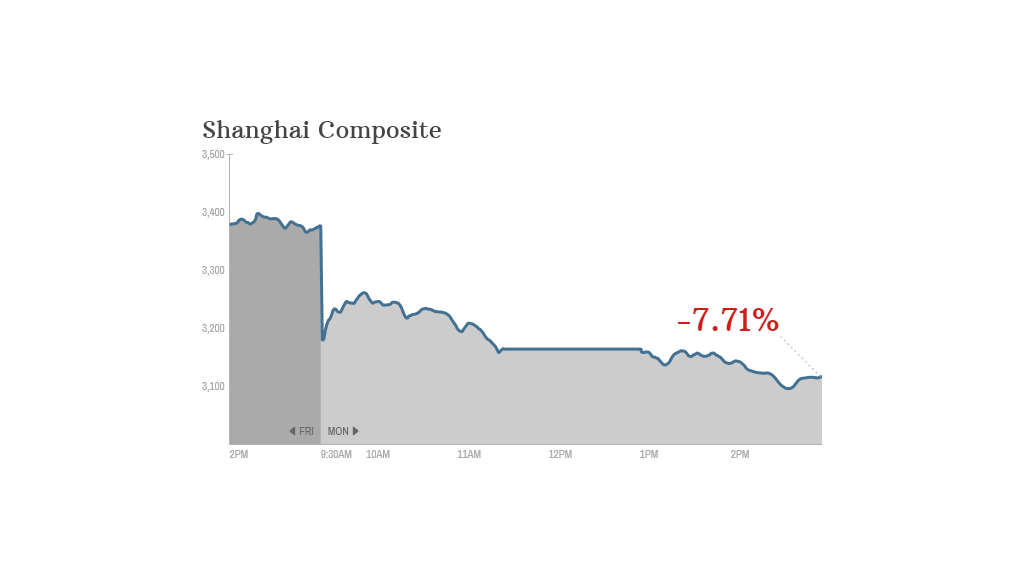

China's benchmark index suffered its worst day of trading in recent memory on Monday after regulators penalized three brokerages for breaking rules that limit risky margin trading.

The Shanghai Composite dropped nearly 8% as investors reacted to the ruling, which will prevent the brokers from opening new margin trading accounts for three months.

Shares of two affected brokerages -- Citic Securities and Haitong Securities -- quickly lost 10%, the daily limit for stocks trading in Shanghai. Guotai Junan Securities, the third broker, was trading down more than 10% in Hong Kong.

The fallout was limited to stocks trading in China. Japan's Nikkei gained nearly 1%, and most regional indices finished higher.

Deng Ge, a spokesman for the China Securities Regulatory Commission, said the brokers were caught rolling over margin trading accounts for a large number of clients "and had been warned," according to Reuters.

Related: Plunging oil prices won't solve China's economic problems

Margin accounts allow consumers to buy stocks with money borrowed from their brokerage, and can yield huge returns. They are also very risky, especially for inexperienced retail investors.

Citic said in a statement that it would take steps to rectify the problems identified by regulators, and no longer allow customers to extend margin loans beyond the six month limit mandated by law.

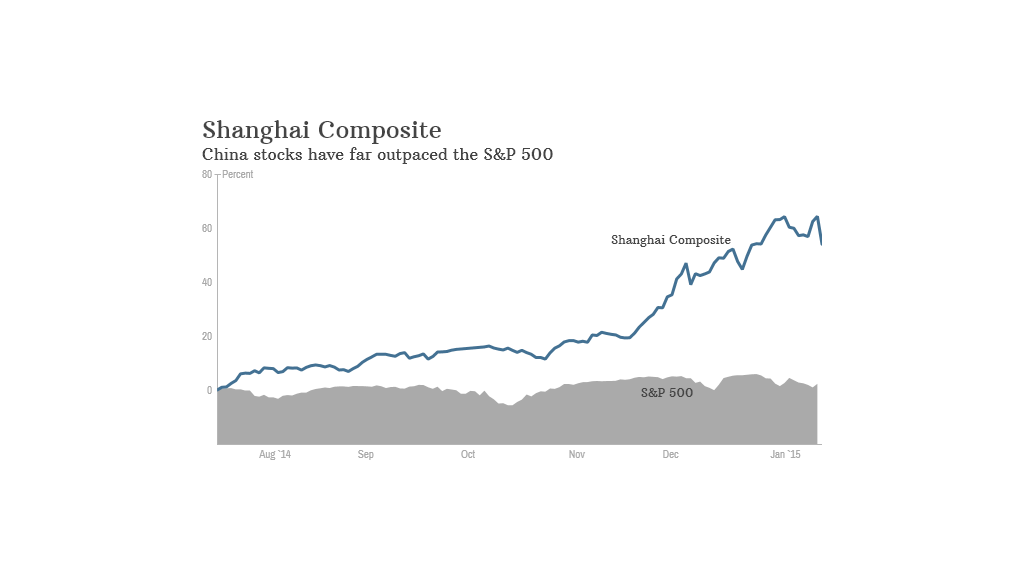

The crackdown is thought to be a reaction to an increase in margin trading that helped fuel the Shanghai Composite's meteoric rise in recent months.

It is not yet clear whether the ruling will blunt broader market enthusiasm. The Shanghai Composite had surged a jaw-dropping 63% over the past six months, and many analysts predict the index has even more room to run.

The exuberance is not supported by economic data -- factory activity is dour, the real estate sector is shaky and GDP growth is expected to slow further this year to 7%, according to a CNNMoney survey of economists.