The days of taxpayers ponying up billions to bail out failing banks may be coming to an end.

That is, if world banking regulators get their way.

New proposals unveiled Monday are designed to place the cost of rescuing, or winding up, the world's biggest banks squarely on the shoulders of investors.

The new rules would cover 30 of the world's biggest banks -- those deemed vital to the smooth running of the financial system -- such as HSBC (HSBC), JP Morgan (JPM), Citigroup (C)and Barclays (BCS).

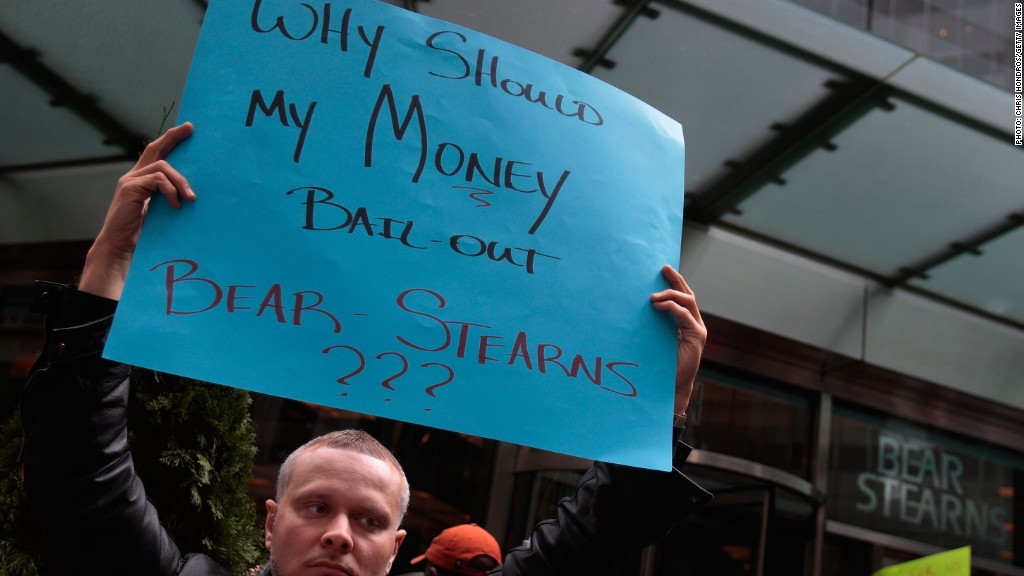

Governments in the U.S. and Europe were forced to throw huge lifelines to a number of big banks and insurers during the global financial crisis, including Bear Stearns, AIG (AIG) and Royal Bank of Scotland (RBS). They supported many others with cash and loan guarantees.

Financial institutions had grown so large, and so interlinked, that they became 'too big to fail' -- regulators feared the collapse of one could trigger a domino effect that would end in the implosion of the entire system.

"Agreement on proposals for a common international standard ... is a watershed in ending 'too big too fail' for banks," said Bank of England governor Mark Carney, who chairs the global Financial Stability Board.

Many countries are still struggling with the debt they took on to rescue the banks. The bill has been passed on as higher taxes or reduced government spending on benefits or services.

If adopted, the banks would be required to set aside much more money to cover potential losses. For many -- particularly in Europe -- that could mean issuing new debt worth hundreds of billions of dollars

And the banks may find they have to pay more to raise money from investors, because of the loss of the implied state guarantee.

The proposed rules will be presented to the leaders of the 20 biggest developed and emerging economies at a summit in Australia later this week. They could take effect from January 2019.

Three big Chinese banks -- Agricultural Bank of China (ACGBY), ICBC and Bank of China (BACHF) -- will be granted an exemption initially.