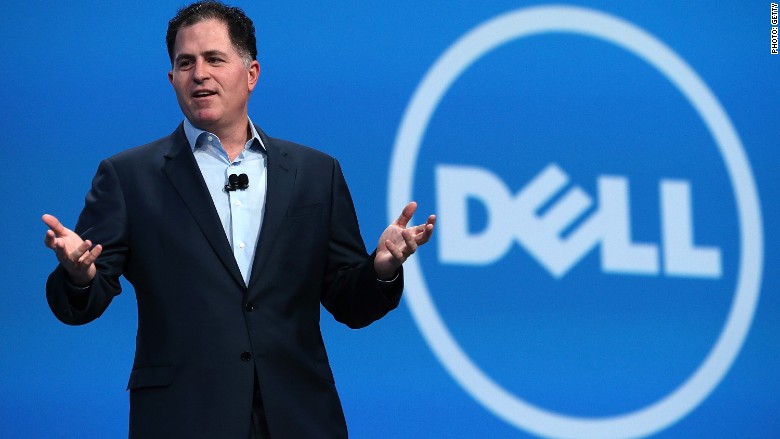

Michael Dell might be about to pull off the biggest tech deal in history. But he better get it done before the next freakout on Wall Street.

Recent media reports strongly suggest Dell is planning a mega marriage with EMC (EMC), the data-storage heavyweight. The only problem is the sheer size of the proposed deal -- roughly $50 billion -- requires Wall Street's cooperation.

To get the deal done, Dell would need to raise an estimated $40 billion most likely by selling junk bonds. But that's a ton of money, and Dell is already saddled with lots of debt from its last deal.

Two years ago Dell got tired of the harsh scrutiny from short-term minded Wall Street on the firm he founded in his dorm room in 1984. So he teamed up with Silver Lake Partners to bring the company private for $25 billion. Much of it was funded by debt.

But Dell and EMC are mature tech companies in aging markets. So it will be hard for investors to look past their balance sheets, like they might be willing to do for a cooler and fast growing company like Uber or Snapchat.

"That's going to be a lot to swallow. You can see why the market might have a little bit of indigestion," said Noel Hebert, senior credit analyst at Bloomberg Intelligence.

Related: Michael Dell doesn't miss Wall Street at all

Will Wall Street cooperate?

Most importantly, the sentiment on Wall Street lately has been skittish at best. The markets have been lurching between really bad losses and gains this summer. Fears about trouble in China and Federal Reserve policy sent the Dow plummeting an unprecedented 1,000 points on August 24.

The junk bond market that Dell needs to hit up for money was not immune to that turbulence. The value of the bonds tumbled in what Hebert calls a "puke out."

Thankfully conditions have improved vastly in recent weeks as worries about China have eased a bit. The stock and bond markets have rallied.

But no one knows how long these conditions will last. Renewed volatility could make a deal the size of Dell-EMC difficult to pull off at reasonable terms.

"There is certainly an apprehension in the marketplace," said Hebert.

Related: Hedge fund billionaire: Obama economy is 'amazing'

Deal structure remains mystery

A key question will be what a Dell-EMC marriage would actually look like. No one knows at this point. Some have speculated the amount of debt needed could be lowered by selling off EMC's most coveted asset: Its 81% stake in VMWare (VMW), which provides software for the cloud and virtual space.

Dell did not respond to a request for comment from CNNMoney. EMC declined to comment on "rumor and speculation."

But analysts who cover EMC believe it's a lot more than mere rumor.

"There's meat on the bones here. All indications are that it's 11:59 on the clock and we're about to strike midnight," said Daniel Ives, who covers at EMC at FBR Capital Markets.

Related: Carl Icahn thinks there's a bubble brewing in junk bonds

Too much debt?

But Ives acknowledges there could still be speed bumps, saying: "Financing issues could be a snag."

Both Dell and EMC generate tons of cash, making a combination attractive to bond investors. EMC has little debt and posted $24 billion in revenue last year.

Yet Dell is still carrying more than $11 billion in debt, according to FactSet. A deal with EMC would add lots more.

"That's definitely something on the minds of investors. This type of debt load -- for a tech company?" said Ives.