More than 25 million middle class American families are living paycheck to paycheck.

They have decent salaries. Many own homes and have retirement accounts. But they don't have a lot of savings or readily accessible funds, according to a recent economic study presented by the Brookings Institution.

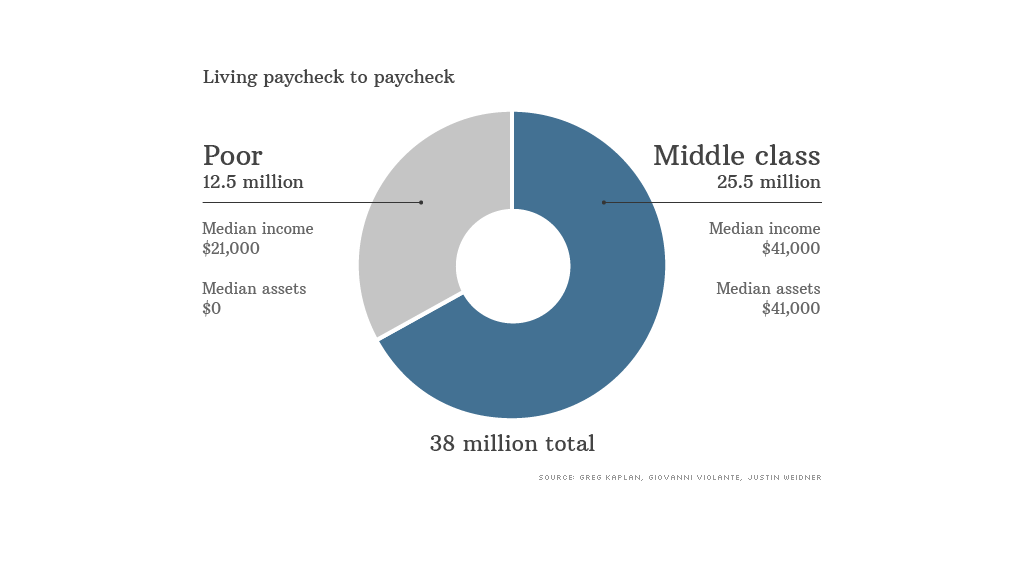

About one-third of American households live "hand-to-mouth," meaning that they spend all their paychecks. But what surprised the study authors is that 66% of these families are middle class, with a median income of $41,000. While they don't have liquid assets, such as savings accounts or mutual fund holdings, they do have homes and retirement accounts, with a median net worth of $41,000.

"We don't expect them to be living paycheck to paycheck," said Greg Kaplan, study co-author and assistant professor of economics at Princeton University.

Poor hand-to-mouth households, by contrast, typically have incomes of $21,000 and no assets. Families that don't live paycheck to paycheck have incomes of $51,000 and assets of $116,000.

Those living paycheck to paycheck have a tougher time weathering income shocks, such as illnesses or bouts of unemployment. The study found that they have to cut back their spending far more than those with a reserve they can tap more readily.

Related: Where the middle class thrives

Just why these middle class households opt not to sock away cash in the bank or stock market isn't clear. One explanation, Kaplan says, is that they think that housing and retirement funds offer better returns so they are willing to forgo having a cash cushion.

"The return is so high that it makes it worthwhile to live paycheck to paycheck," said Kaplan. In a separate study, he found that people who put their money into these illiquid assets can consume more over the course of their lives, though they don't have a smooth pattern of spending.

Many Americans want to own their home, though they know that they won't have a lot of spending money, experts said.

"The typical homeowner knows they are making a big investment in their house, which soaks up a lot of their disposable income but can also be their primary asset when they retire," said Mark Aguiar, an economics professor at Princeton.

This financial plan bucks conventional wisdom, though. Most financial planners recommend people sock away three to six months of expenses in an emergency fund, though few actually do.

Most Americans, however, aren't living hand to mouth for long. Middle class families are typically in this situation for 3.5 years, while poorer households lack a cash cushion for 4.5 years.