Google Ventures is shifting away from investing in the Ubers of the world.

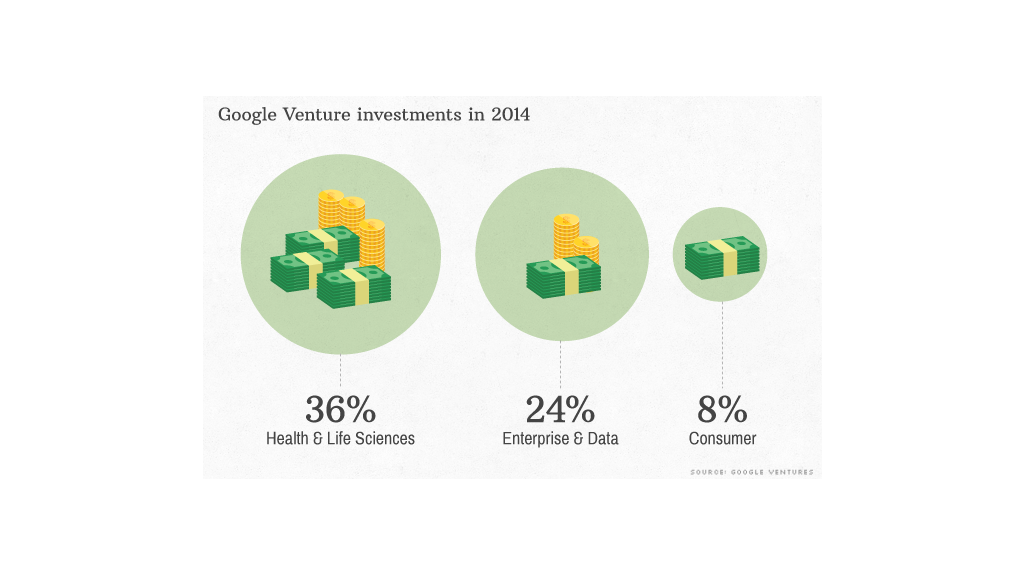

Google (GOOG)'s VC investment arm is doubling down on life science and health service startups. This means everything from digitizing primary care (One Medical) to cloud-based genome data (DNA Nexus). It's the first year that the majority of the fund's investment dollars have been in this sector (36%), followed by mobile (27%) and consumer startups (8%, down from 66% in 2013).

"It's not surprising at all to me that we, as investors, are interested in [the space]," said Bill Maris, managing partner at Google Ventures. "36% of our dollars invested doesn't seem like a huge number. I feel like we could probably do more."

It is, however, a significant increase.

In both 2012 and 2013, funding for life sciences and health startups made up just 9% of their total.

Google Ventures' portfolio includes companies like Nest (since acquired by Google), Blue Bottle Coffee Co., DocuSign, and, of course, infamous transportation disruptor Uber.

Related: Google searching for cancer cure

Overall VC funding mirrors this trend. According to data from PrivCo, funding to health care and life sciences startups jumped by nearly $8 billion from 2013 to 2014, capturing $20.7 billion. It's followed by commerce ($18.7 billion) and mobile ($13.9 billion).

According to Maris, his firm placed a "concerted effort" on funding fledgling startups in the life sciences. ("If we don't, who's going to?" he said.)

Maris -- who helped bring on genetics expert Andrew Conrad to head up Google X's Life Sciences team -- recalls getting criticized for their focus early on.

Related: Hedge funds want one-night stand with startups

"When we started this, we got some amount of criticism on why we'd be investing in life sciences of all things," he said. "It's become clearer that life sciences and technology go together quite well. [But] there isn't the same enthusiasm as there is for technology investing."

This spring, Google Ventures led a $130 million round of financing for Flatiron Health, a New York City-based software company that aggregates cancer data for oncologists. It's the second most funded startup in Google Venture's portfolio (Uber is the first).

Google Ventures -- which also invests in startups in Europe and Israel -- will be on the lookout to support more health and life sciences startups with its 2015 investment fund of $425 million.

After all, the potential payoff is significant.

"Life sciences is such a hopeful area," said Maris. "If you're a venture investor in the space, you've played a very small supporting role in the larger story of helping people live longer. You're investing in companies that really make a difference. It's just a little more meaningful."