"Buy what you know" is one of the oldest stock tips of all time. But it might be more accurate to say "buy what's in your backyard."

Where you live tends to influence what types of stocks you buy, according to data from Openfolio, a platform that allows users to compare their stock portfolios and performance.

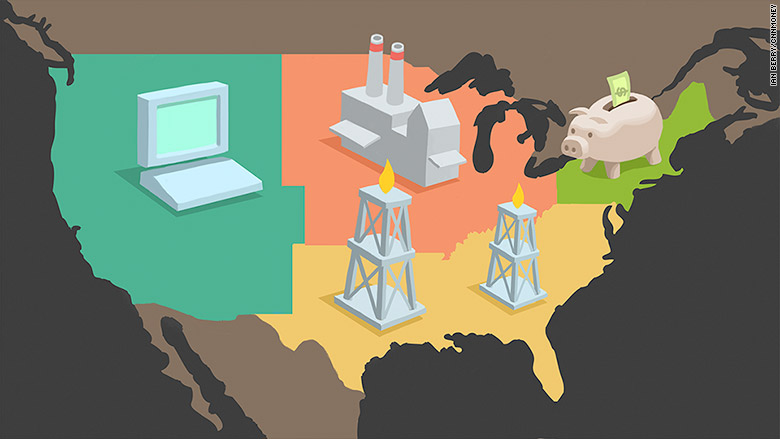

Call it the home field advantage. Investors love to buy companies in sectors that dominate their part of America.

Southerners buy energy stocks more often than people living in other regions of America. The Northeast crowd goes for financial stocks the most, West Coasters opt for tech stocks, and the Midwestern locals invest in industrial stocks.

"It's not only buy what you know, but what you know is influenced by the people you know," says Hart Lambur, co-founder of Openfolio.

Related: I bought my first stock: Starbucks. Here's why.

Even if someone on the West Coast doesn't work in tech, there's a better chance they know a friend, peer or relative in tech than someone in another part of the country. That proximity matters with investing, says Lambur. They feel more comfortable and knowledgeable about those companies.

It may not sound surprising that West Coast folks buy tech stocks more than anyone else. But all four regions of the country -- North, South, East and West -- are aligned to the industries concentrated there.

People living in the South are far more likely to purchase a stock like Exxon (XOM). New Englanders buy financial stocks like Bank of America (BAC) more often. The crowds in the West are big on Apple (AAPL), and there are lots of fans of companies like GE (GE) in the Midwest.

Of course, there are plenty of people who buy stocks from lots of different industries, but the regional trends are pronounced.

The one big exception is health care stocks. They're widely bought across the country with no clear geographic favorite.