Timing is everything, even on Wall Street.

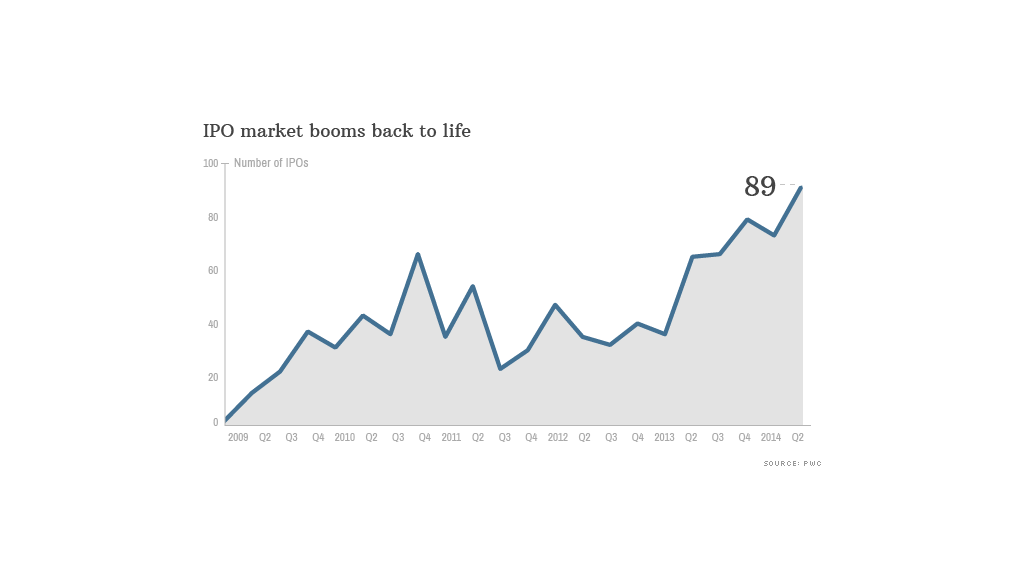

A whopping 89 companies held initial public offerings on U.S. exchanges from April to the end of June. That was the hottest quarter for IPOs since 2007, according to a report released Thursday by PricewaterhouseCoopers.

The IPO surge was headlined by companies like GoPro (GPRO) and Weibo (WB), sometimes dubbed China's Twitter. They wanted to take advantage of the rising stock market and investor appetite for the next big thing.

Together, these 89 companies hauled in $21.5 billion in proceeds during the second quarter, representing a 41% bump from the same period the year before, PwC said.

The report highlights how the IPO market has bounced back after a brief pullback in the spring. Like much of the stock market, IPOs continue to benefit from the Federal Reserve's easy-money policies and the improving U.S. economy.

"There's was a steady accumulation of money on the sidelines. But with the economy appearing to be moving further away from the jaws of death, people's confidence has become a bit more positive," said David Menlow, president of IPOFinancial.com.

The middle of June was an especially hot time for IPOs as 25 companies, or 28% of the quarter's total offerings, went public.

That spike was highlighted by GoPro, the wearable camera maker that zoomed 55% in its first day of trading after raising about $425 million. GoPro's blockbuster debut captured the attention of Wall Street, with the stock currently hovering an eye-popping 78% above its $24 IPO price.

Related: Adrenaline rush! GoPro surges ahead

Strong starts have been commonplace during the IPO boom. The average company going public in the second quarter enjoyed a 9.2% first-day bounce and finished the quarter 20% above its issue price, PwC said.

Like GoPro, 62% of IPOs also priced either above or within their estimated price ranges, the report said. This is seen as a sign of solid demand.

Another high-profile company that enjoyed a successful U.S. debut last quarter was Weibo (WB), China's version of Twitter (TWTR). The social media company popped 19% during its first day of trading, though it's currently only trading 15% above its IPO price of $17.

Tech firms led the way in the second quarter, raising $5.1 billion from 22 IPOs, compared with $2.6 billion from 15 deals the year before, PwC said.

Related: When will Alibaba go public? Ask a fortune teller

While the health-care sector only raised $1.8 billion during the second quarter, it led the way with 24 IPOs, up from 17 the year before. Hot drug IPOs include Zs Pharma (ZSPH), Kite Pharma (KITE) and GlobeImmune (GBIM), all of which debuted in June and are trading more than 40% above their IPO price.

Interestingly, the IPOs in the second quarter of 2014 raised less the fourth quarter of 2013. Of course, that quarter was boosted by the $1.8 billion raised from Twitter's IPO alone.

The growth of the IPO market should trickle down to startups scouring New York and Silicon Valley for investments from venture capitalists.

"A strong IPO market is the life blood of the venture capital industry as it provides an exit alternative and liquidity for venture investments in early stage growth companies," said Mark Cannice, a professor at the University of San Francisco.