If you hit the summer snooze button in August you missed a lot. Stock markets plunged, China got worse, Brazil went into recession and the Fed's rate hike drama only heated up.

But September could be an even bigger roller coaster month.

A plethora of potential game changing events could possibly alter your outlook for the year. It has to do with everything from oil prices and iPhones to China and even the Pope.

Here's the rundown:

1. Huge jobs report

It starts as soon as Friday, September 4, with the monthly jobs report -- one of the most important gauges of the economy. The August jobs report is already shaping up to be the most anticipated one of the year. If the U.S. added 200,000 jobs or more, it would show that the economy is in relatively strong footing.

A key number to look for will be wage growth -- the missing link in America's economic recovery. Wages have barely grown this year despite the dropping jobless rate. Usually low unemployment would translate into higher wages, but that hasn't happened.

The Fed wants to see 3.5% wage growth to reflect a healthy economy. But economists would be cheered to see average hourly earnings increases of even 2.4% today -- that kind of growth hasn't happened in six years.

The main reason why this jobs report is extra important? It's the last one before the Federal Reserve's big monthly meeting in September, when many economists expect the central bank to raise its benchmark interest rate for the first time in a decade.

Related: Cities where wages are growing the fastest

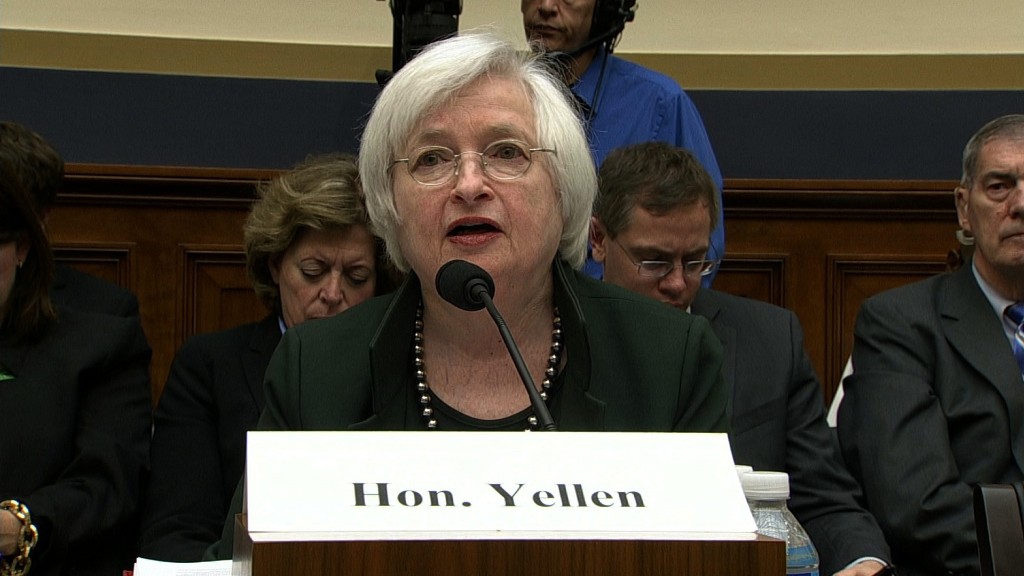

2. Will we get a rate hike in September?

The Fed holds its critical two-day meeting in mid-September, and will announce it's decision on September 17. it's still unclear if the Fed will raise rates next month.

Friday's jobs report could sway the Fed's committee members towards or away from a rate hike.

A rate hike would signal that the economy is healthy enough to withstand slightly higher interest rates.

After all, it is expected to eventually impact everything from future interest rates on bank savings accounts, mortgages and car loans to credit card bills.

Related: Is the Fed trapped now? Rate hike remains elusive

3. China's President comes to town

What's giving the Fed pause is the slowdown in the world's second-largest economy China and the potential of its effect on the rest of the world.

The backdrop is that the Chinese government has been especially active in the financial markets lately. Just this month, the country surprised the world by allowing the yuan to devalue. It propped up its markets by actually buying stocks a few months earlier. And last week, as its stock market tanked, the People's Bank of China cut its key rates for the fifth time in nine months in an effort to keep money flowing in its financial system.

This creates for an especially interesting meeting when China's president, Xi Jinping, visits President Obama in September.

Related: China's contagion and how it spreads across the world

4. The Iran nuclear deal and its effect on oil

The U.S. and its allies struck a deal to curb Iran's nuclear program in exchange for removing some economic sanctions.

The deadline for the first Congressional vote on the Iran deal is September 14.

Even if Congress rejects the deal, President Obama is expected to veto it and send it through. It has major implications for the price of oil because it would mean that Iran can sell its oil across the globe. That would put even more oil into the oversupplied oil market, pushing the price of oil down further.

Oil prices have fallen more than 50% in the past year. The deal would almost certainly have a negative impact on stock prices for companies like Exxon (XOM) and Chevron (CVX).

5. September stock slump

If you thought August was bad, it's time to buckle up.

Historically, September is usually the worst month of the year for stocks. The chances of the S&P 500 finishing September with gains is 43%, according to BTIG Research.

With the jobs report, Fed meeting, China's visit and the Iran nuclear deal in the mix, there's plenty of potential for volatility. And if the markets look shaky, that could spook the Fed from a September rate hike too.

6. Apple's new iPhone generation?

There's one event some investors can smile about. Apple recently announced its hosting an event on September 9 where it's widely expected to unveil its newest generation of iPhones. Apple (AAPL) is America's largest company by stock market valuation, making any of its events a big deal for markets and investors.

7. The Pope arrives

And there's Pope Francis, who is coming to America for the first time as Pope. He makes stops in Washington D.C., Philadelphia and New York -- after he visits Cuba. His planned trip between the two countries symbolizes their renewed relations, both politically and economically. Look to see how U.S. businesses use the Pope's visit to tout their efforts in Cuba or ties to the Catholic Church.