One of the biggest conundrums in the financial world is this: Survey after survey shows that women lack confidence when it comes to investing and retirement planning. Yet if you look at the actual results, women often perform better than men.

Caryn Effron has seen this first-hand. A long-time real estate professional, she was motivated to start the website GoGirl Finance after witnessing a discussion between her college-aged son and daughter, and their friends.

The lunchtime chat was a vibrant exchange among all participants. That is, until the topic changed to stocks and investing. Then the young women went silent.

"Ninety percent of the time women don't participate [in financial discussions]. This is crazy in this day and age," says Effron, who launched her site in 2009 to encourage women to take charge of their finances.

Related: People who lose money make these 2 big investing mistakes

Women invest wisely: The evidence shows that women are far wiser at investing than they realize. Terrance Odean, a professor at Berkeley's Haas School of Business who has spent his career studying investor trends, found that men traded 45% more than women in the 1990s. He blamed it on male overconfidence.

All that extra trading actually caused men to have average returns that were a full percentage point lower than women.

Women are also less likely to engage in risky day trading or put their retirement funds entirely in stocks, according to Fidelity's data. They diversify their portfolios better across stocks, bonds and other investments.

Over the past decade, the median returns for both men and women are 7.3% to 7.4%, according to Fidelity data. But women's portfolios are much lower risk.

In the investing world, that's ideal -- get the highest return by taking on the least amount of risk.

Related: Shocking gender pay gap in London's banks

Women can end up with more: Kathy Murphy, president of Fidelity Personal Investing, is quick to point out that women save more than men on average and their investment portfolios perform as well if not better than men's.

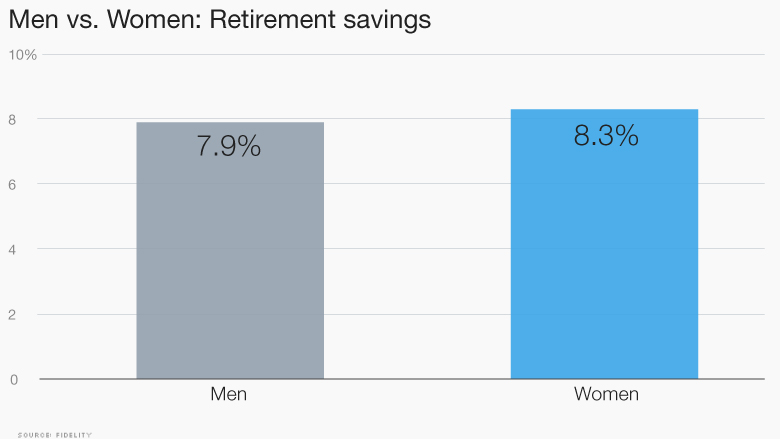

Females typically save 8.3% of their income, while men only save 7.9%, Fidelity found after looking at over 12 million retirement accounts and adjusting for certain pay disparities between men and women.

That may not sound like a big difference, but it adds up over time. Consider that the median household income in the U.S. is around $50,000. If you apply those savings rates to the median income, women save about $200 more a year.

So if their returns are about the same, women would end up with more.

The data tell the story: Yet, research by Fidelity backs up what Effron saw at her dining room table. In a new study, Fidelity found that eight in 10 women admit that they held back from talking about their finances, even with close family and friends.

"Despite all the progress women have made in the workforce and otherwise, they still have an unwarranted confidence gap about their ability to engage in financial planning," says Murphy of Fidelity.

It's telling that 77% of women report they are confident discussing their health with a doctor on their own, yet less than half feel the same confidence when talking about money and investments with a professional.

Related: Women build bigger businesses

A seat at the table: The key is for women to take a seat at the table and participate in the financial conversation.

"Frankly ... it's just not that hard," Murphy emphasizes.

This isn't just about gender equality, it's common sense given the shifting dynamics of American households.

Already 40% of women out-earn their spouses, according to Pew Research, and nine in 10 women are expected to be the sole financial decision maker for their household at some point given that women are staying single for longer and often outliving their partners.