Tim Eimer defines 2008 in one word: Bleak.

The science teacher and textbook author was fighting off a rare and terminal form of cancer as he watched the Great Recession swallow up 40% of his investment portfolio. Friends in finance warned him to dump his stocks because they feared the Dow would soon plummet from its already depressed 8,000 level to 1,000.

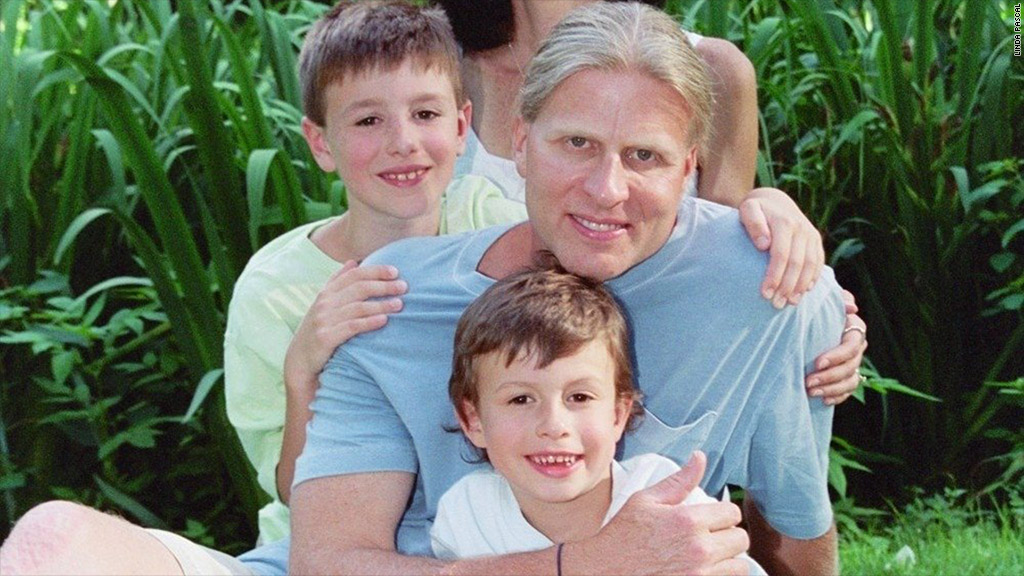

Despite those daunting challenges and ominous warnings, Eimer poured cash into the stock market at the depths of the crisis, a decision that has left him and his wife Gayle on track to become millionaires.

"I didn't jump ship. It was scary buying back into the market at that time," said Eimer, who lives in Horsham, Pa., a suburb of Philadelphia.

Eimer, who in 2005 had been given just two years to live, said he stuck to his belief that you've got to be in the market to make money.

Besides, he said, "If the Dow goes down to 1,000, then all of us have a lot more problems than losses in stocks. You're talking about the collapse of our economy."

Related: How a 77-year-old trader is cashing in on growth stocks

'Prepared for the worst' Eimer's courageous investing during the financial crisis was made possible by his family's frugal, debt-free lifestyle.

Unlike most Americans, he didn't lever up during the mid-2000s on luxury cars, over-the-top houses or second mortgages.

Instead, Eimer and his wife saved half of his salary and invested heavily in their retirement and college savings funds. They paid off a mortgage on their two-bedroom condo in 2003 and bought a new Toyota Corolla for just $15,000. Later they "splurged" on a Honda Element for $18,000.

"Frugality was grounded into me from a young age," said Eimer, whose grandfather lost everything in the Great Depression. "If we had not prepared for the worst, we would be faced with financial disaster."

Eimer said he converted his wife from a "spendthrift" when they first met to a frugal manager of the household budget. "Without her, we wouldn't have been able to do any of it," he said, noting the family gets by on just a single prepaid cell phone.

Related: U.S. recovery hits 5-year mark, but has long way to go

Beating the odds: Disaster struck in 2005 when Eimer was diagnosed with an extremely rare and terminal form of thyroid cancer. That forced him to give up his lucrative side career making up to $200 an hour writing textbooks for McGraw-Hill, Prentice Hall and other publishers.

There was one doctor on the whole planet who was researching this form of cancer, Eimer said, and she developed an experimental chemotherapy drug that helped save his life.

While the drugs extended his life considerably, he still deals with chronic pain, fatigue, abdominal pain and loss of his hair, which has since returned. But Eimer has been able to continue teaching middle school science at Phil-Mont Christian Academy in Springfield, Pa.

Almost a decade after receiving his grim diagnosis, Eimer has beaten the odds and is currently in stable condition. He's also beaten most retail investors by actually participating in the bull market that has left many everyday Americans behind.

"I went through the dotcom bubble, but this seemed worse," Eimer said about the 2008 crash after Lehman Brothers collapsed in September of that year. He said friends who were financial advisors told him to "ditch all stocks and buy silver."

Related: Why hasn't Main Street recovered like Wall Street?

Buying at the bottom: But Eimer did the exact opposite of those dark warnings: He scooped up beaten down stocks and bonds at what turned out to be historically-low prices.

Eimer said he felt confident enough to do this because he had no debt and a ton of fresh powder: 25% of his portfolio had been in cash when the market cratered. At that point, he had bigger problems as he braced for cancer to take his life.

Related: I sold my startup to Cisco. Here's why

Rather than risk trying to find individual stock winners, Eimer continued a strategy that he's implemented since the 1990s: Buy a diversified variety of index and mutual funds.

Bad luck while investing in individual stocks led Eimer to conclude: "It was only my broker who was getting wealthy."

One mutual fund that's been particularly kind to him is the Vanguard PRIMECAP Fund (VPMAX), which invests mostly in technology and biotech stocks like Google (GOOGL) and Amgen (AMGN). The fund has soared 133% since the start of 2009, besting the S&P 500's 123% gain.

"Today, our portfolio is up about 2-1/2 fold from the recession lows. We have zero debt, we're on target to become millionaires in about three years and I'm still alive," Eimer said. "We count ourselves blessed!"