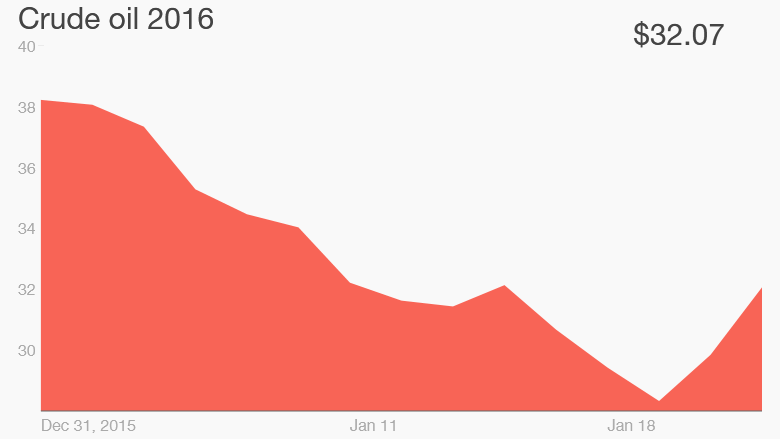

It's been an absolutely insane few days for crude oil, the most closely-watched commodity on the planet.

Oil prices spiked 9% -- the biggest daily jump since August -- to close at $32.19 a barrel on Friday. It represents a dramatic rebound from Wednesday.

Crude crashed to $26.19 a barrel Wednesday, the lowest level since April 2003. Since then, oil has surged a remarkable 23%.

There didn't appear to be an obvious trigger for the rebound. Traders pointed to extremely oversold conditions that simply couldn't last.

"A bounce at some point was inevitable. Things don't go one direction all the time. It was primed for turnaround," said Darin Newsom, senior commodities analyst at DTN.

Related: Why you should worry about cheap oil

The rally gathered momentum on Thursday when oil prices rose 4.2%, the biggest one-day percentage gain since October 28.

All of this is great news for the stock market, which has been intensely focused on the price of crude oil. The Dow jumped more than 200 points on Friday, with energy stocks leading the market higher. Shares of BP (BP) and ExxonMobil (XOM) posted solid gains, while smaller Williams Companies (WMB) spiked 20%.

However, Newsom said the fundamental backdrop remains very bearish for oil. The world simply has too much oil, especially given lackluster demand growth due to the slowdown in China

"Have we put the low in? I doubt it," said Newsom. He thinks it's possible oil could even dive below $10 a barrel, a level it hasn't seen since November 2001.