It's all going downhill for Russia, again.

Russia's central bank cut interest rates by 1% to 14% on Friday, highlighting the dire state of the country's economy.

The bank also slashed its growth forecast. It expects the Russian economy to contract by between 3.5% and 4% in 2015, worse than its January prediction of 3%.

There is plenty to worry about.

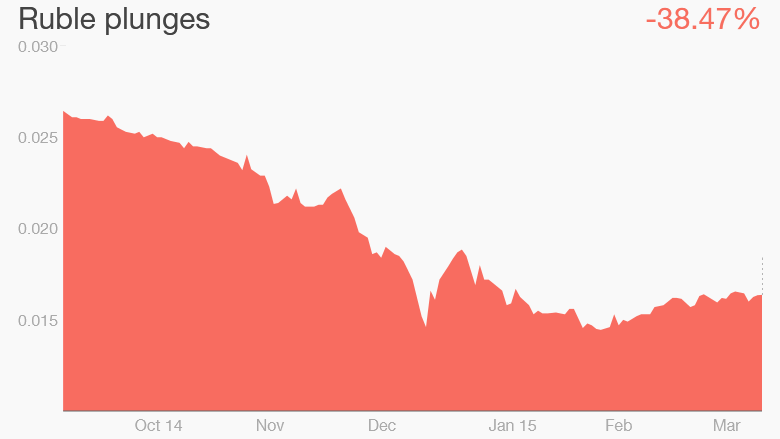

Low oil prices and Western sanctions have crushed the economy. The ruble plunged 40% against the dollar in just six months -- sparking a backlash against the central bank. Some even accused it of sabotage.

The Bank of Russia is caught in a bind. Inflation is soaring -- it hit 16.7% in February, with food prices jumping by 23% compared to last year. Cutting rates could push prices even higher, but leaving them at elevated levels may mean an even deeper and longer recession.

Industrial activity and consumer demand is slowing, according to the World Bank.

Related: How billions of rubles secretly flow to the U.K.

The past few months have been a roller coaster ride for the bank. In December, it shocked markets by jacking up interest rates to 17% from 11.5% at a stroke, in an attempt to defend the ruble.

It then delivered another surprise in January, cutting rates back to 15%.

The bank's radical strategy seemed initially to work. The ruble has stabilized since the beginning of the year, giving the central bank some room for the rate cut.

The currency firmed slightly Friday to trade at 61 to the dollar.

But the central bank's warning of a deeper recession to come means Russia's crisis is far from over.