The double-whammy that slammed Russia last year is back: Oil prices are tumbling again and Western sanctions have just been extended.

That's wreaking more havoc on the economy, which is heavily dependent on oil and gas exports.

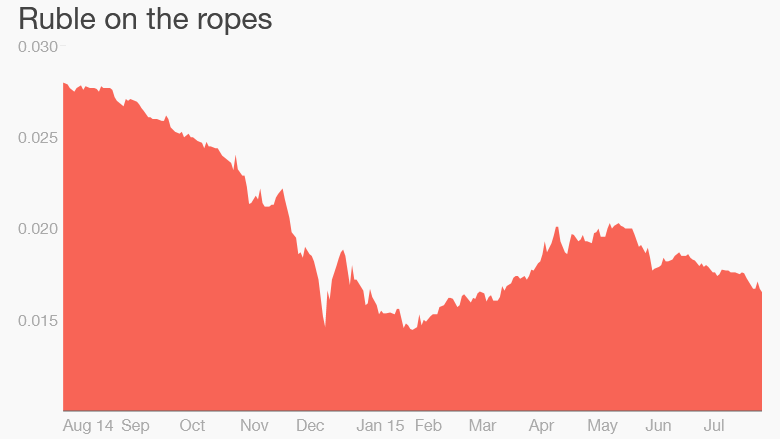

The ruble is on the skids -- plunging 12% against the U.S. dollar in a month -- and inflation is soaring. It hit 15.8% in July, according to central bank estimates.

Russians are already feeling the pain. The recession is deepening, unemployment is rising -- albeit it from a low base -- and millions more find themselves in poverty due to a sharp fall in wages.

Related: Vladimir Putin fired 110,000 officials

Against that background, the Bank of Russia decided Friday it had to cut interest rates, taking them down by 0.5% to 11%.

It figured it had to act to prevent an even worse economic slump, even though lower rates could put more pressure on the ruble and risk even higher inflation.

The central bank has been cutting rates since January, from a peak of 17% hit last December when the ruble was in free fall.

It said the recession in the first half of the year was worse than it expected, and warned it may have to revise its forecast for 2015. It has said previously that GDP could fall by about 3% this year.

"The economic situation in Russia will further depend on the dynamics of world energy prices and the economy's ability to adapt to external shocks," the Bank of Russia said. "At the same time, the scenario [of] oil prices remaining below $60 per barrel for a long time is more probable than it was in June."

Annual inflation should fall sharply in early 2016, before dropping to its target of 4% in 2017, the bank added.