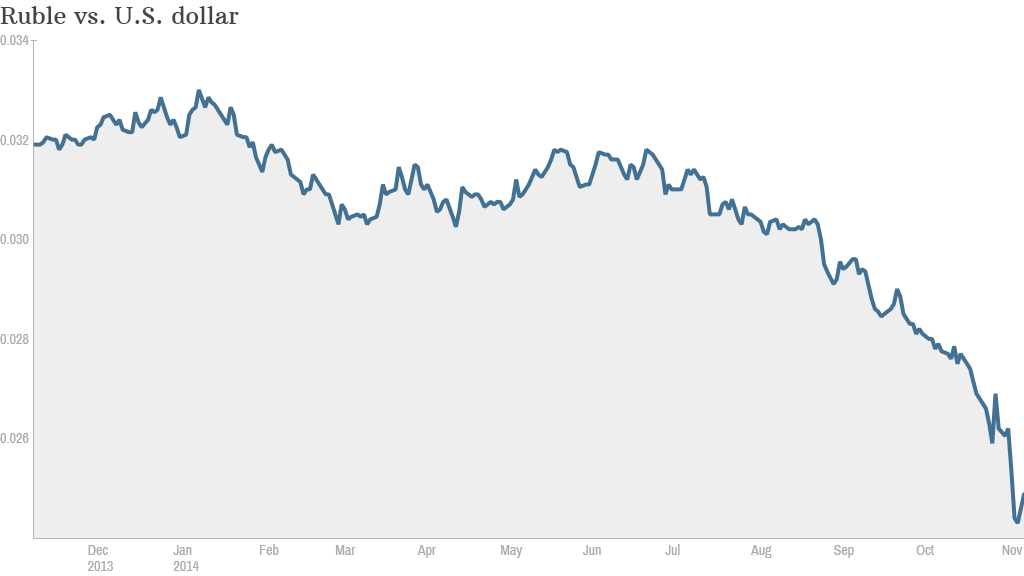

Things in Russia are going from bad to worse.

A double whammy of falling oil prices and sanctions imposed over Ukraine has led to rampant inflation, a plunging currency, a stagnant economy and a loss of confidence among foreign investors.

The Russian central bank said Monday it expected no growth in 2015, and little improvement the following year, confirming what many economists and external officials have been saying for months.

Here are five reasons the country could face even tougher times:

1. Banks squeezed

Russian banks have amassed about $192 billion in foreign debts, but have very few assets in dollars to set against them.

The plunging ruble, combined with the lack of dollar income, is making it harder for the banks to repay that debt. If the ruble remains at its current level, the additional cost to Russia's banks could be as much as $22 billion, Capital Economics estimates. That's equivalent to more than 1% of the Russian economy.

2. Budget hole

Government documents show that Russia's 2015-2017 budget is based on oil trading at $100 a barrel. The central bank forecast of zero growth next year is based on a price of $95. Both assumptions are way above the current price of $84 a barrel.

Finance minister Anton Siluanov has called that an "alternative economic reality". He has warned that the government will need to cut spending by 10% to make up for the difference.

Oil and gas accounts for more than half of Russian government revenues.

Related: Russia's currency won't stop falling

3. Sanctions

Tensions in the region are rising again. Ukraine has accused Russia of sending yet another armored column into its territory, while the town of Donetsk has just seen the worst outbreak of violence in over a month. Russia has also recognized elections held by separatists in eastern Ukraine last week.

All this is fueling speculation that the West might step up its sanctions, which are already sinking the Russian economy. The central bank said Monday it expects the measures to last until 2017.

The bank now expects foreign capital outflows to hit $128 billion this year, up $38 billion on its previous estimate. Next year will see another $100 billion leave the country, it estimates.

4. Inflation

The tit-for-tat sanctions Russia imposed on Europe, the U.S., and other western countries have backfired. The near complete ban on Western food imports is pushing Russian inflation up. The central bank now expects inflation to exceed 8% in 2014 -- well above its 5% target.

Looking ahead, the bank's 4% target for 2016 is now unrealistic. The bank said it hoped to reach it in 2017 -- barring any more economic disasters.

Related: Which foods are off Russian menus?

5. Putin in denial

Despite the warnings from his own ministers and central bankers, Russian President Vladimir Putin seems to be in denial about the state of the economy.

"These events in the currency market which we see now in Russia are not at all connected to the fundamental economic reasons and factors," he said.