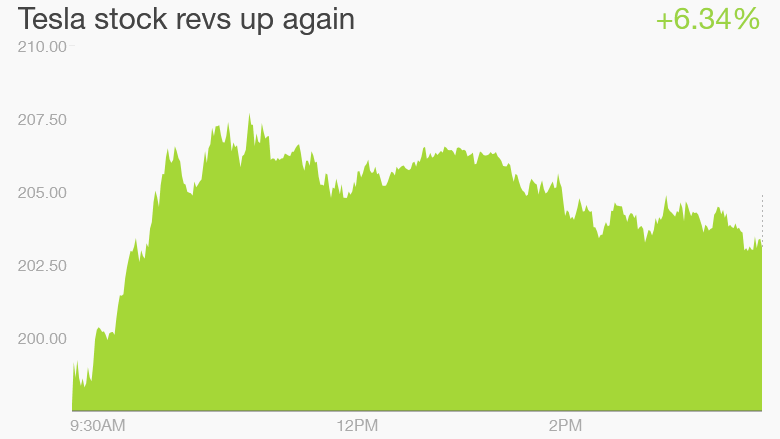

It's been a bumpy year for Tesla Motors shares, but they powered back on Monday.

Tesla (TSLA) has seen its high-priced stock fall this year after CEO Elon Musk said in January that sales in China have been weak. But Friday's strong sales figures sent shares up 6.3% in Monday trading, wiping out about half of this year's sell-off in a single day.

The company said last week it sold 10,300 of the Model S, which starts at around $70,000, in the first three months of the year, up 55% from the same period of last year. That was about 500 cars more than expected.

The worries about China had caused some people to think Tesla would miss sales targets, said Rod Lache, auto analyst for Deutsche Bank.

"It's good to see the company exceed targets," Lache said. "But in the long run this should not be why anybody is buying the stock at this point. You should be buying because you believe the company will be a much larger business in the future."

Related: Tesla to unveil new product line

The roll out in China, the world's largest market for car sales, has not been smooth. Last month, it announced it was cutting 30% of its staff, or 180 jobs, in China, due to the early problems there. Musk said in January that Chinese buyers had "a misconception that charging was difficult." Tesla started deliveries of cars in China in 2014.

Tesla's quarterly sales announcement did not give a geographic breakdown on sales. Independent car sales tracker Autodata estimates the electric car maker has sold 3,550 cars in the United States during this period, which is down 24% from a year ago.