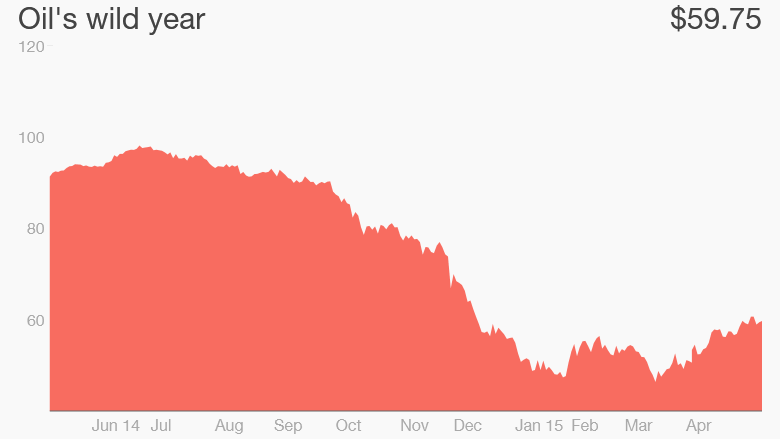

The past nine months have given most energy investors pause to consider whether the oil and gas industry is the best place to park their money right now.

While the last month has seen an appreciable rise in regular stalwarts like ExxonMobil (XOM), Chevron (CVX) and BP (BP), as the price of crude has lifted to $60 a barrel, oil and gas stocks are still dangerous waters to navigate for the average investor. Short-term supply and demand dynamics for crude oil are tough to read.

As an alternative, energy investors could take a look at solar stocks.

Skeptics will remember the beating that solar companies took in 2012 when the Chinese flooded the market with cheap solar panels. Of course, the last few months have been no picnic for solar investors, either. As the price of oil has dropped, the competitive advantage of solar versus fossil fuels has also been negated somewhat, leading some observers to advise investors to short solar.

Related: The Greenest Oil Companies In The World

Looking at the sector as a whole, however, it appears that now might not be a bad time to get back into solar; two of the most popular solar ETFs are indicating an uptrend. While the Market Vectors Solar Energy ETF (KWT) is nowhere near the dizzying heights of its $211.50 a share peak in Feb 2011, the ETF is now trading at a respectable $86.10, near its 52-week high of $87.36. The fund is up nearly 30% year to date. The Guggenheim Solar ETF (TAN) has done a little better, gaining 38% since January 1.

The real money though, is likely going to be made in companies that outperform expectations. For those looking to place their bets on specific solar companies rather than an index fund, here are five to follow.

1. First Solar, Inc. First Solar (FSLR) develops, engineers, constructs and operates some of the world's largest grid-connected PV plants in the world. The Arizona-based company has over 10 gigawatts installed globally. First Solar is known for the efficiency of its solar modules, with the company's best production line now shipping solar modules with 16.3% efficiency.

First Solar is forming a yieldco with SunPower called 8point3 Energy Partners, which will hold long-term contracts separate from the parent companies. (A yieldco is a publicly-traded company formed to own operating assets that produce cash flow, which is then distributed as dividends). First Solar also recently announced a strategic alliance with Caterpillar to manufacture a package for microgrid applications featuring the Caterpillar brand.

Related: What Is Holding The Green Revolution Back?

2. SunPower Corp. SunPower (SPWR) is a U.S. solar panel maker that has high-efficiency panels featuring SunPower's Maxeon cell technology. Based in Silicon Valley, SunPower generates over 18 million mega-watt hours of solar energy. In April SunPower announced a partnership with Apple that will result in two solar power projects totalling 40 megawatts in China's Sichuan province. SunPower has beaten Wall Street consensus and management guidance over the past eight quarters, and analysts are expecting the firm to reach price targets of $35 to $36 per share.

3. SolarCity Corp. SolarCity (SCTY) is not a panel manufacturer, but rather, installs the panels made by companies like SunPower and First Solar, tying together financing and installation to bring solar power to residential and commercial buildings. SolarCity announced on May 2 it is offering to lease Tesla Motors' solar-powered home battery storage unit, Powerwall, beginning in October. Analysts at Deutsche Bank AG said on May 1 that the battery announcement by Tesla is among catalysts that could drive the stock higher. The analysts placed a buy recommendation and set a price target of $90.

Related: Warren Buffett Betting Big On Wind Energy In Nebraska

4. SunEdison Inc. Based in California, SunEdison (SUNE) develops and operates hundreds of solar plants, representing a global PV capacity of 135.8MW. The company specifically provides opportunities for Ontario firms to leverage rooftop space and vacant land for installation of solar systems, through purchase or lease. SunEdison recently reported the interconnection of two new solar plants in Ontario, the 17.9MW DC Bruining plant, and the 17.8MW Solar Spirit. SunEdison is up 48% year to date after a big bounce last week.

5. SunTech Power Holdings Co., Ltd. Chinese company SunTech Power (STPFQ) supplies PV panels in the multicrystalline and monocrystalline categories. SunTech has over 8GW installed PV power in over 80 countries, the company states. Investors hoping to take advantage of the growth of solar in China should consider SunTech as an investment vehicle.

In 2013 China announced a plan to more than quadruple its solar capacity to 35GW this year, including 17.8GW in 2015. Year to date, SunTech's stock (which is traded over-the-counter) is up a whopping 200%, with most of the appreciation happening in the last three months. As an over-the-counter stock, the risk is obviously higher than the previous four picks which trade on the NASDAQ and the NYSE.

Andrew Topf is a journalist for Oilprice.com. He is not invested in any of the above-mentioned securities.