Americans have one less reason to feel bad for the nation's wealthiest: they are getting richer and younger.

That's right: affluent Americans aren't all reading AARP magazine at a tony golf resort. Some probably read Buzzfeed too.

Call it the Mark Zuckerberg trend. In the 1960s, almost half of the wealthiest Americans were senior citizens. Now less than 40% of the super rich are over 65, according to a recent report by economists Emmanuel Saez and Gabriel Zucman.

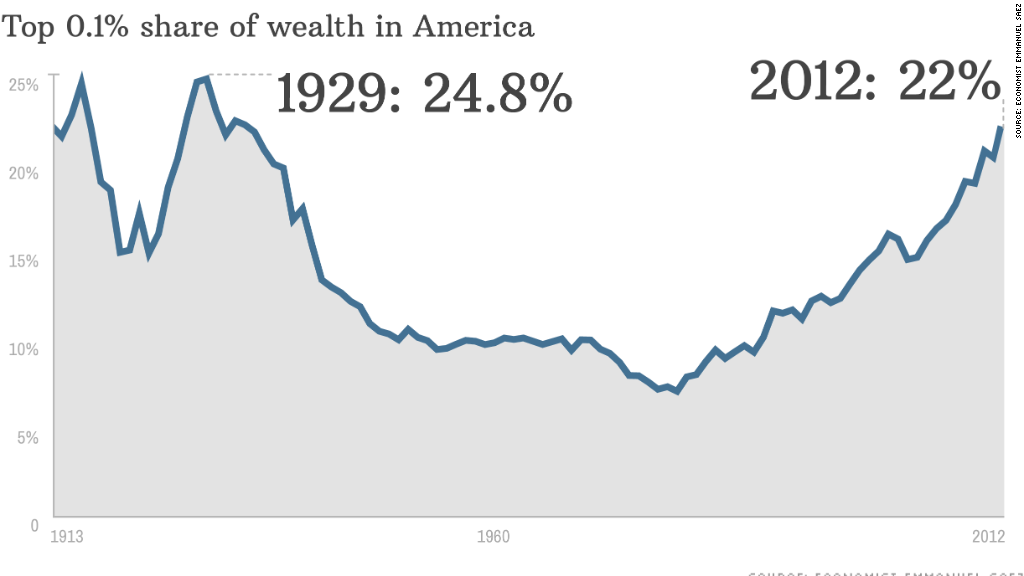

This shift is happening as wealth inequality in America reaches its highest levels since the 1920s.

Unsurprisingly, the rich are getting richer thanks primarily to ownership in stocks and bonds.

Related: Amercia's youngest female billionaire

Rising inequality: Inequality peaked during the Roaring Twenties, then fell after the Great Depression, hitting its lowest point in the 1970s.

Since the 1980s, the rich have steadily regained a larger share of total wealth in the United States.

"Wealth inequality is making a comeback," Saez and Zucman write. "This snowballing effect has been sufficiently powerful to dramatically affect the shape of the US wealth distribution over the last 30 years."

The most elite group of Americans -- the 0.1% -- consists of only 160,000 families, yet they own 22% of the total wealth in the nation. That's about the same amount of wealth that the bottom 90% of Americans collectively own.

Related: Over 48 million Americans live in poverty

What is less clear is whether the young and opulent are self-made, new money or beneficiaries of old money.

"There may be more Mark Zuckerbergs at the top of the wealth distribution than in the 1960s, but also more Paris Hiltons," Saez and Zucman write.

The gap between most Americans and the upper echelon continues to grow quickly.

Between 1986 and 2012, the top 0.1% of Americans took in half of the nation's wealth accumulation while wealth growth stayed flat for most Americans.

The trend is unlikely to change soon.

As the rich earn more income, they save more of their money and then invest more in financial markets than average Americans, according to the report.