The good news for BlackBerry? The smartphone company reported a surprise profit in its most recent quarter on Friday. The bad news? It continues to lose customers hand over fist.

BlackBerry's sales plunged 32% to $660 million for the three months that ended in February. That was well below Wall Street's estimates of $786 million and is the lowest level of sales for the company since the middle of 2006.

The company did report a profit of $28 million, or 5 cents a share. Analysts were expecting it to lose money. Profits have been rare in the past few years.

BlackBerry also reported that it its cash balance grew by more than $600 million from a year ago. It now has $3.27 billion in cash, which the company said matches the most it has ever had.

That is great news for BlackBerry since it wasn't that long ago that investors were worried the company was burning through cash too quickly.

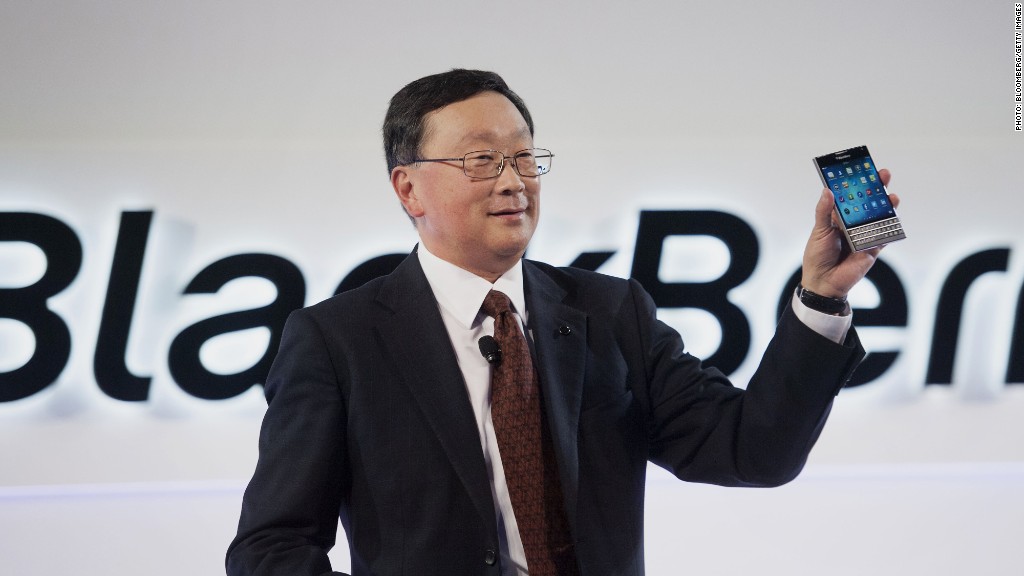

"I am very pleased to announce that our financial house is in order," said CEO John Chen during a conference call with investors. "Our financial viability is no longer in question."

Shares of BlackBerry (BBRY) closed nearly 2% higher.

But it was a choppy day for the stock as bulls and bears did battle. Shares were up as much as 5% at one point.

What matters more for BlackBerry's future? The fact that it is profitable again or that sales remain in freefall?

Related: Chen was one of CNNMoney's Best CEOs of 2014

The stock is down 14% so far this year but enjoyed a more than 40% pop in 2014 as Chen implemented a turnaround strategy since he took over in late 2013.

Wall Street approves of Chen's plans to emphasize its core business customers and focus more on software and services.

Along those lines, BlackBerry also announced licensing deals with two Hong Kong mobile companies Friday morning: the Hong Kong subsidiary of China Mobile (CHL) and 3 Hong Kong, which is owned by Hutchison Telecom (HTHKY).

BlackBerry's software revenues grew 20% from a year ago. But they only make up about 10% of the company's overall revenue.

So there are still questions about whether or not it's too late to return the company to its former glory.

BlackBerry's market share has been in a steady decline for years as both average consumers and corporate professionals have flocked to Apple's (AAPL) iPhone and devices that run on Google's (GOOGL) Android operating system. BlackBerry now trails Microsoft's (MSFT) Windows Phones as well.

Related: BlackBerry unveils new 'Classic' phone for CrackBerry addicts

The company is continuing to make new phones, such as the square Passport and the Classic, which features the signature QWERTY keyboard that many CrackBerry devotees still favor over touchscreen smartphones.

It doesn't appear that BlackBerry will ever get out of the hardware game completely. But as long as that business continues to decline, there could be more rumors about BlackBerry needing to find a merger partner.

Earlier this year, speculation about a Samsung (SSNLF) takeover of BlackBerry resurfaced. But both companies denied that there are any talks going on.