Extremely cheap oil is back, and it may get even cheaper.

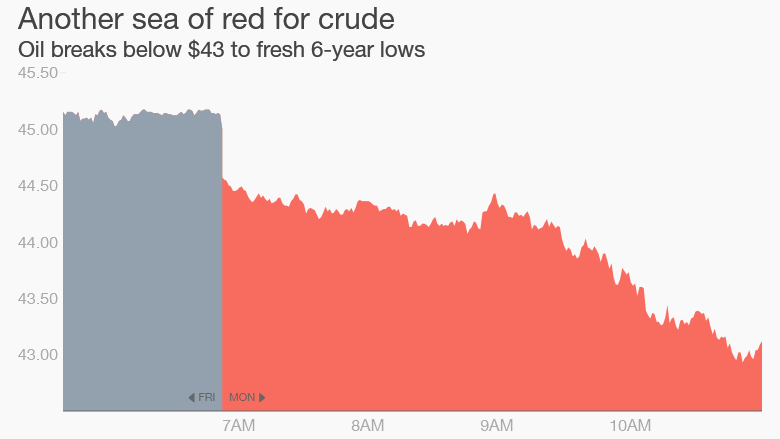

Crude plunged 4% to as low as $42.85 a barrel on Monday. That's the lowest price since March 2009 and marks the fifth consecutive day of losses.

This should bring smiles to the faces of the millions of American drivers who have watched gasoline prices creep higher in recent weeks.

A month ago, people were talking about an "oil comeback." Now that looks like just a mirage. More and more analysts predict prices of $40 or lower, at least in the near term.

"I think the market almost has to have a $30-handle on it before it gets this out of its system," said Tom Kloza, chief oil analyst at the Oil Price Information Service.

That could cause gas prices to take another tumble, Kloza says, bringing the average U.S. price back to around $2 a gallon. It's currently at $2.42.

Related: The 'smart money' is investing in oil now

What's fueling the latest plunge? The world still has too much oil. The supply glut that sparked the dramatic crash in crude from $100 a barrel last summer to under $50 in January remains. Oil settled at $43.88 on Monday.

The key now is to see a pullback in production, but so far no one wants to budge. OPEC hasn't scaled back production, and power player Saudi Arabia continues to say it has no intention to do so.

In the U.S., shale companies also continue to pump more and more oil. While there are signs that the number of oil drilling rigs has fallen significantly in recent weeks, there's a lag before that drop in rigs really translates into less production.

"Shale production is not getting dented," says Kloza.

Related: Tomorrow's oil price? Guesses range from $20 to $200

Strong dollar, weak oil: At the same time, the U.S. dollar continues to skyrocket at an even faster pace than anyone expected. One dollar is now nearly worth one euro, and Goldman Sachs thinks the euro could plunge to just 80 cents by the end of 2017.

A stronger greenback is bad for oil prices because the black stuff trades in dollars. So when the dollar strengthens, it makes oil more expensive for foreign buyers whose own currencies are weaker.

One factor that could spark another round of selling is a nuclear deal with Iran that lifts sanctions on the country. Allowing Iranian oil to flood the market would only exacerbate the ongoing supply glut.

Related: The dollar is crushing other currencies

Key numbers to watch: While the oil slide has been going on for months, there are key thresholds that act as trigger points for the market. Crude's collapse below $43.50 a barrel on Monday represents one of those points.

Barclays said that breach makes the bank more negative on oil and signals a further move below $40. In other words, the selling is probably not done.

"It will overreact to the downside. There are an awful lot of smart people who think this market is on a rendezvous course with the December 2008 low of $32.40," says Kloza.

That level represents a modern day low, although it occurred under extremely different circumstances. Back then oil was slammed by lack of demand as the world's largest economy was trying to rescue itself from a major financial crisis. Today oil is falling because there is too much supply.

These prices probably won't last, experts say. Oil is unlikely to average a low figure like today's $43 for all of this year or next. But it's part of the recovery process.

"It's a little bit like a professional athlete tearing his meniscus. There is a lot of rehab needed," says Kloza.