An eyebrow-raising interview with Tinder's CEO put a kink in its parent company's plans to go public.

Match Group (MTCH), which owns Tinder, is set to begin its relationship with Wall Street on Thursday, but its plans were complicated Wednesday night due to a story in the British Evening Standard.

The article includes incorrect metrics about Tinder, and inadvertently lewd quotes attributed to Tinder's top executive Sean Rad. The interview raised questions about whether the company violated its "quiet period," the window between filing a public document and the time the SEC deems it effective. Companies are supposed to stay mum about the information it contains.

Match issued a new public filing Wednesday night saying the article and Rad's comments were "not endorsed or condoned" by the company.

Match advised its potential shareholders to rely on information in its prospectus and not the Evening Standard report. According to Match, the Evening Standard incorrectly reported that Tinder has 80 million users, saying it actually has about 9.6 million.

Rad, who co-founded the dating app Tinder, is quoted saying, "Apparently there's a term for someone who gets turned on by intellectual stuff. You know, just talking. What's the word?' His face creases the effort of trying to remember. 'I want to say 'sodomy'?'"

The owner of dating sites including Match.com and OkCupid plans to sell more than 33 million shares at $12 each. The offering will raise nearly $400 million and value the company at about $2.8 billion.

Match, which will trade under the ticker symbol "MTCH," is clearly hoping to cash in on the rising popularity of online dating among Millennials. Over the past four years, Match's sites have grown their active users by 63% a year, giving the company a total of nearly 60 million.

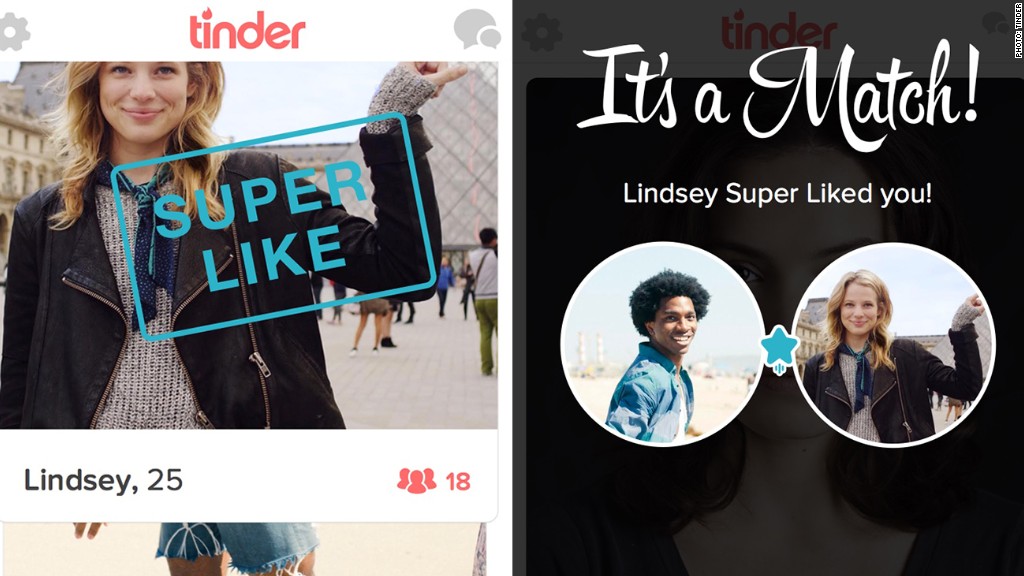

At the "heart" of that growth is Tinder, the popular yet controversial app that has exploded onto the online dating scene. Tinder famously lets users swipe right if they like a prospective date and left if not.

Online daters have been doing a ton of swiping lately. Match said Tinder users swiped through an incredible 1.4 billion user profiles each day in September. But critics argue Tinder promotes a culture of "hooking up" instead of real relationships.

Related: Billionaire Barry Diller: I'd use a dating app

Unlike Square, Match is making money

Match's first date with Wall Street is actually more of a double date. It coincides with the high-profile debut of Square, the mobile payments company started by Twitter (TWTR) CEO Jack Dorsey. Square's (SQ) IPO could end up pricing the company at a big discount from where it was last valued in the private markets.

But unlike Square, Match is already profitable. The company earned $85 million in the first three quarters of 2015 and its revenue rose 16% thanks to a rise in paid customers.

"Match has an unbelievable profitability profile," said Kathleen Smith, a principal at Renaissance Capital, which manages IPO-focused ETFs.

Related: Square IPO looks like it's out of shape

Could Tinder 'cannibalize' Match?

But Smith said investors need to be mindful of the "erosion" Match has experienced in the revenue per paid subscriber. That key metric has declined each of the past three full years and is down so far in 2015 as well.

These concerns have led some analysts to warn that Match is nothing but trouble for investors.

BTIG analyst Brandon Ross wrote in a research report that the "explosive growth of online daters with free profiles, particularly from Tinder, is cannibalizing the rest of the business."

He dubbed this phenomenon the "Tinder Catch-22," suggesting subscriber losses will continue in the non-Tinder side of Match's business.

Smith thinks that criticism doesn't give Match enough credit for developing Tinder in house.

"This is a management team that has something going for it if they can pull off a Tinder. They're not just buying sites," she said.

Related: Swipe right or left on Tinder/Match and Square IPOs?

Can Match avoid the fate of GoPro?

Match is going public at a time when investors have ramped up scrutiny of unproven companies. Shares of a number of newly-public companies have taken big tumbles, including Alibaba (BABA), Fitbit (FIT), Etsy (ETSY) and Shake Shack (SHAK). The clearest example is GoPro (GPRO), which last week fell below its IPO price.

Prior to the IPO, Match was part of IAC/Interactive (IACI), the conglomerate run by media mogul Barry Diller. IAC has previously spun off a number of brand-name companies, including Expedia (EXPE), TripAdvisor (TRIP) and HSN (HSNI).