsidiaries -- and it is likely that some of that cash is being used to purchase U.S. bonds.

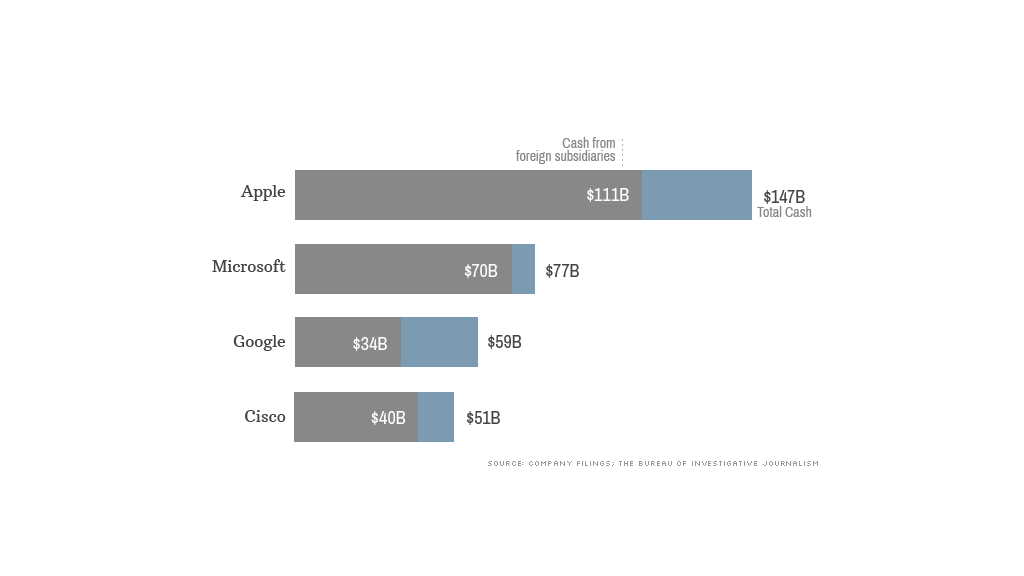

The group used data from annual filings that companies are required to send the Securities and Exchange Commission. All told, Apple (AAPL), Microsoft (MSFT), Google (GOOG) and Cisco (CSCO) have $250 billion in cash abroad.

If these firms are buying U.S. debt with that money, then U.S. taxpayers are on the hook for hundreds of millions in debt payments to the same U.S. companies they already buy billions of dollars from in iPads, software and routers.

"It means American taxpayers are effectively rewarding U.S.-based technology firms for avoiding taxes," said Nick Mathiason, the author of The Bureau of Investigative Journalism report.

But the situation isn't a surprise -- or even a problem -- according to international tax experts.

"U.S. corporations can defer taxes by keeping earnings abroad and they can continue to defer the tax by buying U.S. Treasuries," said Michael Knoll, a professor at the University of Pennsylvania Law School.

Related: Apple grilled about tax havens

While there is a debate on Capitol Hill regarding repatriation -- or bringing cash home to the U.S. that was earned overseas -- Knoll said that there are some benefits from having big companies owning U.S. debt. After all, the yield on a bond goes down when investors are buying bonds. So the bond purchases may help keep interest rates low.

Some argue that the 35% tax rate on foreign profits should be lowered to encourage U.S. companies to bring that money back home. But others think Congress should impose rules that penalize companies for shifting earnings out of the United States.

What Apple, Microsoft, Google and Cisco are doing is perfectly legal. And the companies stressed that it's up to Congress to enact new rules if they aren't happy about the practice of parking cash overseas.

An Apple spokeswoman said that CEO Tim Cook told the Senate last year that the company complies not just with the laws but "with the spirit of the laws." Cook also noted in that testimony that Apple paid nearly $6 billion in federal taxes in 2012.

Google told CNNMoney that "if politicians don't like the laws, they have the power to change them."

A Microsoft spokesman pointed to Congressional testimony in 2012 from Bill Sample, the company's vice president of worldwide tax. "We believe the U.S. should reform its tax rules to support the ability of worldwide American businesses to compete in global markets and invest in the U.S," he said at the time.

Cisco spokesman Scott Gerber said that "the rest of the world encourages businesses to bring back their foreign earnings at very low rates" and added that the U.S. "should level the playing field, modernize the system, and make it more competitive with the rest of the world."

But Mathiason thinks this is a bigger deal than the companies are making it out to be.

"This is tangible evidence of a tax system in urgent need of reform so that the government has funds to invest in public services, infrastructure and productive investment," he said. "I think the American public will be shocked that its government pays hundreds of billions of dollars in interest to giant tech companies who are keeping vast sums of cash offshore sheltered from tax."