Let's cut to the chase on Greece.

Wall Street is betting that there's about a 75% chance that Greece defaults on its debt.

Athens is running out of time to cobble together enough bailout funds to avoid a possible default. The Greek government has just days to reach a deal before risking an exit from the eurozone that would likely be disastrous to its economy.

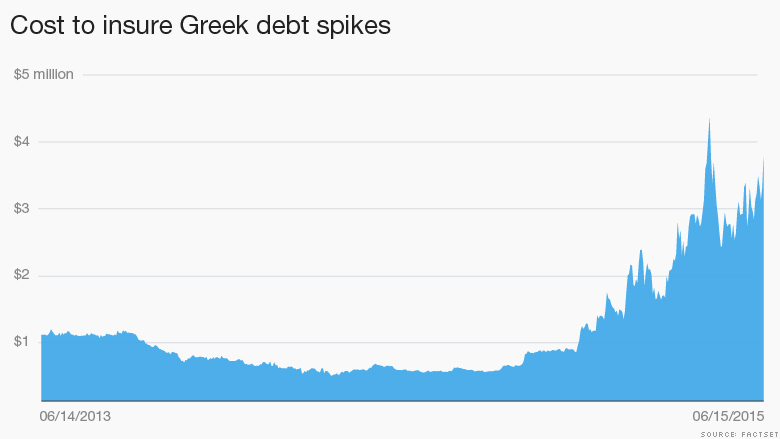

Given these dramatic stakes, the risk of a Greek default has gone way up. One way to measure that risk is by looking at the skyrocketing price of insurance policies that would pay out if Greek bonds go bust. The cost to insure Greek debt for one year against the risk of default has skyrocketed 456% since the start of the 2015, according to FactSet data.

These insurance-like contracts, known as credit default swaps, imply there is a 75% to 80% probability of Greece defaulting on its debt, according to Jigar Patel, a credit strategist at Barclays.

The probability of a Greek default soars to a whopping 95% for five-year CDS, Patel said.

"Default is looking more and more likely," Peter Boockvar, chief market analyst at The Lindsey Group, wrote in a note to clients on Tuesday.

Related: Greece has just days to get real

The chance that Greece secures a last-minute deal with its creditors is "looking slimmer now" and may be less than 50/50, said Jan Randolph, director of sovereign risk at IHS Global Insights.

Greek creditors are "looking for a regime change in Athens with a government they can actually do business with," Randolph said, adding they've "given up on" Greek Prime Minister Alexis Tsipras.

Related: Will indebted Greece turn to sanctioned Russia?

Way, way riskier than Russia: The CDS market is clearly flashing warning signs about Greece.

It now costs a whopping $3.6 million a year to insure $10 million of Greek bonds against the risk of default, according to FactSet. While that's down from the peak of the European debt crisis back in 2011, it's up nearly eight-fold from a year ago.

To put that into context, it's currently 10 times more expensive to insure Greek debt against default than Russian debt. That means the markets believe Greece is way riskier. It costs $355,000 to insure $10 million of Russian bonds against default, according to FactSet. That's down 25% so far this year thanks to Russia's stabilizing economy and the fact oil prices have stopped plunging.

Of course, the CDS market is just one measure of risk. It's also highly dependent on assumptions, especially about how much of their investment a creditor would recover if the country does default.

Related: The 3 sticking points holding back a Greek deal

Greek stocks, bonds plunge: Yet other, more liquid markets are also flashing warning signs about Greece.

The Greek stock market has plummeted 13% over the past three trading days, including a 3% drop on Tuesday alone.

In the bond market, the yield on Greek two-year debt has skyrocketed to 30.2%. A month ago, the yield was only 20%. Yields rise as bond prices fall.

A Grexit is still a longshot: Even if Greece ultimately defaults, it doesn't necessarily mean it will exit the eurozone.

"We have another two or three episodes until we get to a Grexit -- and that's unlikely," Randolph said.

He pointed to recent polls indicating many people in Greece don't want to ditch the euro, a transition that would be extremely painful financially. A new currency would be valued significantly below the euro, crushing the value of assets Greek people own.

"It is political suicide to try to introduce a new currency. No one wants to volunteer for a 60% pay cut or a 60% depreciation of their homes," said Randolph.