Puerto Rico's economy is heading into a "death spiral" right now.

That's how the commonwealth's governor, Alejandro García Padilla, summed up the situation in an interview with the New York Times. Puerto Rico owes about $73 billion in debt, which Padilla says the government can't pay.

This could be a very bad week for Puerto Rico. On July 1, Puerto Rico's government-run energy subsidiary, PREPA, must make a large debt payment, and it's unlikely to be able to pay.

A PREPA default on Wednesday would set the stage for the Puerto Rican government to default on more of its debt later this year.

Here's what you need to know about how it got this dire:

Related: Puerto Rico's terrible economy is pushing people out

1. Why is the Puerto Rican economy so bad? Puerto Rico has a small population that is similar to Connecticut, but it has about the same debt load of New York State, a huge state economy. It's been in a recession for years now with no end in sight. The commonwealth's problems stem from massive government overspending, a big dependence on debt and a costly, inefficient energy system.

The government's inability to invest in and grow the economy for years means that unemployment is going up, businesses are shuttering, and the island's population is shrinking as Puerto Ricans move to the mainland U.S. for jobs.

Related: Puerto Rico near 'death spiral'

2. What will happen if Puerto Rico defaults? A Puerto Rican default would be the largest in the history of U.S .municipal bonds, which cities and states use to pay for basic services like repairs to roads.

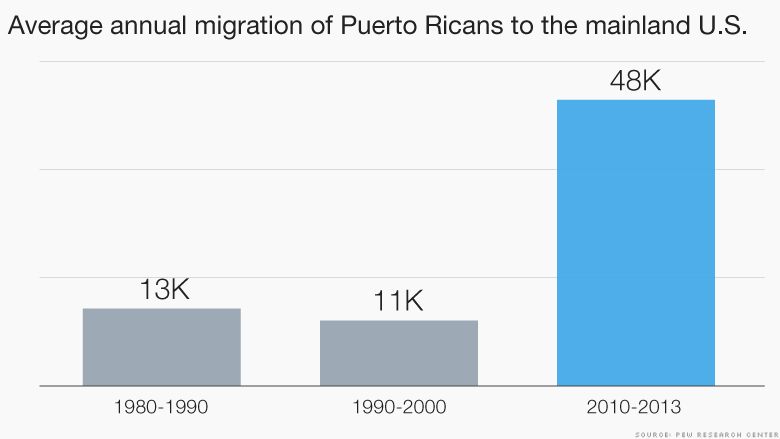

A default could accelerate an alarming trend: an exodus of Puerto Ricans leaving the island. Since 2010, the number of Puerto Ricans coming to the United States per year is four times higher than it was between 1980 to 2000, according to the Pew Research Center.

It's a painful cycle. The economy gets worse, Puerto Ricans leave and then the government has less tax money to pay its debts. So the government takes out more debt to pay for other debt, and the domino effect repeats. The island's legislature has refused to hike taxes higher than they already are to compensate for the population loss.

Unlike cities such as Detroit, Puerto Rico can't declare Chapter 9 bankruptcy because of its special status as a commonwealth. Chapter 9 is only available to cities. This puts the island into further economic uncertainty. A default would likely lead to a debt settlement process between the government and its creditors that could take years to unravel.

Related: Greece could be the biggest national default in history

3. Will the U.S. federal government bail out Puerto Rico? Right now: No. The Obama administration has been clear that it has no plans to bail out Puerto Rico. Because of its commonwealth status, it's unclear if the International Monetary Fund or World Bank might intervene. At the moment, there's no life jacket for Puerto Rico's economy.

4. What's next for Puerto Rico? At the center of Puerto Rico's debt problems is PREPA, the island's energy subsidiary.

Puerto Rico has long been criticized for an inefficient energy policy. The island imports crude oil to provide electricity to its residents, which is very costly. Other Caribbean islands use a mix of solar and wind power, along with natural gas and oil, to keep the lights on and be cost effective.

PREPA must make a $400 million debt payment on Wednesday. Moody's has rated PREPA's bonds in the lowest possible category, well below investment grade. PREPA will almost certainly default on its debt. It owes about $9 billion in total. By comparison, when Detroit went into bankruptcy, it carried a debt load of close to $20 billion. In the final bankruptcy deal, Detroit "only" shed $7 billion of its debts.

Monday could offer a bad harbinger for Puerto Rico and PREPA: after Padilla's comments, Puerto Rican bonds hit record lows.