Most people know in their heart of hearts that making gobs of money can't guarantee true happiness.

Then again, most would acknowledge that you need to have at least a minimum income for a shot at well-being - if only so you don't have to scrounge for every meal.

In between gobs and a bare minimum, of course, is where most of us live.

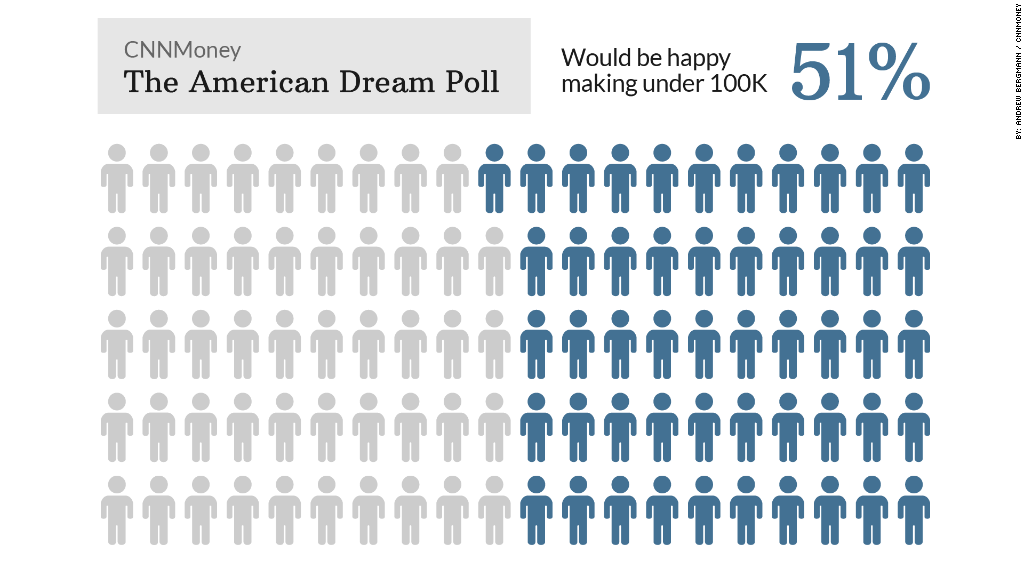

And it turns out many Americans don't think they need a CEO paycheck to be happy, or even six figures.

When asked how much would do the trick, just over half of people surveyed in CNNMoney's American Dream poll said it would take less than $100,000.

Nearly a quarter of the people who took the poll, conducted by ORC International, said between $50,000 and $74,999 would work. That calls to mind the results of a Princeton study, which found that emotional well being rose with income, but not much beyond $75,000.

In other words, past a certain income level, your happiness comes from other factors.

Interestingly, some people really don't care about money: 10% of those polled said somewhere north of a buck but south of $30,000 would be their minimum requirement.

And 6% said money can't buy happiness, period.

On the high end of the scale, 23% said they'd need between between $100,000 and $199,999.

Share your story: Have you achieved the American Dream?

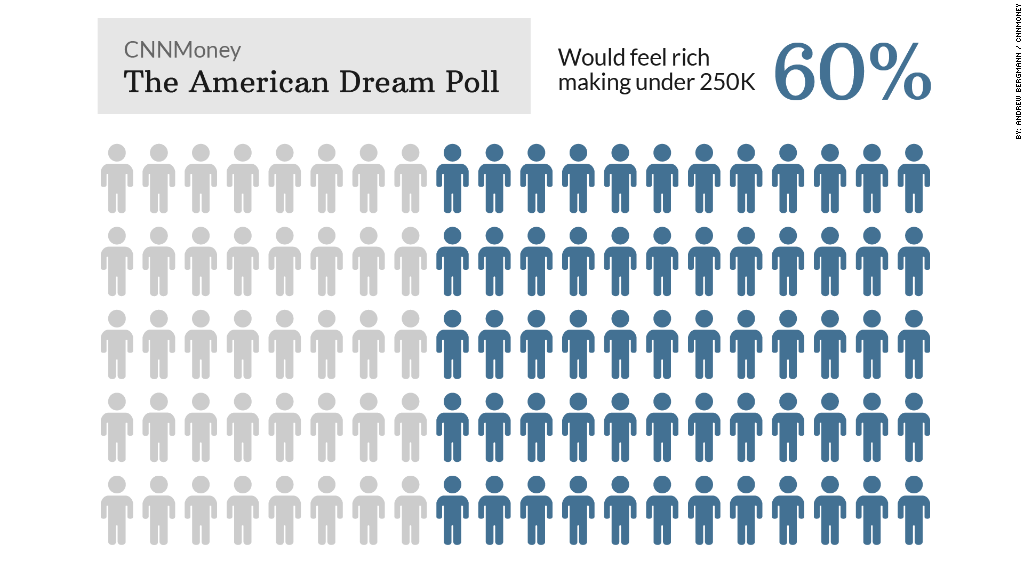

What about how much it takes to be "rich?" A six-figure paycheck was a more typical answer when the same adults were asked that question. But even here, their answers didn't approach the stratosphere.

The most typical answers fell between $100,000 and $199,999. In fact, a full 60% thought incomes below $250,000 would be enough. And only 11% said they'd need to make $1 million or more to consider themselves rich.

The answers given tended to be higher from those who currently make more than $50,000 today.

Read the full CNN/ORC poll results

Of course, making a high (or higher) income doesn't guarantee you'll be rich. It all depends on what you do with your paychecks.

If you're interested in amassing wealth, and wondering when you'll be a millionaire or whether you can retire early, saving and investing a large chunk of your income will certainly help.

Certified financial planner Mari Adam of Boca Raton, Fla., works with a couple - a welder and a nurse - whose joint income is less than $75,000. But, Adam said, "they're very happy with what they have. And the irony is they have more saved than some people who make two or three times more than they do."

Related: Five 401(k) millionaires

Where you live will also play a role in your ability to make the most of what you earn, since cost of living and taxes can vary greatly. That's why a $100,000 paycheck in New York City won't go nearly as far as the same salary in Austin, Texas.

CNNMoney's American Dream Poll comes from telephone interviews with 1,003 adult Americans, conducted by ORC International from May 29 to June 1, 2014. Both landlines and cell phones were included in the sample.