The budget deficit for 2016 will be 31% higher than projected just a few months ago, thanks in great part to a $900 billion tax deal passed by Congress in December.

That same tax deal, which made many temporary tax breaks for businesses and individuals permanent, is primarily accountable for nearly half of the $1.5 trillion increase in deficits now expected over the next decade.

Just under a third of that increase is attributable to lower growth expectations.

That's according to data from the nonpartisan Congressional Budget Office's budget and economic outlook, a summary of which was released Tuesday.

In August last year, the CBO was projecting a $414 billion deficit for this year. Now the agency anticipates it will be closer to $544 billion. The jump, the agency said, is "largely attributable" to that tax deal.

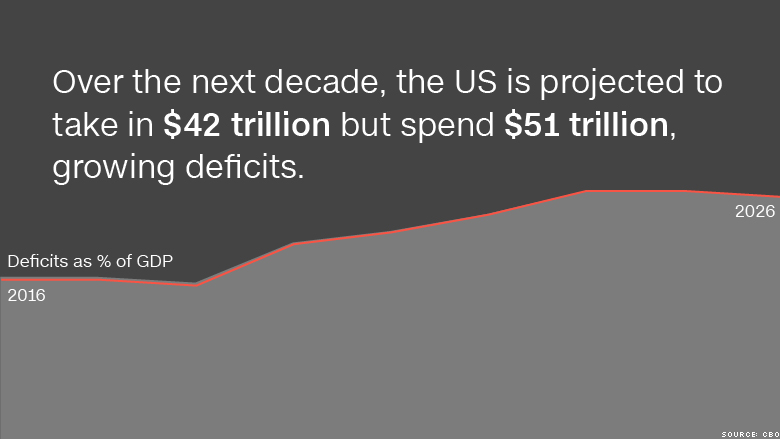

This year will mark the first time since 2009 that the annual deficit will grow as a share of the economy. While still modest, it's estimated to be 2.9% of GDP, up from 2.5% in 2015, a jump of 16%.

That's roughly where it will stay for the next few years, assuming there are not changes to current law. But then it will start to grow in 2019. By 2026, the CBO projects it could reach 4.9% of GDP.

Related: How you'll benefit from the new tax deal

Going forward, the CBO estimates that annual deficits from 2017 through 2026 will total $9.4 trillion, bringing the country's accumulated public debt to $23.8 trillion, or 86% of GDP. Today it's nearing 76%.

Deficits, of course, reflect an imbalance between spending and revenue. As it has in most years since 1930, the country spends more than it takes in.

But in recent years -- spurred largely by the financial crisis in 2008 -- it has spent considerably more than it's taken in. And it's projected to do the same in the decades to come in great part because of the aging of the population and rising health costs. Both of those factors raise how much needs to be spent on major safety net programs such as Medicare, Medicaid and Social Security.

Spending for those entitlement programs is projected by CBO to rise to 15% of GDP by 2026, up from 13.1% today. "Almost half of the projected $2.5 trillion increase in total [spending] from 2016 to 2026 is for Social Security and Medicare," the CBO notes.

Paying interest on the country's accumulated debt. meanwhile, is expected to double as a share of the economy, both because of the growing debt load and because of anticipated rate increases. The CBO now projects interest costs will grow from a relatively modest 1.4% of GDP ($255 billion) this year to 3% ($830 billion) by the end of the decade.