U.S. stocks hit new all-time records earlier this week and the economic recovery is on the cusp of turning five years old. So why are investors continuing to rush into safe haven Treasury bonds?

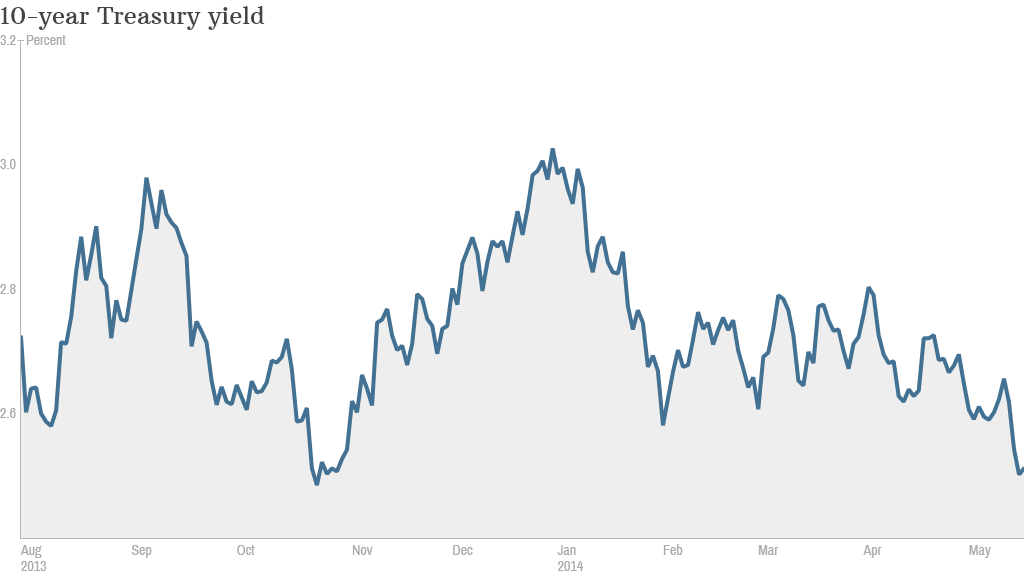

The yield on the benchmark 10-year Treasury tumbled below 2.5% this week for the first time since Halloween. Many experts had been predicting at the start of the year that rates would go up.

Bond yields have been driven down by a confluence of factors, ranging from tame inflation and slow global growth to aggressive central bankers around the world and even Vladimir Putin.

Little inflation = lower rates

The lack of a serious inflation threat may be the biggest reason why long-term rates have been falling.

"Lower inflation leads to lower rates and a stronger stock market. It's good all around," said John Krey, international investment analyst at S&P Investment Advisory Services.

The thinking is that the low bond yields will keep the pressure off the Federal Reserve to hastily withdraw monetary stimulus and hike short-term rates, which have been near zero since the depths of the 2008 financial crisis.

"Inflation is the number one evil of bond investors. But inflation is not a concern in the near term," said Brian Rehling, chief fixed income strategist at Wells Fargo Advisors, which manages about $1.4 trillion in assets.

Related: Don't blink: Stocks race past milestones

The move lower in Treasury yields gathered momentum this week amid reports that Germany's central bank has blessed more aggressive monetary stimulus from the European Central Bank. An ECB rate cut should boost demand for U.S. debt and lower yields even further.

But some experts weren't sure why the bond market shrugged off stronger-than-expected inflation data from businesses as well as upbeat figures on jobless claims and manufacturing growth. A healthier economy usually leads to higher rates.

"It's difficult to reconcile. Either the 10-year Treasury is signaling it's not buying better economic growth or it just doesn't care," said Mark Luschini, chief investment strategist at Janney Capital.

Bond investors have concluded that central bankers are going to follow a "glacial" path to higher rates, Luschini said.

Investors have been caught off guard by the recent move lower in rates and some experts are now revising their targets for where the 10-year yield will finish 2014.

Wells Fargo Advisors recently trimmed its year-end target for the yield on the 10-year Treasury to 3.25% from 3.5%. But that's still a far cry from Friday's yield of 2.51%.

The Putin effect

Few foresaw the role that Putin would have in keeping a lid on rates. Global jitters have frayed investor nerves, especially Russia's annexation of Crimea and ongoing tension with Ukraine. During times of geopolitical uncertainty, U.S. government debt clearly remains the go-to spot for investors.

"There is a good deal of concern that the situation in Ukraine could heat up rather uncontrollably and tear the country apart," said Krey.

Related: Ukraine crisis starts to hit European firms

At the same time, China has been flexing its own muscles in Southeast Asia, picking territorial fights with Japan and Vietnam.

Meanwhile, investors are no longer fearing the collapse of the euro, allowing bond yields in previously-embattled eurozone countries to plunge. For example, the yield on Spain's 10-year debt is now below 3%.

Investors have decided U.S. debt is still relatively attractive, especially given the lower risks and increased liquidity Treasuries provide, said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

Related: Wall Street 'experts' pick loser stocks

So what does this all mean for investors and consumers?

Relatively low Treasury yields should continue to support stock prices because they force investors to search for higher returns elsewhere. Stocks are often an obvious choice, especially companies that pay large dividends.

According to S&P Dow Jones Indices, there are now 148 S&P 500 stocks with dividend yields above 2.5%.

Low yields can also help the economy by reducing borrowing costs for businesses. And the recent pullback in rates can also help consumers, particularly those who are looking to buy a home or already own one.

Mortgage rates should fall if long-term bond yields stay around their current level or dip further. That makes it more affordable for consumers to take out new mortgages and also could lead to an increase in refinancing by homeowners.