The last major sell-off on Wall Street occurred so long ago that Hollywood has had time to churn out three different X-Men movies since then.

To be precise, it's been 1,042 days since the S&P 500 was last in "correction" mode, a technical term for a 10% (or greater) drop.

"It's unnatural to have gone as long as we have without a correction," said Mark Luschini, chief investment strategist at Janney Montgomery Scott.

A correction typically occurs about once every year and a half, according to S&P Capital IQ. But it's been nearly three years since the slump that ended in early October 2011.

Last week, it appeared the long-awaited correction might be in the works amid growing geopolitical crises in Ukraine, Gaza and Iraq, and worries about interest rate hikes. German stocks, which are much more exposed to turmoil in Russia, actually did tumble enough to be considered a correction.

Related: Watch Out! Bears resurface on Wall Street

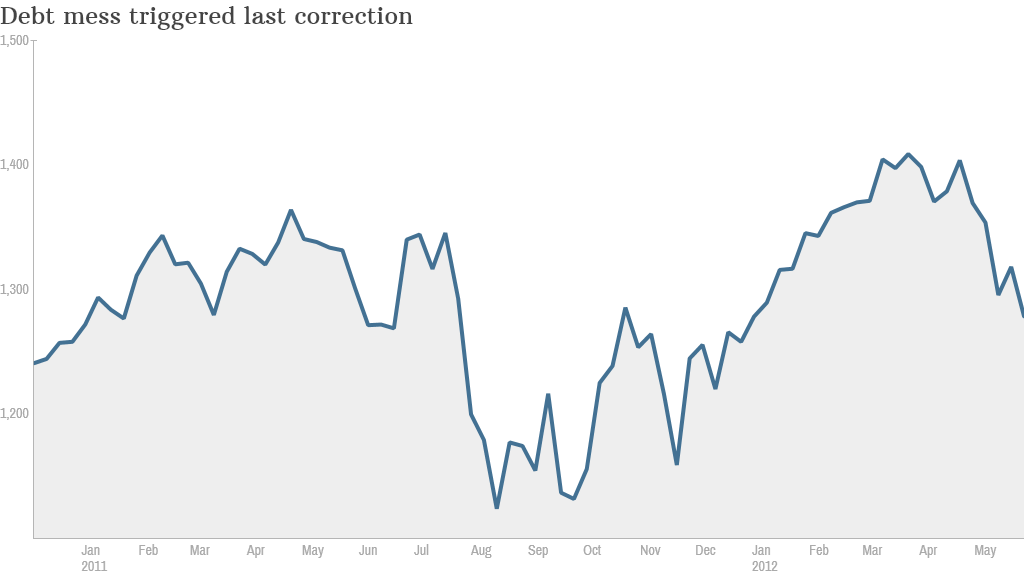

'Only game in town': The last market meltdown began in April 2011 and was triggered mostly by the European sovereign debt crisis, which has long since faded. Back then, there were legitimate fears that the euro zone might fall apart, or at least lose a few weak links like Greece.

The shaky economic environment was exacerbated by Standard & Poor's unprecedented downgrade of U.S. debt, which raised fears about America's fiscal health. Ultimately, the S&P 500 plunged 19.4%, narrowly avoiding a bear market (when stocks plunge 20% or more).

Analysts attribute the lack of a correction since late 2011 to continued "easy money" policies from the Federal Reserve, stronger U.S. economic growth and the lack of inflation.

"Equities became the only game in town. Everyone knew that's where they had to go so it ended up being a pretty smooth ride," said Luschini.

Related: How to stay safe in a scary stock market

It's too early to say whether the current slump will turn into a correction. Thanks to Friday's solid rebound, the S&P 500 is only about 3% below its all-time high. It currently sits at 1,930 and would have to tumble to about 1,790 before being declared a correction.

Better than a bear market: Even if a correction does occur soon, it wouldn't necessarily be a terrible thing for the stock market. It could provide an entry point to investors stuck on the sidelines, strengthening the bull market in the longer run.

Related: The 4 biggest mistakes investors are making

"I'd rather get the reset out of the way now because if we're not careful it may end up becoming a bear market rather than a correction," said Sam Stovall, chief investment strategist at S&P Capital IQ.

Stovall pointed to his research that shows there's only been four other times since World War II that U.S. stocks evaded a correction for as long as the current 34-month stretch.

In three of those previous instances, when stocks did finally fall into correction mode, they didn't stop until they plunged at least 20%.

Related: Small cap stocks are sinking

"Because the economy isn't pointing to a recession, I don't think we will get a bear market. But I do think we'll get a correction. I'm not smart enough to know whether it's this time or some other time though," said Stovall.

If this current slump does morph into a correction, it's not likely to be particularly deep or lengthy, according to Luschini.

"The trigger points, at least so far, aren't significant enough to take us down 20%," he said.