Saudi Arabia doesn't look so mighty now that oil prices are sitting at $30 a barrel.

The Saudi stock market is plunging, its mountain of oil cash is shrinking and now at least one elite investor is betting against the country's currency.

Billionaire Bill Ackman told investors this week his hedge fund has purchased options that pay off if the Saudi riyal loses value. Ackman's Pershing Square has already made a modest profit from the trade. He said it's serving him well as a hedge against the oil selloff.

Ackman pointed to "growing pressure" on the riyal and questioned the wisdom of Saudi Arabia spending hundreds of billions of dollars to protect the currency's peg to the U.S. dollar.

The billionaire is part of a growing chorus of investors who are speculating that the crash in oil prices may force Saudi Arabia to break its dollar peg.

"As oil prices breach 12-year lows, Saudi Arabia will be tempted to depeg its currency from the U.S dollar," Meredith Persico, a research analyst at money manager R-Squared Macro Management, wrote in a recent client note.

Related: Saudi Arabia could run out of cash in five years

Will Saudi Arabia ditch the dollar peg?

That's because devaluing the riyal could provide an instant boost to Saudi Arabia's shrinking revenues, 75% of which are generated from oil. Each barrel of oil, which is priced in U.S. dollars, would bring in relatively more revenue. Dropping the peg to the dollar would also save Saudi Arabia from spending heavily to defend its currency.

Speculation about the riyal has gotten so intense that Saudi Arabia's central bank recently ordered banks to limit traders' ability to bet against the currency by halting the sale of certain options contracts, Bloomberg News reported.

Despite the pressure, Saudi Arabia has consistently said it will keep the dollar peg in place. Many observers agree, pointing out that the link has been a source of economic security for the kingdom over the past 30 years.

"We continue to think that devaluation will only be used as a last resort," Jason Tuvey, Middle East economist at Capital Economics, wrote in a client report.

R-Squared's Persico warned that devaluing the riyal could "exacerbate perceived economic stability," cause an inflation spike and set off a "domino effect" of similar moves by neighboring Gulf countries.

Related: Saudi Arabia faces 'economic bomb'

Saudi stocks dive, cost to insure debt spikes

There's mounting evidence of the financial pressure on Saudi Arabia, outside of the currency world.

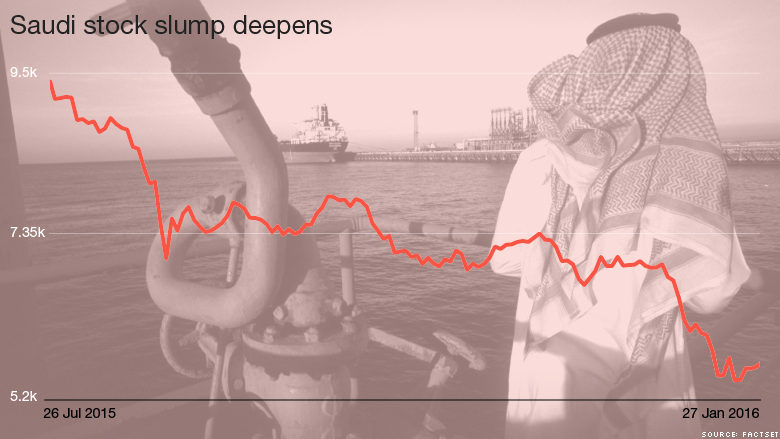

The kingdom's stock market opened up to much fanfare last summer to financial institutions that had at least $5 billion of assets under management.

But Saudi Arabia's benchmark Tadawul index has plunged 18% so far in 2016 and 34% over the past year.

"Investors are shying away from the market," said Michael Daoud, vice president of Africa/Middle East equities at Auerbach Grayson, a broker dealer focused on emerging and frontier markets.

Related: Why you should worry about cheap oil

Investors are also growing nervous about the health of Saudi Arabia's balance sheet. The kingdom recently disclosed a budget deficit of nearly $100 billion in 2015 and Standard & Poor's downgraded its credit rating in late October.

That explains why the cost to insure five years of Saudi debt has surged 26% over the past month, according to FactSet Research.

"This trend will no doubt continue given the country's current precarious fiscal situation which shows no signs of reverting, given oil's decade low levels," Simon Colvin, research analyst at Markit wrote in a recent report.

Saudi Arabia has been forced to slash spending by 14% to improve its fiscal situation. That included cutting expensive perks it provides to citizens, resulting in a 50% hike in gas prices. All of this is raising concerns about the threat of social unrest that could further destabilize the situation in the Middle East.

"Low oil prices could make it impossible for the Saudis to keep their own country stable, much less the rest of the region," says Brad McMillan, chief investment officer at Commonwealth Financial Network.