Plenty of people have donated a few dollars on Kickstarter to help fund everything from jeans to school field trips and the new "Veronica Mars" movie.

These "investors" rarely expected more in return for their money than T-shirts, a ticket to a movie screening or maybe an early version of a new product.

That's about to change. Companies are starting to view crowdfunding as a legitimate option to raise serious cash.

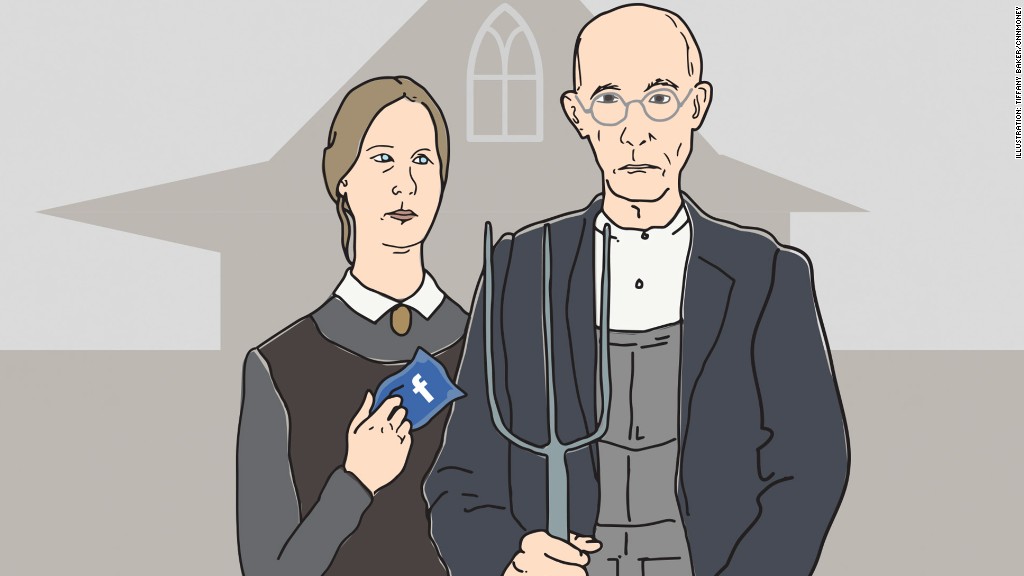

Imagine the next Facebook (FB) getting its start from average Joes and Janes deciding to give a few bucks each. Instead of just getting a nice thank you note, people who give money would get stock in the company.

In fact, virtual reality headset maker Oculus recently angered some of its earlier backers on Kickstarter by selling out to Facebook. Some Oculus fans felt betrayed and left out.

Related: 'Veronica Mars' scores on Kickstarter

But mom and pop investors may soon have a chance to invest in startup companies. The Securities and Exchange Commission is in the midst of the approval process for so-called "portals" to connect regular people and entrepreneurs.

"If mom and pop had put $1,000 into Facebook in the beginning, they would have ended up with $200,000 the day Facebook had its IPO," says Kim Wales, CEO of Wales Capital and CrowdBureau.

The formal name for this is equity crowdfunding, and the process has already begun for "accredited" investors. Right now, the SEC defines an "accredited" investor as someone who makes more than $200,000 a year (or $300,000 together with spouse) or has a net worth over $1 million (excluding the value of their primary home).

But the new rules the SEC is working on would let anyone invest in startups via crowdfunding sites.

Of course, there are clear flaws to throwing open the doors to anyone. The most obvious is that most startups fail and people lose money.

The SEC plans to limit losses by restricting average investors from putting down more than $2,000 or 5% of annual income or net worth in any 12-month period -- if the investor makes less than $100,000.

But $2,000 is still a lot of money to someone who doesn't earn a high income.

Kim Wales is aware of the criticism. But she points out that there are plenty of checks and balances to keep investors from getting burned, including a 21-day investor protection period in which you can get your money back if you decide not to invest after all.

Wales hopes to make CrowdBureau, a third party information site that will cater to crowdfunders a "bridge between Main Street and Wall Street."

She also points to the success of the Australian Small Scale Offering Board, a crowdfunding platform launched Down Under 8 years ago.

"There has been zero instances of fraud. It's not that people haven't tried, but the crowd has been very diligent in rooting it out," she says.

While that may be true, some security experts worry that crowdfunding could be a bastion for scammers.

Related: Kickstarter pulls plug on Kobe beef jerky scam

Dan Karson, chairman of risk consulting and mitigation firm Kroll Associates, poses this scenario: "Someone in Bucharest creates a fictional identity but has a real bank account and gets lower-income, unsophisticated investors to send him money."

That said, Karson does think equity crowdfunding will be "exciting for small investors." He is just concerned that it's "a new market with limited regulation."

But fraud may not be the biggest problem. Lynn Turner, a former SEC chief accountant, notes that investing in startups is inherently risky.

"There's a very clear track record that isn't going to change. A vast amount of companies will fold," he says.

The Small Business Administration reports that roughly half of all new businesses survive five years or more with about a third making it to 10 years.

Turner calls the pending equity crowdfunding situation "a fiasco" that could land the SEC with complaints from thousands of small investors who lose $2,000 each.

"My prediction, but not my wish, is that equity crowdfunding will die from bad publicity after people lose their money from businesses that go belly up," he adds.

Equity crowdfunding will not make sense for many investors.

Related: What's the deal with crowdfunding investments?

Daryl Bryant, founder and CEO of StartupValley, a registered intermediary "or portal" that hopes to connect entrepreneurs looking for investors, concedes as much.

"There is no promise or guarantee. What we offer is high risk, high reward," he says, adding that average investors shouldn't be thinking about investments in startups as retirement savings.

Investors are going to need to do their homework as well. Companies looking to raise $100,000 or less, will be allowed to certify their own financials. You heard that right. And while a venture capital firm can afford to swing for the fences and lose money in the hopes of finding a few big hits, the average investor can't.

But equity crowdfunding advocates say we are forgetting something important: the wisdom of the masses.

"With this platform, it's the crowd that helps determine if this is a good idea or not. The crowd is passionate about due diligence. The crowd will sniff out whatever doesn't smell right," Bryant said.