Half of America has money invested in the stock market.

No wonder the past few days have been alarming for many. On Monday, the Dow fell 1,000 points in the morning -- its largest point swing ever.

But most Americans aren't day traders. They are in the stock market for the right reason -- because they want to grow their money over many years or decades.

The smartest move in the past few days was to not panic and dump stocks. Here are 5 simple charts to get some perspective on where investors are at after these wild swings.

Related: Turnaround Tuesday: Dow soars 400 points

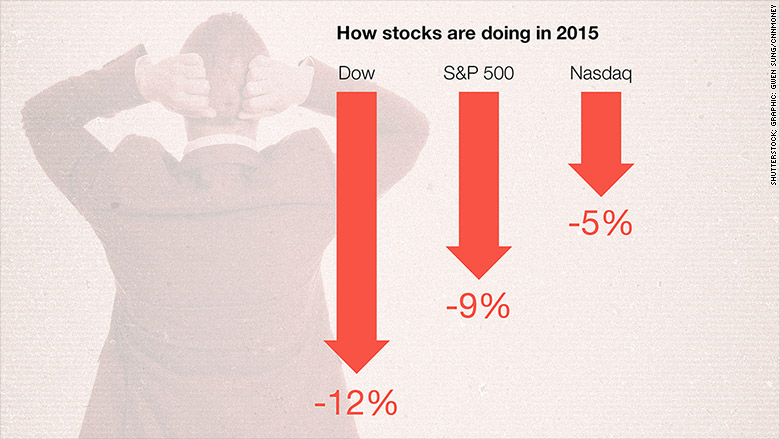

1. Your stocks are losing money in 2015

Forget the day-to-day moves. The first thing to check is how stocks are doing so far this year.

The news isn't great -- all three of the major U.S. stock market barometers -- the Dow, S&P 500 and Nasdaq -- are in the red. People are losing money.

For example, if you had $100,000 in the S&P 500 at the start of the year, you would have lost about $9,000 so far this year.

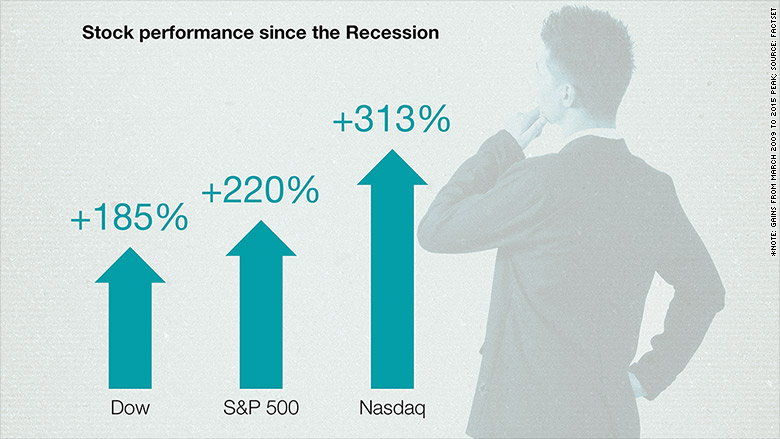

2. But you made a lot of money the past 6 years

But before you consider selling any stocks, remember that you have made a lot of money in the past six years. The S&P 500 has gone up a stellar 220% since March of 2009 when stocks bottomed out after the financial crisis.

To put that another way, your money tripled since March of 2009. While the recent "haircut" is frustrating, it's a mere trim. The S&P 500 is still up 180%, even after the recent losses.

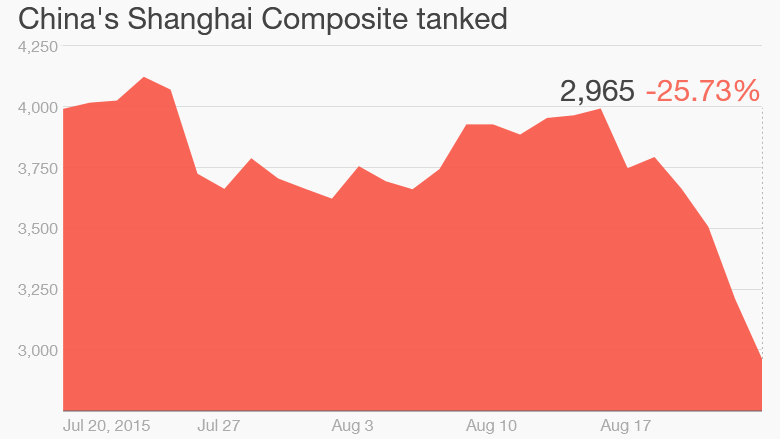

3. China is the heart of this problem

Investors aren't too worried about the U.S. They're concerned about China. The Chinese stock market -- commonly called the Shanghai Composite -- has fallen almost 40% since June.

It's a crash. There's a lot of uncertainty over just how much of an economic slowdown China is undergoing. But that doesn't mean it's going to drag the U.S. economy or stock market along with it.

The U.S. economy is in pretty good shape. It is expanding at about 2% a year and unemployment is back to the lows it was at before the Great Recession.

Related: China's economy is in trouble. How bad is it?

4. Oil is so cheap that some companies are hurting

Oil is the other factor driving this downturn. Drivers in the U.S. are loving cheap gas prices, but energy companies like Exxon Mobil (XOM) and Chevron (CVX) are not.

Profits are way down. Generally speaking, lower cost oil is a good thing for the America economy because it saves people and businesses money (that they can possibly spend on other things). But investors believe oil is too low now.

Crude oil fell below $40 a barrel on Friday for the first time since the Great Recession. There's a lot of uncertainty over how long oil prices will stay this low, and investors don't like uncertainty.

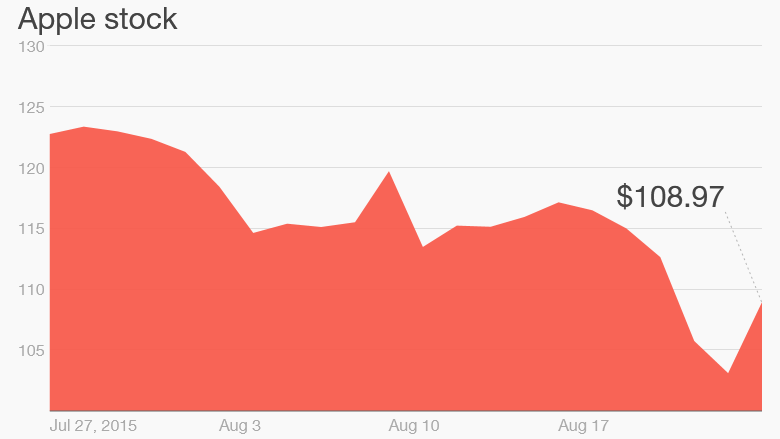

5. America's favorite stocks like Apple are down. Maybe too much?

Many of America's favorite stocks -- Apple (AAPL), Disney (DIS) and Starbucks (SBUX) -- have been hit hard by this selloff.

Apple is down over 20% from its record high price in April.

People have been arguing that stock prices were too high. That's why this latest stock market pullback is actually healthy. It's allowing everyone to pause and re-assess.

It's notable that on Tuesday, companies like Apple, Starbucks (SBUX) and Netflix (NFLX) actually managed to gain. Some investors think there's been too much selling.