There's a mining fire sale going on around the world.

America's largest mining company, Freeport-McMoRan (FCX), said Tuesday it plans to sell some of its coveted mines -- likely at bargain basement prices. It joins other global mining giants Glencore (GLCNF) and Anglo American (AAUKF), which last year began a mad scramble to raise cash to pay down debt.

Glencore and Anglo American have already started selling copper and coal mines located in Australia, Chile and South Africa. Freeport hasn't named the mines it could sell.

But how the tables have turned. Just two years ago, business was booming and things were so good that the coal and gold miner Freeport shelled out nearly $9 billion -- mostly in debt -- to purchase two oil and natural gas companies.

The timing couldn't have been worse. Copper and oil prices have since cratered to crisis levels and Freeport is trying to quiet bankruptcy fears even as it drowns in $20 billion of debt.

"If they don't undertake asset sales to reduce debt ... the company could end up owned by its creditors," said Daniel Rohr, a Morningstar analyst.

Related: Why the stock market is obsessed with oil

Glencore, the Swiss-based mining and trading conglomerate, had to do the same thing last fall. And British giant Anglo American, which owns diamond company De Beers, announced plans in December to shed about 85,000 jobs and sell off 60% of its assets over the next few years. All three companies are saddled with too much debt, taken on during far brighter times.

Freeport said it is searching for a buyer for its more recently-acquired oil and gas assets too.

"We face serious challenges because of what's going on in the marketplace and because of the situation with our balance sheet," Freeport CEO Richard Adkerson told analysts during a conference call on Tuesday.

"We're addressing this seriously and with a degree of urgency," he said.

Related: Red flag: Oil company defaults are spiking

Freeport stock down 92%

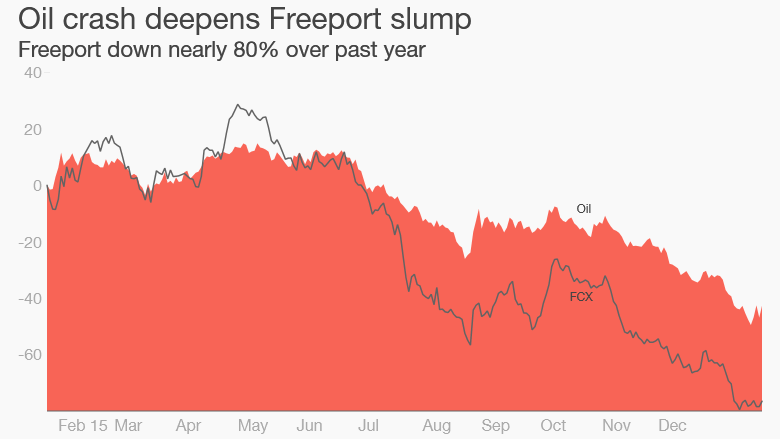

Freeport's struggles are a stark reminder of the boom-and-bust nature of the commodities industry. Copper and oil were both changing hands at sky-high prices just a few years ago thanks to China's voracious appetite for raw materials. Now that China is slowing down, some fear dramatically, commodity prices are tanking, crushing Freeport's cash flows.

That's why Freeport's stock has lost a stunning 92% of its value since July 2011. That's even after counting the stock's 7% surge on Tuesday.

Late last year, just months after billionaire investor Carl Icahn purchased a stake in Freeport, the company shook up its management team by announcing the departure of James Moffett, its founder and executive chairman.

Scrambling to preserve cash, Freeport also suspended its dividend and slashed capital spending by $1 billion.

Related: Cheap prices fail to kill U.S. oil boom

Bond markets reflect bankruptcy fear

But financial pressure continued to mount as the commodity crash intensified in early 2016. Last week, oil prices plummeted to $26 a barrel, down 75% since mid-2014. And copper dropped below $2 per pound for the first time since 2009.

The bond markets are signaling alarm about the situation. The yield on a $2 billion bond due in 2023 has spiked to 18%, according to FactSet. Translation -- if anyone were to lend the company money today, it would charge interest rates around that level.

"The market is pricing in a material risk of bankruptcy," said Rohr.

Freeport's CEO sought to ease those concerns. While acknowledging the $20 billion debt, Adkerson said the company has "adequate liquidity," an untapped $4 billion bank credit facility and limited debt that's due in 2016.