Oil and stocks have lately been in a sort of seduction dance, moving closer and closer. Last week, it got so heated that oil and stocks were moving almost in sync.

"This is not normal. This is not fundamentals," says Michael Block of Rhino Trading.

All you had to do was look to see if oil is falling. If so, stocks would likely start sliding too.

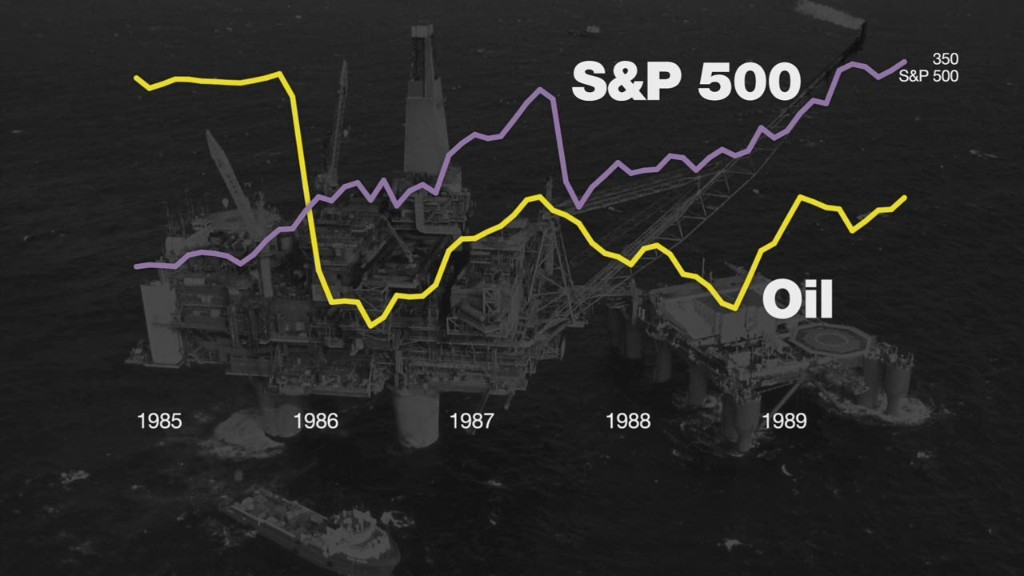

It hasn't always been this way.

In fact, in the past few years the correlation between stocks and oil prices was a mere 20% or so, Block says. In other words, the two didn't move together very often.

Related: U.S. shale industry may shrink by 30%

Since the beginning of this year, that correlation has jumped to 60% or even higher. On some three-day stretches it has even hit 90%.

That's because when prices of some key assets -- like oil -- fall dramatically, investors have a tendency to start selling across the board, without much thought. It's similar to what happened during the financial crisis or even the panic sell-off in early October.

"It's the pain trade," says Block. "Stock prices aren't just driven by fundamentals. They're driven by who owns what."

He explains that losses in one part of a portfolio often trigger selling in other parts out of fear or because people need to raise cash to cover a bad position and they have to dump what they can, even if they don't want to.

Related: Warning: Bond rates are going negative

A turning point? But the dance could be ending -- or, at least, the stock market may be eying other partners.

In recent days, oil has been oscillating between $45 and $49. It's still a painful level for energy producers compared to the days of $100 oil -- more layoffs and spending cutbacks have been announced this week -- but the free fall seems to have stopped for now.

On Tuesday, stocks actually rose despite a 5% fall in oil.

"At a minimum you just want to see things stabilize. Then you start asking, what is the level that will matter?" says Dan Greenhaus, chief global strategist at BTIG.

Look for the market to turn its attention to two more pressing matters: earnings and Europe.

U.S. stocks enjoyed their first three-day rally of 2015 this week thanks to wide speculation that the European Central Bank will come to the rescue and announce some sort of stimulus package on Thursday.

Related: Deflation 'Death Star' firing lasers at economy

Investors are also getting a look at fourth quarter earnings now. That means the conversation is shifting from forecasts about how oil prices, the global economic slowdown and currency moves to actual numbers.

"As you progress through earnings season and see more energy and industrial companies, you start to see a more concrete understanding of what the effects of lower gas are. Right now it's a guessing game," says Greenhaus.

Prepare for the market tempo to change again.