If there was any doubt that Europe will get another dose of central bank stimulus soon, it was removed Friday with data confirming that growth is slowing again.

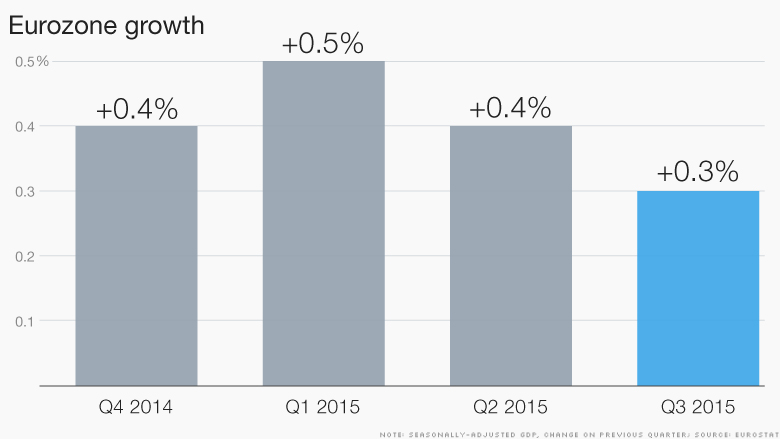

Third quarter GDP across the 19 countries that use the euro grew by just 0.3% over the previous three months. That was weaker than expected and represents a slowdown since the second quarter, when the economy grew by 0.4%.

European Central Bank President Mario Draghi and fellow officials had already been talking up the chances of an interest rate cut, expanded money printing, or both, when they meet for the last time this year on December 3.

Friday's growth figure, non-existent inflation, and unemployment rates stuck near 11%, make more monetary policy easing in December look like a done deal, barring a miraculous turnaround.

"The modest deceleration in growth reinforces the case for the ECB to deliver further stimulus at its December policy meeting," noted BNP Paribas market economist Dominic Bryant.

That could leave the two most powerful central banks in the world moving in opposite directions. Many expect the Federal Reserve to raise interest rates for the first time in almost a decade when it meets December 15 and 16.

The prospect of money getting cheaper in Europe and simultaneously more expensive in the U.S. has already had a big impact on the dollar/euro exchange rate.

One euro is now worth just $1.08, down from $1.15 a month ago -- that's a fall of 6%.

That should help European exporters struggling with weaker demand in emerging markets. But the euro's tumble this year has already hurt earnings at some big U.S. companies.

And it could get worse. There's virtually no chance the ECB will tighten monetary policy before September 2016 at the very earliest. By then the Fed may have a couple of interest rate rises under its belt.