The oil crash -- and cheap gas bonanza -- probably isn't over yet.

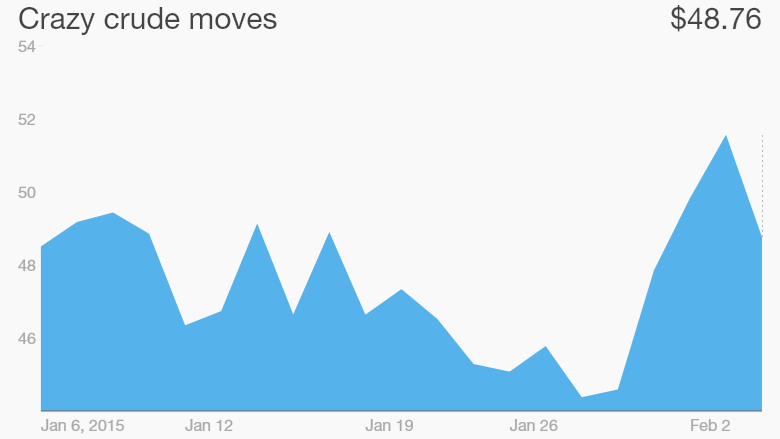

For a few days, oil was showing real signs of life following last year's meltdown. Prices spiked above $54 a barrel on Tuesday after oil's best three-day performance in six years.

Drivers may have even noticed a little pop in gas prices. The national average price of gasoline jumped nearly five cents a gallon on Wednesday, according to AAA. The oil bounce also caused stock prices to surge on Tuesday.

But the rebound is already looking like it may be short lived. Oil plummeted nearly 9% on Wednesday to settle at $48.45 a barrel. That's the commodity's worst day since November 28 when OPEC rattled the market by deciding to keep production steady.

What's going on? It all goes back to simple supply and demand. The world is awash in oil -- more than it needs, especially given sluggish demand caused by lackluster growth overseas.

Prices did mount a comeback on signs that U.S. oil producers are racing to fix that oversupply problem by shutting down oil drilling rigs. Some experts began calling a bottom in oil prices and a top OPEC official even predicted crude could eventually explode to upwards of $200 a barrel.

But Citigroup doesn't buy the bottoming out thesis. In a pair of reports released this week, the bank warned crude oil may need to tumble to $30 because the world still has too much oil on hand.

"For the market to truly balance, U.S. oil rig counts would have to fall significantly further and the bottom of the price trading range for 2015 is likely to be a good deal lower," Citi analyst Seth Kleinman wrote in a research report on Wednesday.

Related: How the oil boom changed the face of North Dakota

Oversupply problem persists: Citi estimates supply continues to outpace demand by about 1 million to 1.5 million barrels per day. That's not exactly a recipe for higher prices, especially since OPEC appears unwilling to step in to balance the market like it usually does.

Oil prices spiked after Baker Hughes said U.S. rig counts plunged by a record amount last week. They are now down by 24% from their peak in October.

But just because rig counts are falling doesn't mean production is, especially given productivity gains U.S. shale producers have achieved in recent years. U.S. production actually increased to a record of 9.3 million barrels per day during the week of January 23, according to Yardeni Research.

"Energy production isn't like flipping a light switch. Supply response happens in months, not days," said Art Hogan, chief market strategist at Wunderlich Securities.

Citi also notes that rig counts have only declined by 9% from their peak at the Big 3 shale oil plays: the Bakken, Eagle Ford and Permian. That's a big deal because these regions are pumping tons of oil.

Without sizeable rig count declines at the Big 3, U.S. oil production could still rise by about 1 million barrels per day in 2015.

Related: More energy firms slash spending

Head fake? This wouldn't be the first time the energy market was faked out by falling rig counts. Back in early 2009 U.S. natural gas prices prematurely rallied on deceptive rig data only to fall to new lows later in the year.

"History appears destined to repeat itself," Kleinman wrote.

If oil producers fall for another fake, they may end up hurting themselves more in the long run.

"Any expectations of an early price recovery could well ward off deep cuts in production, thereby prolonging the oversupply and price distress," Kleinman wrote.