Just four short years after Dov Yoran dreamed up his cyber security startup, one of the biggest names in Silicon Valley came calling with an offer he couldn't turn down.

Yoran had grown accustomed to refusing countless tech companies and investors who wanted a piece of his firm's sophisticated threat intelligence platform.

"We've been saying no to people for years. We didn't build a company just to flip it and move on," said Yoran, who co-founded ThreatGRID with Dean De Beer. "We really wanted to experience the whole thing from a startup and having guys sleep on couches and bootstrapping it."

And then Cisco Systems (CSCO) entered the picture.

Cisco began informal conversations with New York-based ThreatGRID late last year. The talks quickly accelerated this winter and culminated this week with Cisco announcing a deal to acquire ThreatGRID and pair it with its rapidly expanding security platform.

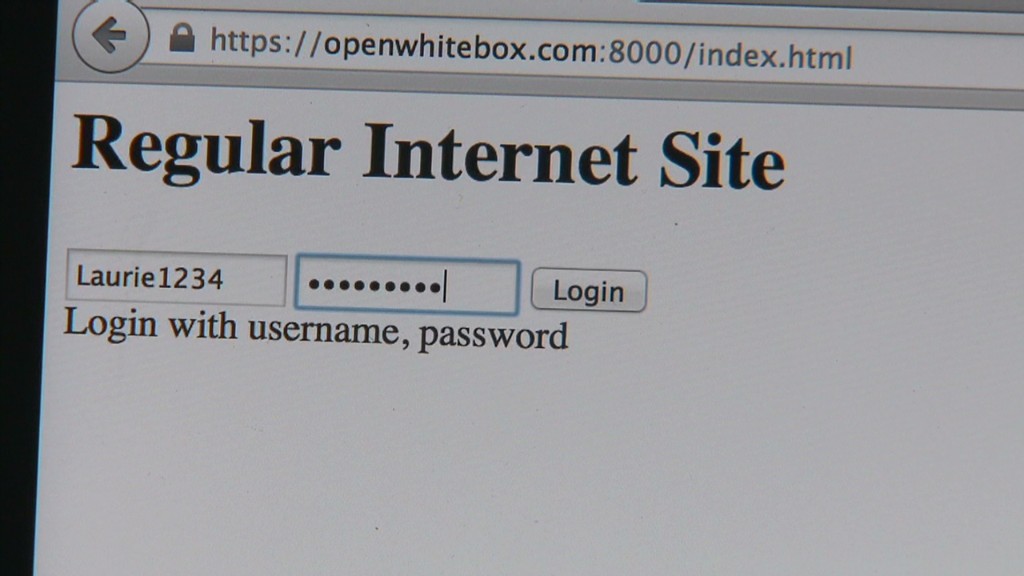

Related: Internet Explorer bug lets hackers control your PC

"They made an incredibly compelling offer -- for not only today but what the vision looks like going forward," said Yoran, who is CEO of ThreatGRID.

Neither Cisco nor ThreatGRID would disclose the value of the deal due to confidentiality agreements.

But Yoran said "it was a fantastic exit for investors, shareholders and employees."

Yoran, who is 38 years old and lives in New York's SoHo neighborhood, said he doesn't plan any major lifestyle changes despite the looming financial windfall.

"It really wasn't about the money. It was about the drive and excitement of what we were building. The money came afterwards, which is pretty cool," said Yoran, who was a pre-med major at Tufts University before changing direction and earning a bachelor's in chemistry. He received his master's at George Washington University.

So why did Yoran decide to sell to Cisco after saying no to many others?

The clincher was the ability of Cisco to help ThreatGRID expand by incorporating the platform with its other products. Cisco plans to marry ThreatGRID with SourceFire, the cyber security company it acquired last year for $2.7 billion. SourceFire and ThreatGRID should be comfortable with each other since they had a previous partnership.

It also helps that the sale won't rock the boat for ThreatGRID's 25 employees, who will be allowed to continue doing what they do now, including working from home.

ThreatGRID crowdsources massive volumes of malware to provide threat intelligence to its clients, which include security subsidiaries of General Dynamics (GD) and EMC (EMC).

"We analyze data that are captured by endpoint and network vendors and we make it readable in a way their products can digest and take action," said Yoran.

Related: U.S. wants companies to share security data

Cyber security firms continue to be objects of desire for big tech companies due to the rising threat level.

Consider that the ThreatGRID deal was unveiled during a week headlined by a major hacker crackdown by the FBI, the U.S. accusing Chinese hackers of cyber espionage, eBay (EBAY) disclosing a cyber attack and Target (TGT) detailing its struggles to recover from last year's epic breach.

"For cyber attackers, and those who defend against them, the stakes could not be higher than they are right now," said Hilton Romanski, head of business development at Cisco, in a blog post announcing the ThreatGRID acquisition.

ThreatGRID is the first company Yoran co-founded that wound up being acquired, but it's hardly his first rodeo in the merger and acquisitions world.

Over the past two decades, Yoran worked at and invested in companies acquired by Intel's (INTC) McAfee and Symantec (SYMC), including a firm co-founded by his two brothers.

He said that experience helped guide him through Cisco's rigorous acquisition process and contemplate other potential options -- such as another round of funding or even an initial public offering.

And he made sure to remember this important lesson.

"You're not selling the company. Someone is buying the company," he said.