Google has buckled under growing pressure and agreed to pay millions in back taxes to the U.K. government. But its critics are still not satisfied.

Google (GOOGL) is the latest global company to be targeted over its tax affairs. It has agreed to pay £130 million ($185 million) to cover unpaid taxes since 2005, following an audit by British tax authorities.

The company will also begin paying taxes on sales from advertisers based in the U.K. to reflect "the size and scope" of its British business, Google said.

While the back tax payment may look big, many say it's not enough.

"[The British tax authorities] must publish details of deal with Google," tweeted John McDonnell, the finance spokesman for the opposition Labour Party. "Paying only £130 million for 10-year backlog looks like public relations sop."

Others echoed his comments on Twitter (TWTR), with one person saying the deal seemed like "state-sanctioned [tax] evasion."

Meg Hillier, a lawmaker who chairs the U.K.'s public accounts committee, said she would ask tax officials and Google to explain the agreement to the committee.

Public anger has been mounting for years as details have emerged of how multinational companies use complicated structures to dodge taxes in some countries.

The Organization for Economic Co-operation and Development estimates that loopholes allowed companies to avoid paying as much as $240 billion per year around the world.

In 2013, the public accounts committee issued a report that focused on Google's corporate taxes. The report indicated whistleblowers had revealed inconsistencies in the technology company's structure, which raised serious questions about whether it was acting lawfully on how it pays taxes in the U.K.

These reports, combined with pressure on government budgets in a time of austerity, encouraged world leaders to agree to a detailed package of global tax reforms in November. The new rules force countries to share more information about tax to ensure companies pay their fair share.

McDonald's (MCD) has also recently been accused of using shady deals to avoid paying tax. The European Commission announced in December it was investigating the fast food giant for failing to pay some taxes in both Luxembourg and the U.S.

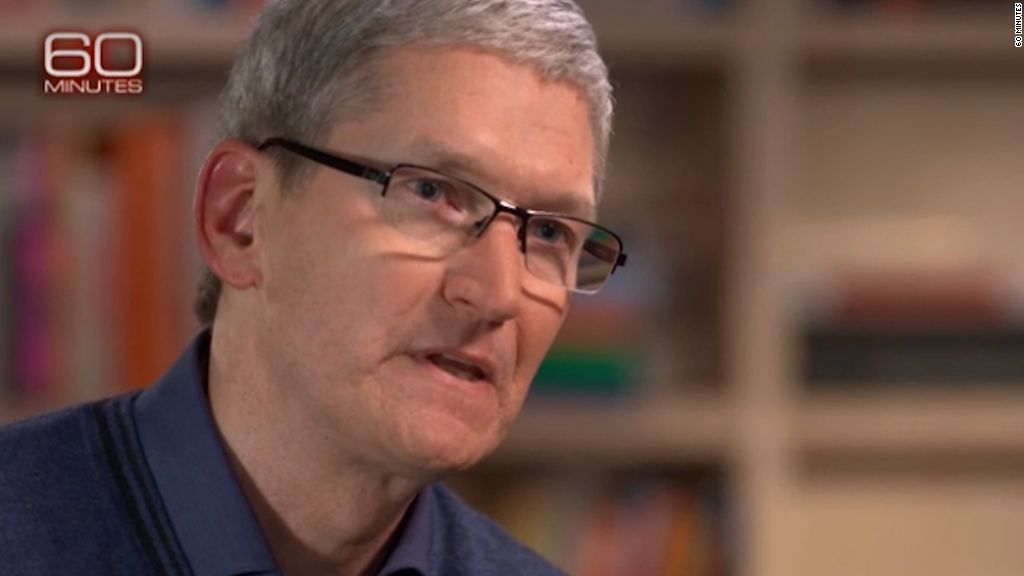

And authorities in Italy extracted a 318 million euro ($344 million) tax payment from Apple (AAPL) at the end of 2015 for years of unpaid taxes, according to a source at Italy's tax agency. Apple has not commented on that payment.

Starbucks (SBUX) and Fiat Chrysler (FCAM) have also been ordered to repay millions in taxes after European officials found the companies benefited from illegal deals with Luxembourg and the Netherlands

U.K. finance minister George Osborne said he expects other firms to "pay their share" of taxes.