This has been one terrible, horrible, no good, very bad week for the Chinese stock market.

China's benchmark Shanghai Composite index is now in correction territory after falling 13% over the past five trading sessions, as investors grow increasingly wary of what many analysts describe as a bubble.

The pain was most acute on Friday, when the Shanghai Composite shed more than 6%, with losses accelerating in afternoon trading. The Shenzhen Composite, which is heavy on tech stocks, dropped by the roughly the same amount.

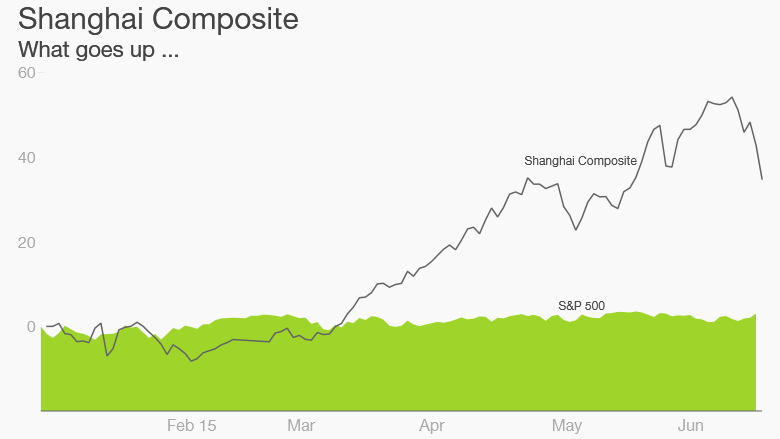

For investors, the pullback is a major reality check. The Shanghai stock market has more than doubled over the past year. The smaller Shenzhen market has grown by 160% over the same time period.

Some observers have been using the "bubble" word for months. Still, the Shanghai Composite has powered on, gaining nearly 40% since Jan. 1. By comparison, the S&P 500 has gained only 2% over the same time period.

Experts remain puzzled by the stock boom. China's economy is going through a cooling off period, with growth now at its weakest pace since 2009. Corporate profits are actually lower than a year ago.

In other words, exuberance for Chinese stocks isn't being backed up by fundamentals. Instead, it appears the market is being carried higher by various forms of government stimulus and investor frenzy.

In recent years, people in China -- who tend to save significantly more than their Western counterparts -- sunk their excess savings into the real estate market. Now that the housing market is deflating, investors are turning to the stock market.

China stocks are still not ready for primetime

Of particular concern is an explosion in margin buying -- the practice of buying stocks with borrowed money.

According to Oxford Economics, 86% more margin accounts were opened in 2014 compared to the previous year. In December alone, 700,000 new accounts were created. The vast majority were opened by unsophisticated retail investors.

Cracks in the market began to show last week, when investors abruptly pulled out nearly $7 billion from Chinese funds and ETFs, according to financial data firm EPFR.

The withdrawal comes after index provider MSCI surprised investors by announcing that it wouldn't include shares traded in Shanghai and Shenzhen in its widely-tracked global benchmarks due to concerns over China's market restrictions.