OPEC is winning.

The cartel's strategy of pumping as much oil as it can to force other producers out of the market appears to be working.

"There is evidence the Saudi-led strategy is starting to work," the International Energy Agency said in its monthly report. "Lower prices are clearly taking a toll on non-OPEC supply, with annual growth shrinking."

The IEA, which monitors energy market trends for the world's richest nations, said non-OPEC production rose by just 300,000 barrels a day in November. At the start of the year, production from countries outside the cartel was rising by 2.2 million barrels a day.

Growth will evaporate completely early next year, with non-OPEC supply expected to fall by about 600,000 barrels per day in 2016, largely due to a decline in U.S. shale production.

U.S. oil companies are clearly hurting, but OPEC's strategy to defend its market share by forcing others to close wells is causing pain for the cartel's members too. They've seen revenues crash.

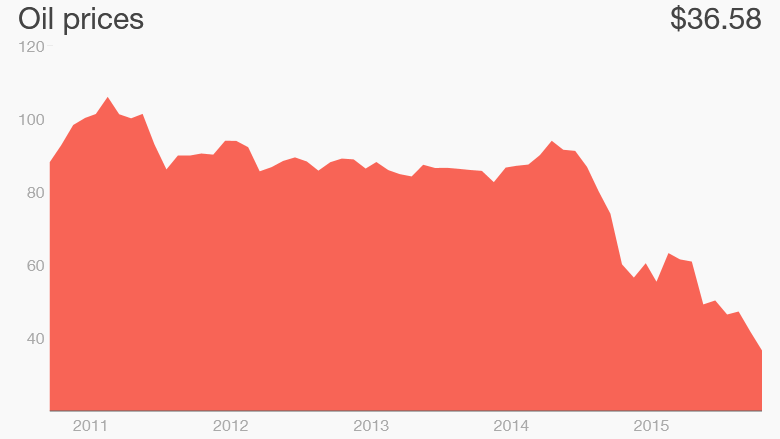

The global supply glut continues to swell and oil prices have plunged to their lowest level in seven years.

U.S. crude futures were trading 1.5% weaker at just over $36.20 per barrel on Friday. They reached a peak of $108 per barrel in June 2014.

Related: Iran gears up for big return to world oil markets

OPEC last week was divided over whether to agree a production ceiling.

Saudi Arabia, the leader of the group, resisted calls from other members for supply cuts to boost prices.

"The move appears to signal a renewed determination to maximize low-cost OPEC supply and drive out high-cost non-OPEC production -- regardless of price," the IEA said.

The result is a huge global oil glut that keeps growing. The IEA expects the world's oil market will remain oversupplied throughout 2016.

"As extra Iranian oil hits the market, inventories are expected to swell by 300 million barrels," it said. Iran is hoping to reclaim its spot among the world's largest oil producers after Western sanctions are lifted.