There are many hoops that Greece has to pass through before it can actually get its bailout.

While European leaders agreed to the latest $96 billion bailout package for Greece, they are waiting for the country's government to push several reforms through the parliament. Last week, it passed the first few, and has two more to approve by Wednesday.

As soon as these reforms go through, Greece can start talking with European leaders on the details of the bailout and a timeline for the cash to be released.

The clock is ticking -- Greece needs to secure the deal before August 20, when it needs to pay 3.2 billion euros ($3.5 billion) to the ECB, in order to stay in the eurozone.

Greece crisis: Complete coverage

On Wednesday, the Greek parliament will vote on two new laws. It has to adopt a rulebook for failing banks, and find a way to make its lengthy judicial procedures more efficient.

The reforms are part of the initial agreement signed by the leaders last week.

Greece had been rejecting reforms for months, hoping to get a better deal with Europe. After that strategy failed, and brought the country to the brink of collapse, the government conceded to the creditors and signed up to a program of tough economic reforms.

Athens also agreed to transfer up to 50 billion euros ($55 billion) worth of assets to an independent fund, reform its pension and VAT system, and implement more spending cuts.

The first vote last week sparked a rebellion inside the governing Syriza party, with several members of parliament, including the former finance minister Yanis Varoufakis, all voting against their own government. Anti-austerity protests erupted outside the parliament building.

Debt restructuring: What can Greece hope for?

The details of the new package aren't finalized yet, but one thing is certain: other European countries will be on the hook for most of the loans. That's because the bulk of the money -- around 50 billion euros ($55 billion) -- will come from the eurozone's emergency bailout fund.

Greece's debt has already reached 312 billion euros ($340 billion), according to the latest official data.

It has received 53 billion euros ($58 billion) through bilateral loans from individual eurozone countries, and 142 billion euros ($154 billion) from the bailout fund.

All eurozone countries chip into this pot of money, even those that have been badly hit by the economic crisis, such as Spain or Ireland, and those with lower GDP per head, like Latvia.

That's why the bailout package had to be approved by several national parliaments, and why many European leaders adopted a hard stance towards Greece. Their taxpayers are backing Greece's loans, because the bailout fund uses their money as collateral to raise cash on international markets. If Greece fails to repay the loans, they'd lose their money.

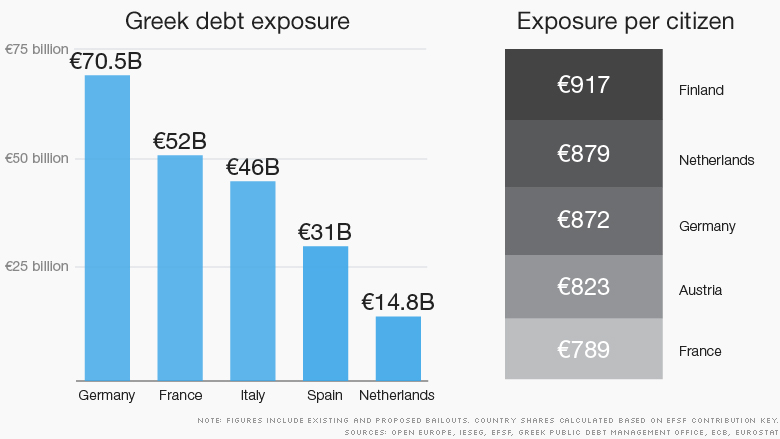

Related: Which countries are most exposed to Greece?

The contributions from each country are based on their population size and economic situation.

As the biggest country, Germany is the most exposed to Greek crisis. Its exposure so far amounts 56 billion euro ($61 billion) -- equivalent to roughly 700 euros ($760) per citizen. France follows with 42 billion euros ($46 billion), and Italy with 37 billion euros ($40 billion).