America got lots of good news Friday.

Lots of people got jobs and workers saw a pay raise.

Those are signs of a healthy U.S. economy, which means that we could see higher interest rates from the Federal Reserve soon.

Already, the dollar is stronger in anticipation because dollar-denominated assets get more attractive with higher interest rates.

But Wall Street doesn't want that.

"What's good for Main Street will be a headwind for Wall Street," says Peter Boockvar, chief market analyst at the Lindsey Group.

That's a problem, especially since investors are champing at the bit to buy stocks -- CNN's Fear and Greed Index of market sentiment has now moved into "greed" territory from "fear" just two months ago.

All those things -- wage growth, higher rates, strong dollar -- usually hinder earnings growth. Here's how:

Related: Strong hiring drives unemployment down to 5%

Employee: YES! Employer: NOOO....

Wages grew 2.5% in October, the best gain in one month since July 2009. It's welcome news for many Americans who haven't seen their paychecks budge much during the economy's recovery.

But higher wages means higher costs for U.S. businesses. Look at Walmart (WMT): the nation's largest retail chain lowered its earnings outlook, citing employee wage hikes taking a share of its profit margins. That trend could play out for all types of businesses if higher wages continue to pick up momentum, experts say.

"The good news is that wages are going up, the bad news is that wages are going up," says Ed Yardeni, chief investment strategist at Yardeni Research. "There's been some evidence that wages are starting to squeeze profits, now we're likely to see more of that."

Others say the impact on profits will be more muted.

That's because pay is rising for some low-wage workers. Mid-level workers -- managers -- are not seeing the same pay increase, says Michael Sansoterra, portfolio manager at RidgeWorth large cap growth stock fund.

"The question is -- does wage growth follow through to higher income employees?" says Sansoterra. "We haven't seen broad-based wage growth."

Related: Obama economy: 8.7 million jobs

Dollar dilemma

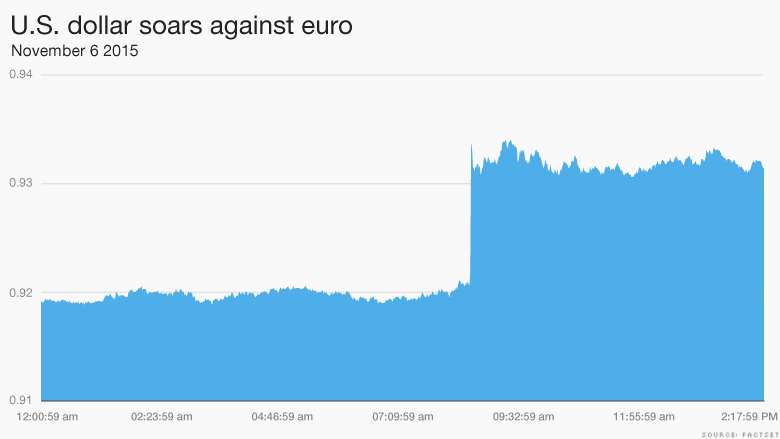

The strong dollar is great for the American traveler (pack those bags to Paris), but spells trouble for multinational corporations. On Friday morning, the value of one euro went from $1.09 to $1.07 -- a big move in just a couple hours.

But a strong dollar is a big bummer for American companies that sell abroad. It makes their products more expensive, and less attractive, to foreign buyers. And the dollar's rise comes as many currencies in emerging markets -- Brazil, Turkey, Mexico -- are losing LOTS of value against the dollar.

Throughout the year, U.S. brands -- from Nike (NKE) and Caterpillar (CAT) to Microsoft (MSFT) and Hershey (HSY) -- have talked about the U.S. dollar's strength hurting their sales abroad.

"The strong dollar is weighing on their earnings," says Yardeni.

And what could strengthen the dollar even more? The Federal Reserve.

Related: Yellen: U.S. economy 'performing well'

Will the Fed finally raise rates in December?

Friday's strong jobs report helps make the case for the Fed to raise its key interest rate in December for the first time in almost a decade. Rates have been near zero since December 2008, and many experts say they no longer need to be so low.

But higher interest rates raise the cost of business. If companies want to borrow money, that's going to be more expensive.

Fed Chair Janet Yellen spoke optimistically about the U.S. economy and said there's a "live possibility" of a rate hike in December.

Stock market blues

Higher rates also suck out some of the easy money from the stock market.

A big criticism about the hyper-low interest rate environment has been that it's made borrowing super cheap and led to a bubble in stock prices.

Many companies borrowed cash for virtually nothing and bought back shares, which artificially raises their stock prices. Experts say that it's one of the reasons behind the massive run-up in stocks in the last six years.

So investors beware: Once such tailwinds go away, some stocks could come down from their lofty levels.