Warren Buffett was one of the biggest shareholders in ExxonMobil. Not anymore.

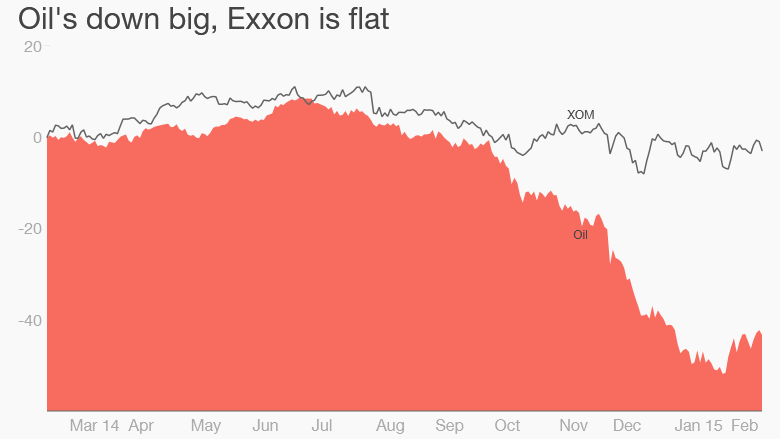

The billionaire sold his nearly $4 billion stake in Exxon (XOM) at some point during the fourth quarter when oil prices were in a seeming free fall. Crude plunged from over $100 in July to $50 by December.

Big Oil used to seem like a slam dunk investment, but the unexpected plunge in crude oil changed the game. Cheap oil is already pressuring Exxon's revenue and threatens to hurt its ability to return lots of cash to shareholders.

Related: Cheap oil killed this CEO's $14 million job

Time to exit? But did Buffett, who has made a career out of being a long-term investor, sell at the bottom?

While it's not known exactly when in the fourth quarter Buffett sold, Exxon's share price dropped from about $105 in June to as low as $86 near the end of the year.

Buffett also dumped his stake in ConocoPhillips (COP), an exploration and production company.

Related: Robert Shiller is buying stocks in Europe

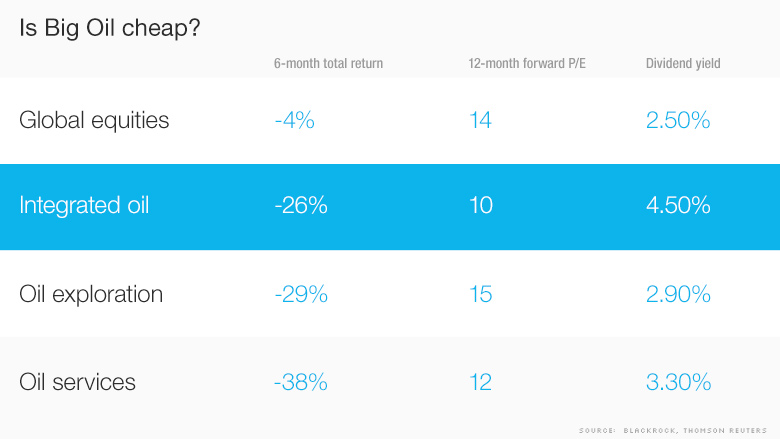

The bullish case for Big Oil: Some experts disagree with Buffett. They believe now is actually the time to buy Big Oil companies. BlackRock (BLK), the world's largest asset manager, said integrated oil companies are its favorite in the beaten-down energy sector.

"We favor the 'super majors' because of their strong balance sheets, high dividends and integrated business models," the BlackRock Investment Institute wrote in a recent report.

Oil prices have rallied since mid-January, raising hopes the worst is over. Exxon shares up 6% from their recent lows.

While oil services firms still look risky to BlackRock, the firm loves that integrated oil companies are sporting a 12-month forward price-to-earnings ratio of 10, which is below their historical levels and global equities broadly. In other words, these stocks are very cheap.

The integrated model that Exxon, Chevron (CVX) and others have means they are involved in all parts of the energy business. That helps shield them a bit from the oil crash because today they stand to benefit from higher refining margins and lower capital costs.

Related: Cheap oil killed this CEO's $14M job

These Big Oil companies also pay fat dividends, with an average dividend yield of 4.5%. That's well above the yield paid out by U.S. utilities, a group that many yield hungry investors have run to lately.

"They've been through all kinds of market cycles and survived them in the past. For income-oriented accounts, they remain very attractive," said Ed Yardeni, president of investment advisory Yardeni Research.

Buffett might have a point though: But as cheap as these companies look right now, there are concerns about whether they will return to their glory days.

Big Oil isn't generating as much revenue as it used to, and companies have been scrambling to cut costs, hurting their global growth ambitions.

Related: America's oil glut problem: How to move it safely

That may be why Buffett decided to dump his stake in Exxon and double down on other parts of the energy sector.

The billionaire boosted his investment in Phillips 66 (PSX), the refinery company previously spun off by ConocoPhillips. Shares of Phillips 66 have soared 32% since falling below $58 last month.

Buffett also bought more shares of Suncor Energy (SU), a Canadian oil-sands company. While Suncor's profits plunged 81% during the fourth quarter, it plans to continue spending on current projects and to increase production despite the oil price drop.

The decisions by big-name investors -- billionaire George Soros also sold his stake in Exxon late last year -- highlight the shifting dynamics facing the energy sector.

"Valuations of global energy stocks have fallen, but selectivity is important," BlackRock wrote.