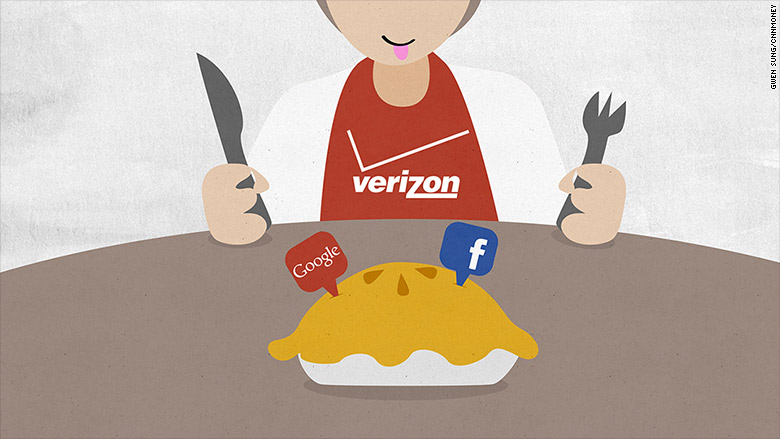

Watch out Google and Facebook! Verizon wants a chunk of those billions of dollars in advertising sales you rake in every year.

Verizon's (VZ) deal to purchase AOL (AOL) is a clear sign that the telecom giant thinks more content, especially video, will help it generate big bucks from digital ads.

Sure, many people hear the letters AOL and still think of what the company was like in the 1990s:

CD-ROMS getting sent to your house every other day. The walled garden experience. That cheesy romantic comedy with Tom Hanks and Meg Ryan that might as well have been an ad for AOL Instant Messenger. It was even called "You've Got Mail" for crying out loud.

Related: Verizon buys AOL for $4.4 billion

But AOL has made a big push into video and advertising technology since it was spun off from CNN parent company Time Warner (TWX) in 2009 after that 2001 merger proved to be a failure.

AOL acquired startup video ad network Adap.tv for $405 million in 2013. It has several original video programs as well, including "Park Bench with Steve Buscemi," "Making a Scene with James Franco" and "The Future Starts Here" with Webby awards founder Tiffany Shlain.

Verizon recognizes that it can make even more money from its wireless network by boosting its own slate of content to its more than 100 million subscribers.

According to estimates from research firm eMarketer, global mobile ad sales are expected to be $68.7 billion this year. Google (GOOGL) and Facebook (FB) are getting the biggest piece of the pie, but there is still room for the likes of AOL, Yahoo (YHOO), Twitter (TWTR) and others.

"It's all about advertising technology for Verizon. A lot of people -- whether it's cable or Web companies -- want a way to tap into the TV and video advertising market that is shifting to digital," said Eric Jackson, managing director with Ironfire Capital, a hedge fund focused on the tech sector.

"This deal is about responding to how well Google and Facebook have already started to adjust for this shift," added Jackson, whose firm has no investments in Verizon or AOL.

Related: OMG! 2.1 million people still use AOL dial-up

Verizon has already announced plans to roll out a so-called "over the top" or OTT video product later this year. Verizon acquired the OnCue digital video assets of Intel (INTC) last year to help its stand-alone video push.

Verizon CEO Lowell McAdam said at an investing conference in January that the package will probably feature 20 to 30 channels.

OTT services are all the rage right now. It's a response by media and cable/satellite companies to the growing threat of cord-cutting and rise of digital video competitors like Netflix (NFLX) and Amazon (AMZN).

Satellite TV firm Dish (DISH) recently announced an OTT service called Sling TV. It costs $20 a month and you don't need to be a Dish satellite subscriber to get the service.

Time Warner is now offering an HBO package to people without cable. And the WWE (WWE), of all companies, was a big pioneer in OTT. It set up a streaming channel to air all its live events last year.

So it's not a huge surprise that Verizon wants to go this route as well.

Related: Youths spend one full day a week online

The company made it painfully clear in its announcement Tuesday about the AOL deal that it is likely to target younger consumers on their beloved smartphones.

Verizon said the merger creates a "mobile-first" ad platform and touted AOL's video series as "millennial-focused." Buzzwords aside, Verizon knows that it must remain relevant with younger customers and adapt to what they want.

Will the strategy work? That remains to be seen. But Verizon is paying only $4.4 billion for AOL. That's a relatively small sum for a company of Verizon's size.

Verizon is making a more cautious bet on video than its biggest rival. AT&T (T) has agreed to pay $47 billion to purchase satellite TV giant DirecTV (DTV).

So if AOL is a flop, it's not a deal that will doom Verizon. And if it succeeds, Verizon could wind up with a lucrative new revenue stream.

"Verizon is still, first and foremost, a wireless phone company. Still, AOL is a tantalizing first step towards creating a mobile advertising platform that is truly unique," wrote the analysts at media research firm MoffettNathanson.