One company uses moss to clean water, while another purifies it by passing it through stone. A third promises a new technology that can cut the cost of turning sea water into drinking water by 70%.

All these firms are out of Minnesota, where talent from a longstanding group of industries is combining with growing demand for water from places like California to create a thriving scene for water tech startups.

Here's how these new technologies work:

Moss

On a return flight from Europe several years back, David Knighton, a retired Minneapolis-area surgeon, was reading an article on how injured WWI soldiers who had their wounds staunched with sphagnum moss had a higher survival rate than those that used cotton.

Being a doctor, he figured the moss must have had anti-bacterial property. Research in old medical journals confirmed his theory.

Knighton is now CEO of Creative Water Solutions, which uses a variety of the moss to purify water. In residential swimming pools and spas, the moss is packaged into a sleeve near the filter. Its cleaning properties reduce the need for chemicals, take the chlorine smell out of the water and extend the life of filtration equipment.

In larger industrial applications, crates of the moss are lowered into the water, where properties from the moss diffuse into the pool. Cleaner water means industries can reuse it several times before having to dump it, reducing water usage by 40%.

Sales at the company are growing 30%-40% per year, said Knighton, and the technology is now employed in hundreds of industrial facilities and thousands of residential pools around the country.

"As with any disruptive technology, sales take a while because people just don't believe you," he said.

Chemicals

It may seem counter-intuitive to clean water with chemicals.

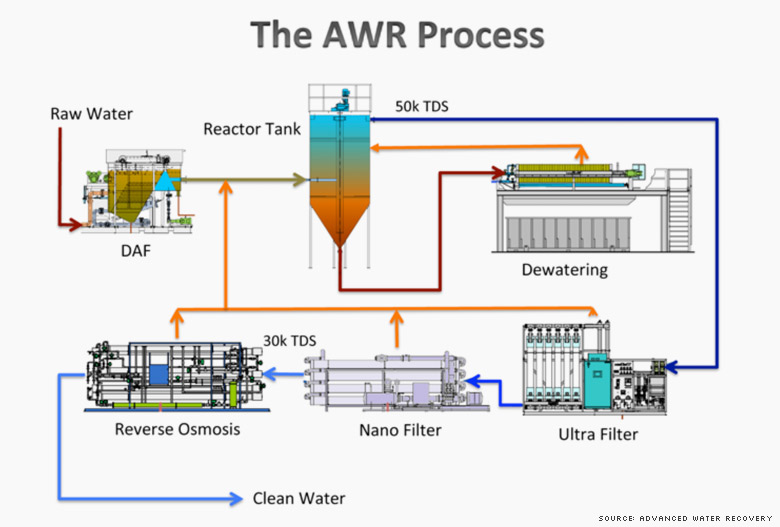

But Advanced Water Recovery uses chemicals to turn salt water into drinking water, then uses a proprietary process to filter the chemicals back out.

The firm is currently building a demonstration plant in Pennsylvania -- where it aims to clean water used in the fracking process. But the real prize would be building plants that make drinking water out of seawater, said William Kohl, the company's head of business development.

Kohl said his firm can desalinate water for 70% less than current technologies. Cost is generally the biggest factor keeping more drought-prone regions from buildings these plants.

If all goes well in Pennsylvania, Kohl said the firm plans on moving into the drinking water space. Already, he said demand has been so great from California companies and municipalities that they "can't even respond."

Stone

It seems improbable, but water does pass through stone. And when it does, it's often cleaned of salt or other pollutants.

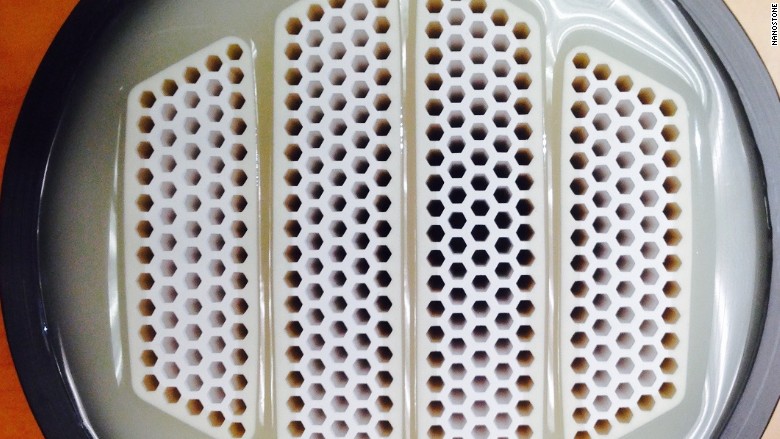

Nanostone, located outside Minneapolis, uses ceramics -- basically manufactured stone -- to purify water. The ceramics take the place of plastic membranes in traditional water purification technologies, but are much more durable. Here again, the idea is that if water is cleaned, it can be used over and over again in industrial processes.

Using ceramic is not new, but it's traditionally been four or five times more expensive than plastic. Nanostone uses a new honeycomb-like design and materials to make it durable like ceramic but cheap like plastic.

The company was originally based in Germany but relocated to the United States last year after it was acquired by a Chicago private equity firm. Proximity to talented employees was one reason why the Twin Cities region was chosen, said Steve Poirier, Nanostone's chief marketing officer.

Related: This wifi sprinkler can cut water use 30%

No one really knows how the Minneapolis-St. Paul area became a hotbed of water technology. Perhaps it's all the lakes and rivers to begin with, or the fact that the area's traditional industry -- agriculture -- uses a lot of water.

But there are hundreds of water-based businesses in the state, exporting over $700 million in water technology and employing nearly 16,000 people, according to the state department of economic development.

Former employees of the state's big, established water companies such as GE (GE), Dow (DOW) and 3M (MMM) are starting their own water firms. The university is focusing academic research around the subject and now runs hundreds of water-related programs.

The regional economic development authority has hired a consultant to explore making the sector an official "cluster," where water businesses would pay a fee and in return get support in things like regulatory guidance and marketing.

"It's starting to look more and more like the clusters in Boston or Silicon Valley, " said Snehal Desai, global business director for Dow's water division.

Creative Water Solutions' Knighton has his own theory as to why there are so many water startups in the area.

"The long winters make you think about things," he said.