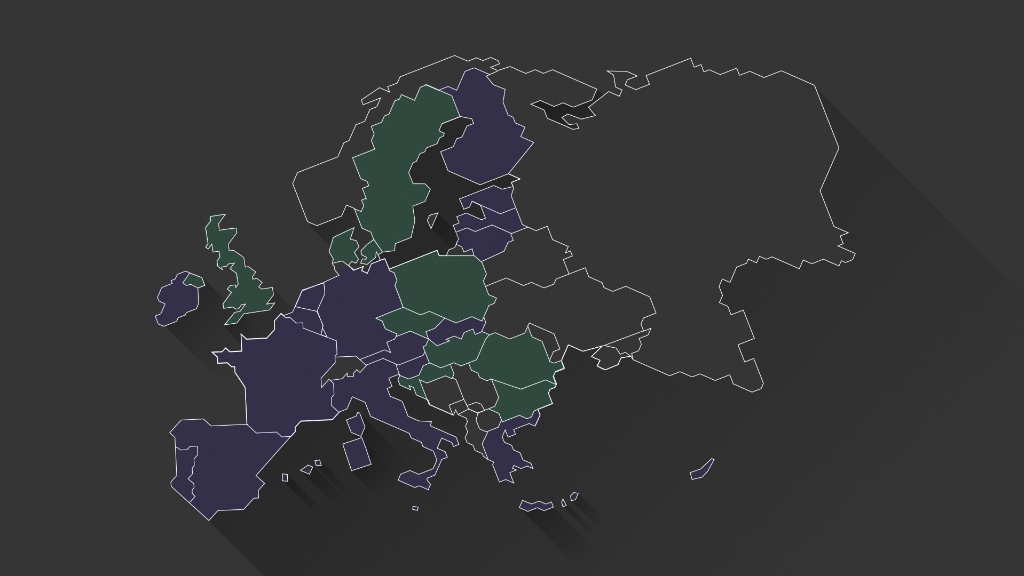

Europe's recovery is picking up pace.

Consumers are spending again because they have more money in their pockets thanks to cheaper oil. Investment is on the rise in some countries too, as massive money printing by the European Central Bank drives down the cost of borrowing.

The eurozone economy grew by 0.4% in the first quarter, compared with the final quarter of 2014. The annual rate of growth picked up to 1%.

Here are 5 things to know about Wednesday's GDP numbers:

1. Stronger than U.S and U.K.

The quarterly growth rate across the 19 countries of the eurozone was stronger than either the U.S. or U.K. managed in the first three months of the year. But the region also outpaced the U.S. this time last year, before falling behind again.

Official European forecasts suggest a similar pattern in 2015: The eurozone is expected to expand by 1.5% this year, just half the growth predicted for the U.S.

Some of the tailwinds are already fading: Oil prices have risen again, and government bond yields and the euro have rebounded from the shock of the ECB's big bazooka.

Related: Europe's deflation worries ease. For now

2. France outpaces Germany

Reversing a recent trend, France reported quarterly growth of 0.6% -- compared with Germany's 0.3%. Economists say the French number looks better than it is, because last year's number was revised down.

They also point to evidence that stockpiling by French companies may have given a one-off boost to the economy that could quickly fade. More robust domestic demand, exports and investment are likely to see Germany overtake France later in the year.

3. Italy is growing again

After years of recession and stagnation, the eurozone's third biggest economy is growing again. Spending on cars appears to have helped. Consumer and business confidence is recovering, and 2015 should see the country deliver its first annual growth since 2011.

4. Spain is on a roll

Spain was the star of the eurozone's major economies, recording its best quarter since 2007 and its strongest rate of annual growth in six years.

It's being helped by the same factors boosting the rest of the region, but also by reforms enacted in the wake of its banking crisis and bailout in 2012.

5. Greece is back in recession

Greece saw its economy shrink for a second consecutive quarter, as wrangling with creditors over its international bailout weighed on business and consumer sentiment. The country is fast running out of cash and needs a deal with Europe in a matter of weeks. Even then, things could get worse before they get better.

"The political uncertainty could have an impact on tourist sentiment towards Greece, potentially taking a toll on the tourism sector over the summer," noted Gizem Kara, senior European economist at BNP Paribas.