The stock market is doing its best impression of a bouncy ball lately and everyone's blaming oil.

But let's take a look at history. Plunging commodity prices have more often sent stocks soaring than falling.

To borrow a marketing slogan from Las Vegas, what happens in the oil patch may stay in the oil patch.

Cheap crude and gas prices don't have to hurt the rest of the market or the broader economy.

Related: Gas is less than $2 at most stations

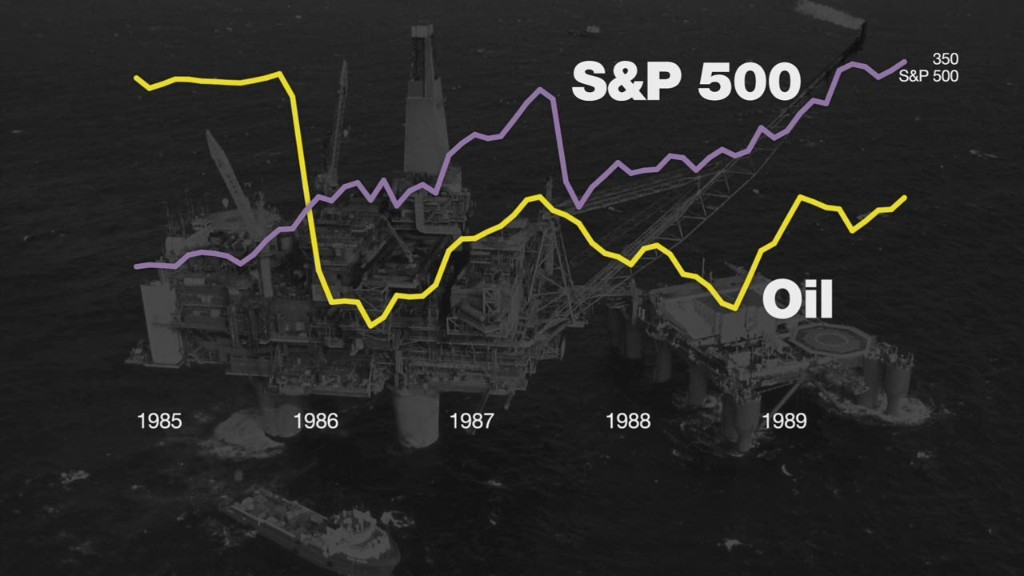

Oil fell during the longest bull market ever. There was a big glut in oil in the early-mid 1980s. When the energy bubble burst and oil prices subsequently fell, that was bad news for Texas.

But the rest of the country did just fine. The nation's gross domestic product, or GDP, rose 3.5% that year according to figures from the World Bank.

The stock market shrugged off the turmoil in oil as well. The S&P 500 rose nearly 15% in 1986 and the Dow gained about 23% -- even though crude prices plummeted more than 40%.

Related: OPEC vs. the U.S.: Who will blink first on oil?

The same thing happened in the late 1990s during the height of the tech boom. Oil prices plunged 40%.

The sudden drop in energy prices led to several big oil mergers -- most notably BP (BP) buying Amoco and the formation of Exxon Mobil (XOM).

However, most investors were too busy chasing hot new Internet stocks like Amazon (AMZN), Yahoo (YHOO) and eBay (EBAY) to notice. The Nasdaq surged 40% that year. GDP growth in 1999? 4.5%.

These market rallies and big jumps in economic growth make sense.

Related: Saudi prince says oil will never return to $100

Cheap gas prices should boost consumer spending. And that helps lift profits for most of Corporate America. So do the lower costs that come with declining oil prices.

Is this a repeat of the Great Recession? But here's the problem. If oil prices fall too far and too fast because of lower demand, that's bad.

That's exactly what happened in 2008. Oil prices hit an all-time high of near $150 a barrel that summer. The average price of gas nationwide reached a whopping $4.11 a gallon.

Remember what happened next? Lehman Brothers went bankrupt. The financial system nearly imploded and the unemployment rate skyrocketed.

Oil fell to as low as about $32 a barrel by the end of 2008. I don't recall any celebrating though. We were all praying that our job would be safe and that our 401(k) plans wouldn't be worthless within a year.

That brings us to today.

Related: Cheap oil cost me my job

If the drop in oil prices is more about too much supply (i.e. the shale gas boom in the U.S. combined with OPEC continuing to pump up production) than too little demand, then stocks may hold up well like they did in the mid-1980s and late 1990s. Oil may soon rebound a bit as well.

But if the pullback in oil is mostly a reflection of weakening economies in Europe, China, Japan and Latin America, then that could lead to more unfavorable comparisons to 2008.

It's just soon to tell. And that's why nervous investors are unlikely to get over their oil obsession anytime soon.