Fill in the blank: In recent weeks, China's stock markets have __________________.

- A) Wiped out as much as $2 trillion of investors' wealth.

- B) Swung by as much as 10% in a matter of hours.

- C) Scared the living daylights out of millions of shareholders.

- D) All of the above.

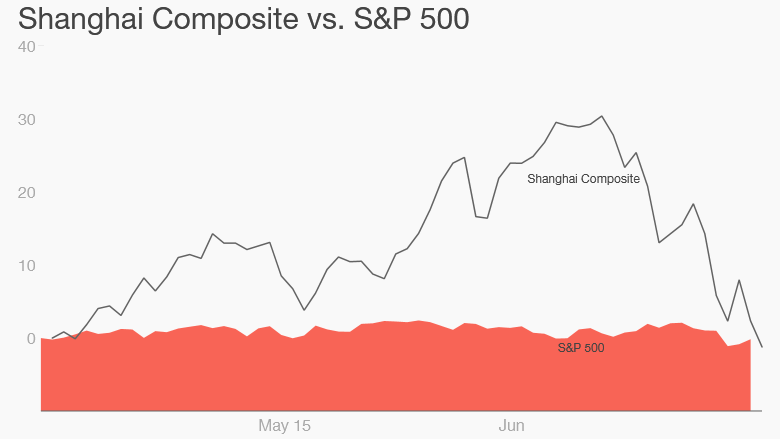

Yes, correct! The answer is "all of the above." China's stocks markets have been swinging wildly since the middle of last month. One minute shares are up 6%, the next they're down 5% and plunging into a bear market. The main Shanghai market lurched lower again Friday, losing 5.8% over an extremely volatile trading session.

Here's what you need to know:

1) First, relax -- at least for now. Unless you're reading this from China, you probably don't have much invested in these markets. Foreigners own just 1.5% of Chinese shares, according to Capital Economics. That number is growing, but only very gradually.

2) For Chinese investors, however, it's been a very wild ride. The Shanghai Composite -- the world's third largest stock exchange if you add up the value of its companies -- has lost 24% since June 12. The bears are growling even louder on the smaller Shenzhen Composite, down roughly 30% in the same period.

3) Right, but those markets are still up for the year? Yes, that's true. The sharp losses follow a long bull run. The Shanghai Composite is still up 20% since Jan 1.

4) Still, there's a lot of pain out there, especially among retail investors. Just 10% to 12% of Chinese households own shares, but a wave of newbie investors have flooded into the market this year. Brokers opened four million new accounts in a single week in April, according to BlackRock.

5) Analysts have come up with a bunch of theories to explain why the bubble burst. Here's the most compelling: Shares prices had got way ahead of economic growth -- now at its weakest since 2009 -- and company profits, which are actually lower than a year ago.

6) Particularly troubling is an explosion in margin trading. That's when investors buy stocks with borrowed money. When margin bets go sour, investors are forced to quickly pay back huge amounts of cash.

7) Things could get much worse. According to Oxford Economics, shares may have to fall another 35% or so to bring them into line with long-term averages.

8) Trouble in the stock market has the potential to ripple through the Chinese economy, the second biggest on the planet with trade ties to nearly every country. Another 30% fall would erase roughly $1 trillion in wealth. That could have a big impact far beyond China.

9) Beijing is worried and is trying to prevent panic. The central bank has already cut interest rates to a record low. Market regulators have tried to reassure investors by blaming "irresponsible internet hearsay" and critical commentaries for "disturbing market order."

10) Regulators have also launched an investigation into possible market manipulation. Criminal cases will be referred to security authorities, they said.

11) But official moves could simply pump more air into the bubble, risking an even bigger crash. Regulators further relaxed rules on margin trading Thursday.

--Sophia Yan contributed to this report