OPEC just fired a shot at the U.S. shale industry.

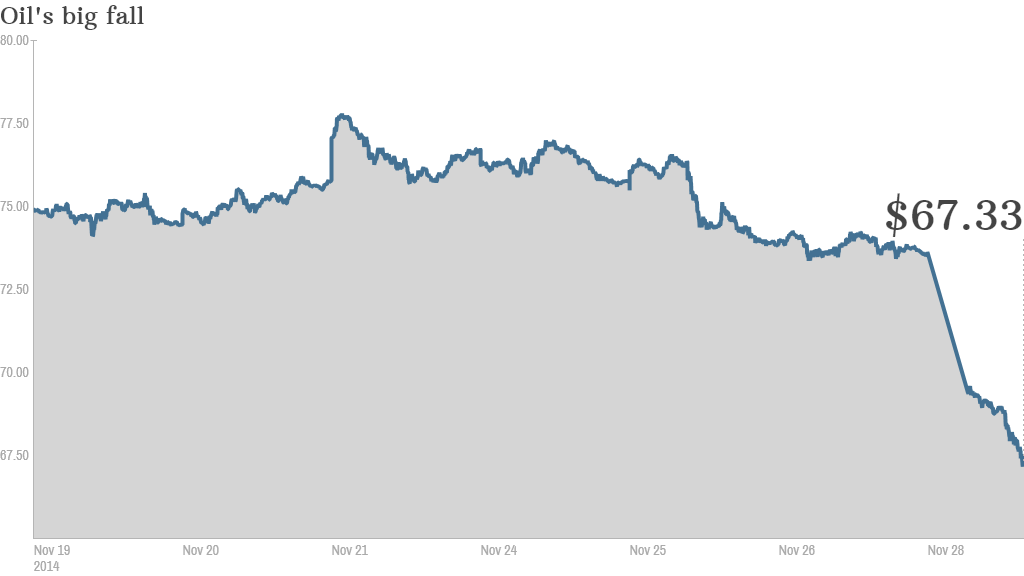

Despite tumbling prices -- the lowest since 2010 -- the cartel surprised the energy industry by deciding to keep pumping oil at current levels. One motivation is to squeeze higher-cost producers in North America, including the booming U.S. shale industry that has reshaped the global energy landscape.

It's a move Tony Soprano would be proud of. OPEC is betting lower oil prices will force U.S. producers to throw up the white flag and cut back on production because they won't be able to turn a profit.

"The gauntlet has been thrown down for Western Hemisphere producers like Brazil, Canada and the United States," Bespoke Investment Group wrote in a note to clients on Friday.

Related: Nightmare for oil stocks

Dot-com bust all over again? The fear is that OPEC's hard line could cause a pull back in the U.S. shale industry, sparking job losses and causing panic in the financial markets.

That's what Russian oil tycoon Leonid Fedun is predicting, although Russia isn't part of OPEC.

"The shale boom is on par with the dot-com boom. The strong players will remain, the weak ones will vanish," he told Bloomberg News on Thursday.

The OPEC move has clearly spooked investors, who sent energy stocks like Halliburton (HAL), Helmerich & Payne (HP) and Schlumberger (SLB) plummeting on Friday. (U.S. markets were closed for Thanksgiving Day on Thursday).

"I think there will be increased scrutiny of the balance sheets of the exploration and production companies. You'll see some of the weaker players fall out," said Tamar Essner, energy analyst at Nasdaq Advisory Services.

Related: The real Black Friday deal: cheap gas

Credit stress ahead: That scrutiny forced SeaDrill Limited (SDRL) to suspend its dividend earlier this week, causing the offshore drilling contractor's stock to plummet 23%.

Essner "absolutely" expects more drillers and oil servicing companies to cut or even suspend dividends. Bespoke's baseline scenario calls for dividend suspensions and bond defaults among more "marginal" named producers.

Many troubled shale companies will be able to avoid bankruptcy by selling acreage to boost cash flows though, said Per Magnus Nysveen, head of analysis at Rystad Energy.

No crash just yet: While financial stress could be looming for shale oil producers, experts aren't forecasting a complete meltdown.

"I don't think this will spell the death knell of the U.S. shale industry. Time and again this industry has proved very resilient," Essner said.

Nysveen said the breakeven crude oil price for U.S. shale producers is around $50 or $55. Despite the recent plunge, oil is still well above that at the $70 range.

Those crucial breakeven points have been trending lower and lower in recent years thanks to technological advances that have made oil producers dramatically more efficient.

"U.S. production is much more competitive than 30 years ago," Nysveen said.