After an awkward start, Tinder owner Match Group officially began its relationship with Wall Street on Thursday.

The online dating company is raising nearly $400 million by selling shares to the public for the first time. Match (MTCH) enjoyed a strong debut on the Nasdaq by closing the day at $14.74. That's good for a 23% pop from its IPO price of $12.

Wall Street is now valuing Match, which also owns OkCupid and Match.com, at $3.5 billion.

Before Match could begin its life as a public company, it had to clean up a messy interview given by Tinder CEO Sean Rad. Match distanced itself from Rad and corrected faulty metrics he cited, which appeared in the British newspaper Evening Standard.

Match's stock priced at $12, on the lower end of its expected range of $12 to $14. That's more than Square (SQ) can say. The online payments company also debuted on Wall Street with it's initial public offering, and alarmed tech watchers on Wednesday when its IPO priced at just $9, well below the expected range of $11 to $13.

That means Wall Street values the company at $2.9 billion, which is less than half the price tag that venture capitalists placed on the company last year.

Related: Trouble in unicorn world: Square IPO flops

Tinder at the 'heart' of Match growth

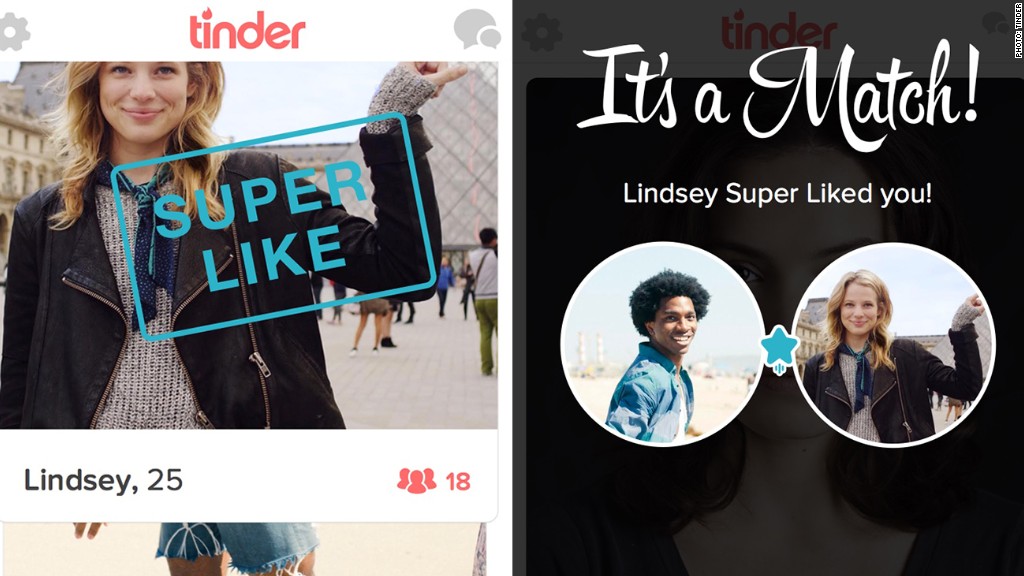

After "checking out" both companies, Wall Street seems to like what it sees from Match a bit more. That's largely because of Tinder, the company's fast-growing yet controversial app that lets users swipe right if they like a prospective date.

Tinder has been criticized for promoting a culture of "hooking up," but in many ways it's the envy of the online dating world. In September, Tinder users wiped through a stunning 1.4 billion user profiles -- each day.

At the same time, Match is profitable -- unlike many newish companies like Square. The online dating company hauled in $85 million in profit during the first three quarters of this year amid a 16% jump in revenue.

Related: Tinder CEO's interview from hell

Cannibalization threat looms

The question is whether or not Match can keep that going amid hefty competition -- from both inside and outside its walls.

BTIG analyst Brandon Ross warned investors to stay away from the Match IPO because of a "Tinder Catch-22" where the hot app's strong growth threatens to cannibalize the rest of the business. The problem is that Tinder, like other online dating apps, offers its services for free. That hurts other platforms like Match.com that rely on a subscriber model.

"We believe that the non-Tinder businesses at Match Group are in secular decline," Ross wrote.

Related: Swipe right or left on Tinder/Match?

Match splits from IAC, but not really

By selling shares to the public, Match is gaining the appearance of independence from its parent company IAC/Interactive (IACI). IAC is the conglomerate run by media mogul Barry Diller. IAC has previously spun off other big-name companies like Expedia (EXPE) and TripAdvisor (TRIP).

However, even after the IPO, IAC will still own a majority of Match's common stock and nearly all of its voting power. That means investors who buy the common stock won't have much of a say on key decisions like mergers, executive compensation and dividends.